Bitcoin Treasury Premium At Risk — What Could This Mean For BTC Price?

Bitcoin (BTC) treasury companies are facing a rather critical situation as their market premium over underlying BTC holdings erodes amid falling volatility and a sharp slowdown in new purchases. Notably, monthly BTC purchases by these companies have crashed by 97% since November 2024, reflecting a highly cautious market approach in recent months. However, recent data from CryptoQuant suggests the need for an immediate change in strategy.

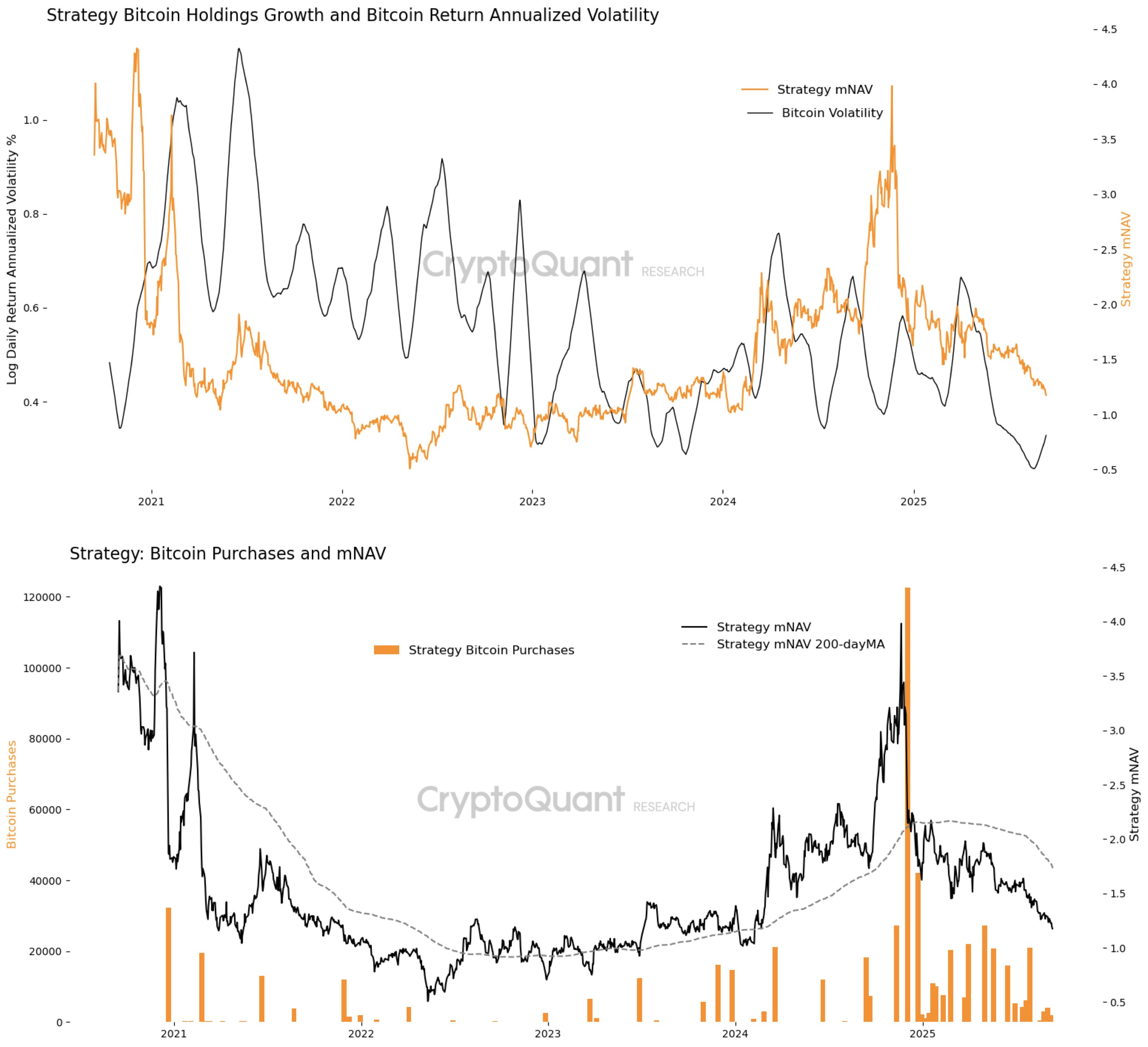

Falling Bitcoin Volatility Threatens Bitcoin Treasuries Market Value

Generally, Bitcoin treasuries trade at a premium, meaning their market value exceeds the actual worth of the BTC they hold, as investors believe these companies can grow their holdings, monetize volatility, and act as a safe exposure to the premier cryptocurrency. Therefore, the market net asset value (mNAV), which compares these companies’ share price to the NAV of their Bitcoin holdings, is always greater than 1. However, CryptoQuant Head of Research, Julio Moreno, shares that annualized Bitcoin volatility has fallen to multi-year lows, removing a key driver of that premium as treasuries have fewer opportunities to capitalize on price swings and justify valuations above their underlying BTC holdings.

In analyzing market data for Strategy, the largest corporate BTC holder, it can be observed that certain spikes in volatility have produced periods when the mNAV surged above 2.0, most notably in early 2021 and again in mid-2024. During these windows, treasury companies were able to monetize volatility, raising equity or debt at a premium and deploying those proceeds into rapid BTC purchases.

Currently, however, volatility has compressed far below 0.4 log daily return annualized, reaching its lowest level since 2020. The flattening volatility curve has coincided with a steady decline in mNAV, which has slipped back toward 1.25. This narrowing premium suggests investors no longer see treasury companies as offering meaningful leverage over simply holding Bitcoin directly.

Related Reading: Tether Announces US Stablecoin Launch, Appoints Ex-Trump Advisor As CEOWeakening Demand Compounds Treasuries’ Problem

Without the “fuel” of price swings, Bitcoin treasury firms struggle to expand their holdings in ways that justify a premium valuation. While there were isolated bursts of buying in late 2024 and early 2025, overall activity remains muted. Correspondingly, Strategy’s mNAV has been trending downward since the turn of 2025, even as BTC itself has traded in a relatively elevated price range compared to recent years. The data suggests that when treasuries buy aggressively, investor enthusiasm pushes mNAV higher, reinforcing the cycle of premium issuance and BTC accumulation. Julio Moreno explains that for the mNAV premium to persist, a rebound in BTC volatility and renewed demand through large-scale purchases are immediately needed. Until then, treasury companies may find it increasingly difficult to justify valuations above their Bitcoin net asset value, forcing investors to consider a direct exposure to Bitcoin for returns rather than on corporate strategy. At press time, Bitcoin trades at $115,810, reflecting a 4.72% gain in the past week.

You May Also Like

US Jobs Miss Fails to Stop Bitcoin Erasing Its $74,000 Breakout Attempt

SushiSwap (SUSHI) Price Prediction 2026, 2027-2030: Future Outlook, Targets, and Long-Term Forecast