US CPI Meets Expectations, Locks In 25 Bps Rate Cut As Bitcoin Pulls Back

US CPI inflation data landed right on target Thursday, cementing expectations of a Federal Reserve rate cut next week and triggering a modest dip in crypto prices.

The Consumer Price Index (CPI) rose 2.9% year-on-year in August, in line with forecasts, while core CPI (excluding volatile food and energy prices) advanced 0.4% from July, slightly above estimates, data from the Bureau of Labor Statistics showed.

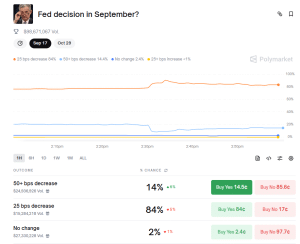

Polymarket bettors quickly priced in a September rate cut, with odds of a 25 basis point cut surging from 79% before the data to as high as 91%, before falling back to near 84%.

Polymarket September rate cut contract (Source: Polymarket)

Conversely, odds of 50 bps rate cut plummeted from 18.9% to 9.1% before rising to 14%. A soft jobs report on Friday and Wednesday’s weak PPI numbers had boosted bets on a bumper rate cut this month.

The CME FedWatch tool also reflects near-unanimous expectations, with analysts assigning a 90.8% chance the Fed trims rates by 25 basis points at its Sept. 17 meeting.

“The core was as expected but CPI beat on the headline number, and we think that keeps a 25-bp cut next week locked in and doesn’t preclude further cuts in October and December,” said Bloomberg Intelligence chief US rates strategist Ira Jersey.

Well-known Bitcoin investor Lark Davis also said that “rate cuts are confirmed!”

An interest rate cut will lower borrowing costs and boost liquidity, and typically encourages more bets on riskier asset classes such as cryptocurrencies.

Bitcoin Slides After The CPI Release

Despite that, the crypto market ticked lower in the hour after the data, with Bitcoin (BTC) sliding 0.6%, from $114,300 to $113,516. Many of the top 10 cryptos pulled back as much as 1% as well.

Top ten cryptos’ price performance (Source: CoinMarketCap)

Data from CoinMarketCap shows that altcoin leader Ethereum (ETH), Ripple’s XRP, leading meme coin Dogecoin (DOGE), and Charles Hoskinson’s Cardano (ADA) took the biggest knocks in the top ten list after the CPI data was released.

ETH corrected 1.13% to trade at $4,395.26, while XRP, DOGE and ADA, fell 1.13%, 1.83% and 1.67%, respectively.

Dollar Index Drops As Confidence In The USD Weakens

The US Dollar Index (DXY) dropped over 0.3% in the same period. The index is a measure of the US dollar relative to a basket of foreign currencies.

TradingView data shows that the index had been in a steady uptrend over the past 24 hours. During this period, it rose from 97.627 to a high of 98.036. However, the latest inflation release erased the 24-hour gains.

Hourly chart for DXY (Source: TradingView)

Hourly chart for DXY (Source: TradingView)

You May Also Like

Bitcoin ETFs Surge with 20,685 BTC Inflows, Marking Strongest Week

Your Crypto Companion: Navigating the Fast-Paced Digital Market