Floki Crypto Eyes Recovery as Bulls Target $0.000097 Resistance

While its market cap hovers near $855 million, traders are watching technical indicators closely to gauge the next move. The latest data suggests consolidation may be setting the stage for renewed momentum.

Traders Hold Ground as Open Interest Stays Steady

Recent data from open interest shows Floki crypto maintaining steady levels near 4.6 million, even as price volatility has increased over the past few sessions. This steady participation from traders suggests that interest in futures and derivatives remains resilient despite short-term declines. The relatively flat open interest indicates that neither bulls nor bears are currently in full control.

Source: Open Interest

The price action during the same period has been marked by sharp dips and modest recoveries, reflecting uncertainty in market direction. While price fell toward the $0.0000880 range, buyers stepped in at lower levels to provide temporary support. This points to active speculation in the market, with traders looking for quick opportunities rather than long-term accumulation.

Market sentiment, while cautious, has not collapsed. The lack of dramatic spikes in open interest suggests that leverage traders are not aggressively piling into positions. This could limit extreme volatility in the near term and may allow price consolidation before a potential stronger directional breakout.

Price Swings Show Signs of Stabilization

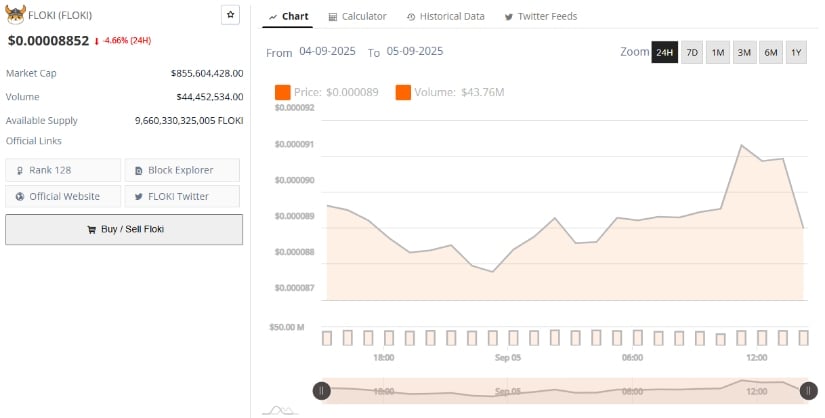

In addition, BraveNewCoin data support open interest data by showing that the price dropped 4.66% over the past 24 hours, settling near $0.0000885. The market cap sits firmly at $855 million, with trading volume crossing $44 million, reflecting sustained liquidity. These figures suggest that although price has slipped, investor engagement remains steady across exchanges.

Source: BraveNewCoin

The hourly chart from this source highlights a gradual recovery after a period of weakness, with intraday highs brushing against the $0.000091 mark before sellers re-entered. This dynamic illustrates a tug of war between speculative buyers and cautious sellers, keeping the price within a narrow band. The stability in supply also underscores that large holders are not aggressively offloading tokens, which tempers bearish pressure.

Momentum Builds Toward Mid-Band Target Near $0.000097

At the time of writing, according to TradingView, Floki crypto was trading at $0.0000909, just above the lower Bollinger Band support near $0.0000849. The bands have narrowed in recent sessions, pointing toward lower volatility ahead. Such squeezes often precede sharper moves, making the coming days critical for price direction.

Source: TradingView

The RSI currently stands near 42, showing that momentum has cooled without fully entering oversold territory. This indicates that sellers have the upper hand, but the pressure is not overwhelming. If RSI trends upward alongside a bounce from the lower band, it may open the door for a modest recovery.

Price remains below both the mid-Bollinger line and key moving averages, which signals that broader sentiment is still tilted bearish. However, the coin’s ability to hold above its lower support is encouraging. Traders will be looking for a push toward the midline resistance around $0.000097 as the next key test for momentum.

You May Also Like

Uniswap & Monero Chase Gains: While Zero Knowledge Proof’s Presale Auctions Target Record $1.7B

Quantum Threat Looms Over Bitcoin, VanEck CEO Says — Zcash Prepares Quantum Upgrade