Adobe (ADBE) Stock: Spikes After $5.99B Q3 Revenue Tops Wall Street Estimates

TLDRs;

- Adobe shares rose 3.07% after hours Thursday on Q3 revenue of $5.99B, beating Wall Street forecasts.

- Company issued stronger Q4 guidance with EPS and revenue both topping consensus analyst estimates.

- AI-influenced ARR surpassed $5B, underscoring rising enterprise adoption of Adobe’s AI-driven tools.

- Despite a 21% YTD decline, Adobe stock gained momentum as investors welcomed proof of AI monetization.

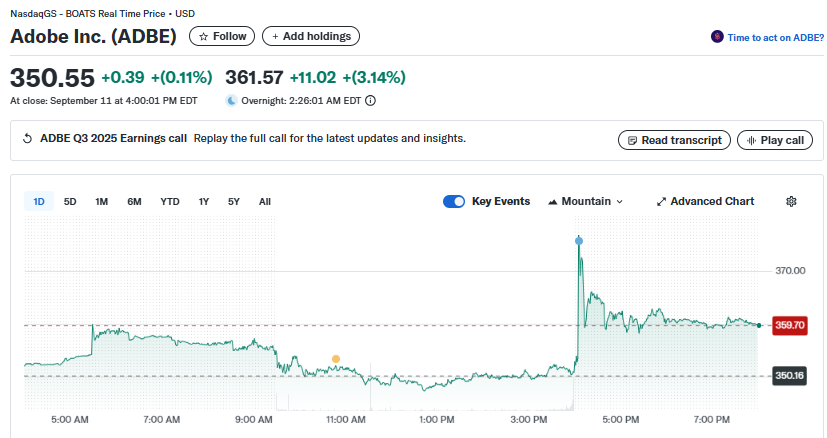

Adobe Inc. (NASDAQ: ADBE) shares climbed 3.07% to $361.32 in after-hours trading Thursday, after the creative software giant reported stronger-than-expected fiscal third-quarter results. At the regular close, Adobe’s stock finished at $350.55, up 0.11% on the day, before rallying on upbeat earnings.

The company posted adjusted earnings per share (EPS) of $5.31, topping consensus estimates of $5.18. Revenue came in at $5.99 billion, above the $5.91 billion analysts had projected, according to LSEG data.

Revenue for the quarter ending August 29 marked an 11% year-over-year increase from $5.41 billion a year earlier. Net income rose to $1.77 billion, or $4.18 per share, up from $1.68 billion, or $3.76 per share, in the prior year’s quarter.

The earnings beat provided a much-needed boost for Adobe, whose stock has fallen 21% year-to-date, underperforming the Nasdaq’s 14% gain. However, Thursday’s rally signaled renewed investor confidence.

Adobe Inc. (ADBE)

Adobe Inc. (ADBE)

Strong Guidance Lifts Investor Sentiment

Looking ahead, Adobe issued guidance that once again exceeded analyst expectations. For the fourth quarter, the company expects adjusted EPS in the range of $5.35 to $5.40, slightly above Wall Street’s $5.34 estimate. Projected Q4 revenue was set between $6.08 billion and $6.13 billion, compared to consensus forecasts of $6.08 billion.

The upbeat guidance extended to the company’s Digital Media division, which remains Adobe’s primary revenue driver.

The firm forecast digital media revenue between $4.53 billion and $4.56 billion, ahead of the $4.51 billion StreetAccount estimate. Annualized revenue growth in the digital media business is now expected to rise 11.3% for fiscal 2025, compared to a prior forecast of 11%.

AI-Driven Growth Powers Momentum

A major highlight of Adobe’s Q3 earnings was the continued infusion of artificial intelligence across its product portfolio. CEO Shantanu Narayen emphasized that AI innovation is beginning to deliver significant returns.

According to Adobe, its AI-influenced annualized recurring revenue (ARR) has surpassed $5 billion, up from $3.5 billion at the end of fiscal 2024. This milestone indicates accelerating demand for AI-powered tools across Adobe’s customer base.

Adobe noted that 99% of Fortune 100 companies have now used AI in an Adobe product, while more than 40% of its top 50 enterprise clients have doubled ARR spending since the start of fiscal 2023.

Competitive Pressure and Investor Concerns

Despite the upbeat results, Adobe still faces stiff competition in the rapidly evolving AI-driven creative software landscape. Rivals such as OpenAI and Canva are introducing generative AI features that pose a threat to Adobe’s market dominance.

Investor skepticism has been evident throughout 2025, with Adobe’s stock struggling amid concerns about monetization of its AI offerings. However, Thursday’s earnings report provided concrete evidence that the company is converting AI demand into real revenue growth.

Anil Chakravarthy, president of Adobe’s Digital Experience division, reassured investors that Adobe’s “commercially safe” approach to AI remains a key differentiator.

With revenue momentum, stronger-than-expected guidance, and rising AI adoption, Adobe is looking to rebuild investor trust after a rocky year on Wall Street.

The post Adobe (ADBE) Stock: Spikes After $5.99B Q3 Revenue Tops Wall Street Estimates appeared first on CoinCentral.

You May Also Like

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip

China Launches Cross-Border QR Code Payment Trial