SEC "gets involved" in the field of crypto games, Immutable chooses to fight to the end after receiving Wells' notice

Author: Zen, PANews

“We will fight for builders, creators, gamers, and digital ownership.”

On November 1, Web3 gaming infrastructure company Immutable announced that it had received a “Wells Notice” from the U.S. Securities and Exchange Commission (SEC), in which the SEC vaguely accused it of violating securities laws and making false statements.

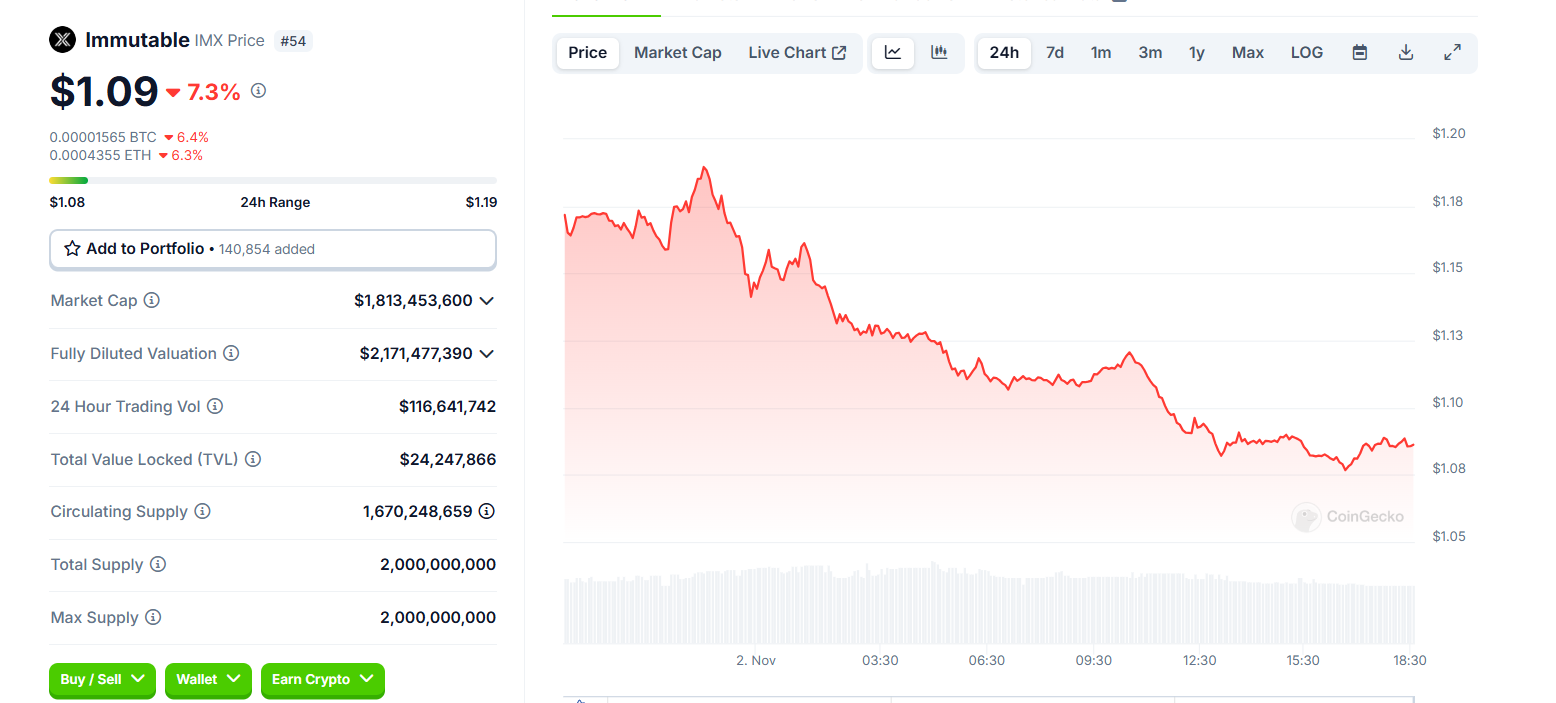

After the announcement, Immutable's ecosystem token IMX fell below $1.30. According to Coingecko data, as of November 2, the price of IMX tokens was about $1.10, and the total circulation market value was about $2.17 billion, still firmly sitting on the leading position in the Web3 game ecosystem.

A hasty accusation lacking details

"With the latest action against Immutable, the SEC's overreach has expanded to the gaming sector." According to Immutable, in its first interaction with the SEC, they were told that the Wells Notice would be issued within a week. But then they received the notice immediately within a few hours. In the past, before the Wells Notice was issued, there would usually be months of interviews and communications between the company's legal counsel and the SEC so that the SEC could fully understand the situation. This accusation, which was suddenly issued shortly before the US election, was really unexpected for Immutable.

More importantly, the SEC seemed to have only cited general statutory provisions in the notice, lacking specific details. Immutable even joked that the substantive explanation in the notice was less than 20 words. Today, more and more companies in the cryptocurrency industry are facing pressure from US regulators, and the industry has never stopped criticizing the practices of the SEC and its chairman Gary Gensler. In the face of the SEC's accusations of being hasty and unprepared, Immutable responded strongly in the announcement. "While the SEC indiscriminately claims that tokens across the industry are securities, we are confident that IMX tokens are not securities."

Regarding the false statements, Immutable believes that the SEC's claims are directed at the listing and private sales of IMX in 2021. In a 10-minute conference call after the Wells notice was issued, the SEC cited a blog post published by Immutable during that period and suggested that Huobi Ventures' pre-IPO investment in IMX claimed in the article did not actually occur. Immutable strongly criticized this, saying, "The SEC made a mistake again: they could have learned this through constructive dialogue with the company."

NFTs not mentioned yet may be potential risks

In addition to tokens, whether NFTs are securities has also been a controversial issue and a focus of regulators in recent years. At the end of August this year, Devin Finzer, CEO of OpenSea, announced that he had received a Wells notice from the US SEC, believing that NFTs on the platform may be securities and threatened to file a lawsuit against OpenSea. At present, in addition to being used in digital art and collectibles, another major application area of NFTs is electronic game items, which is also part of Immutable's gaming business.

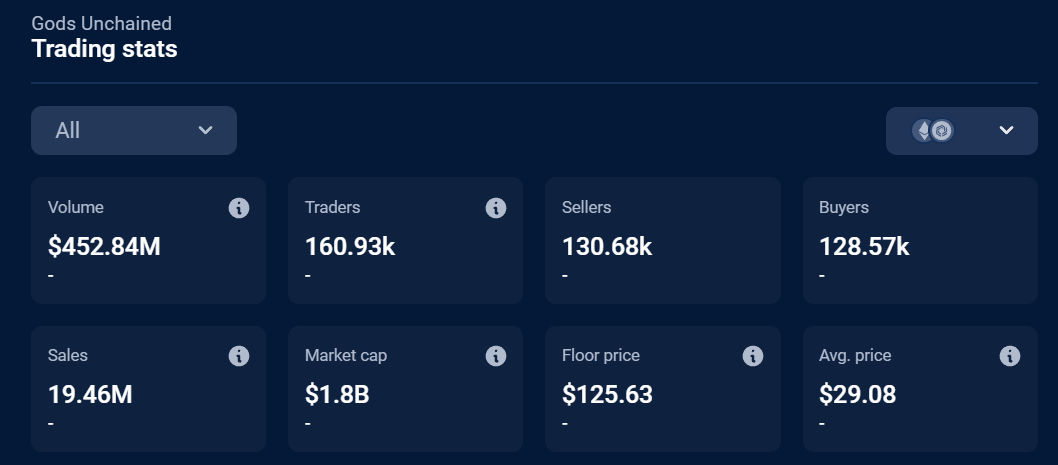

As one of the largest game ecosystems, Immutable has also launched flagship games such as "Gods Unchained" and "Guild of Guardians". In the second quarter of this year, with the launch of "Guild of Guardians" and the release of the "Mainline Quest", which is known as the largest Web3 game task and reward program in history with a reward of over 50 million US dollars, its ecosystem players officially exceeded the 1 million mark, and doubled in May alone. Related reading: "Ecosystem players exceed one million, inventory of Immutable's current 13 games"

According to DappRadar data, the total market value of NFT assets in the collectible card game Gods Unchained is $1.8 billion. According to the SEC's unexpected enforcement style, it first determined that digital artworks were securities, and it seems that it also has a trace of identifying NFT-based game props as securities after "getting involved" in the gaming field.

Maybe the accusation won’t hold up?

Some also see the rush to enforce the law against Immutable before the presidential election as proof that the SEC, led by Gary Gensler, is "on the verge of death."

There are only two and a half months left before the new president takes office on January 20 next year, when Gary Gensler may no longer serve as chairman of the agency. On the one hand, Republican candidate Trump, who frequently shows goodwill to the crypto industry, has simply promised to remove Gensler on his first day in office (whether he has the corresponding legal power and feasibility is not discussed here); on the other hand, according to crypto media Unchained, a close source from Harris' campaign team said in an interview that Harris' transition team is also reviewing his successor.

All in all, there is a high probability that Gary Gensler will be replaced in the new presidential administration, at which time the relevant investigation may be abandoned altogether. Austin Campbell, CEO of blockchain-based digital payment company WSPN, said: "Leadership changes could have a significant impact on the ongoing investigations of the SEC." He added that "after such changes, the investigation may be modified, re-prioritized, or even abandoned."

Regardless of whether the SEC's charges will continue to advance, the tough attitude shown by Immutable shows that they are well prepared: "Immutable remains well-capitalized and has a lot of funds to prepare for the future of games. The SEC's excessive intervention and political agenda will not stop us; they will not stop this industry; they will not stop the inevitability of digital property rights."

You May Also Like

SEC Backs Nasdaq, CBOE, NYSE Push to Simplify Crypto ETF Rules

XRP Price Prediction February 2026: Senator Warren Warns Fed as Pepeto’s 100x Presale Steals the Spotlight From Ripple