A look at the 28 projects and token performances that a16z invested in this year

Author: andrew.moh , Crypto KOL

Compiled by: Felix, PANews

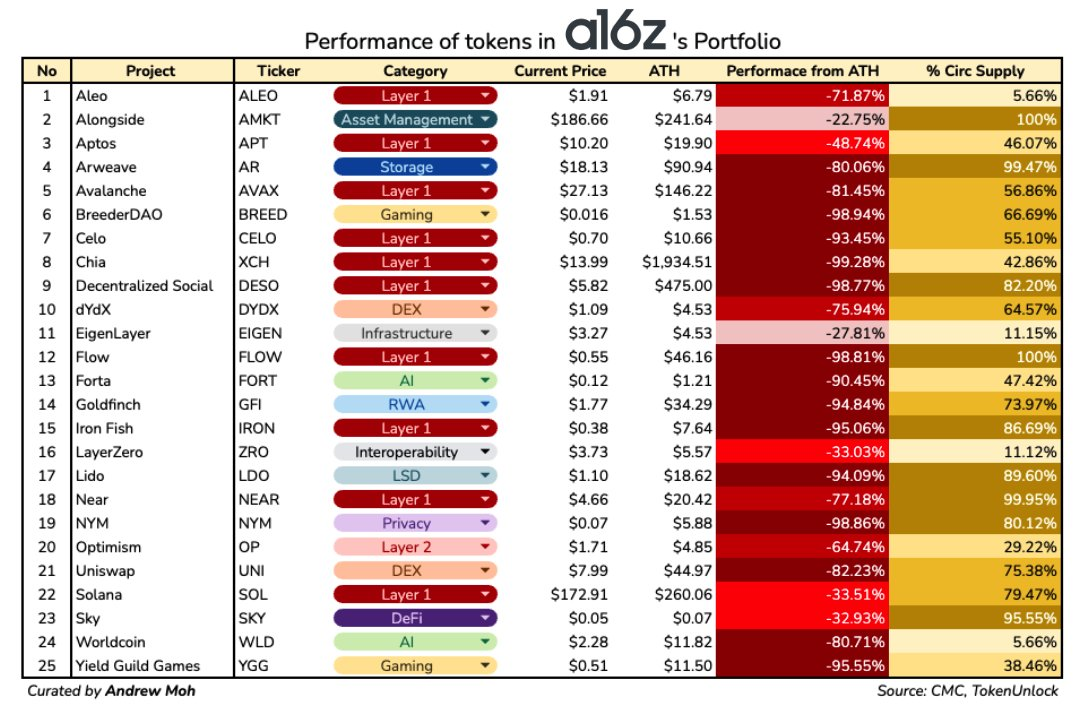

a16z is considered a Tier 1 VC. Following their investment footprint may be a wise strategy. The performance of the tokens in the a16z portfolio is as follows:

Why choose a16z ?

Marc Andreessen and Ben Horowitz are top entrepreneurs and investors. They have invested in big companies like Airbnb, Github, Skype, and Stripe, and their investment performance was outstanding even before the emergence of cryptocurrencies. a16z has more than 100 team members, including well-known figures such as Tim Roughgarden.

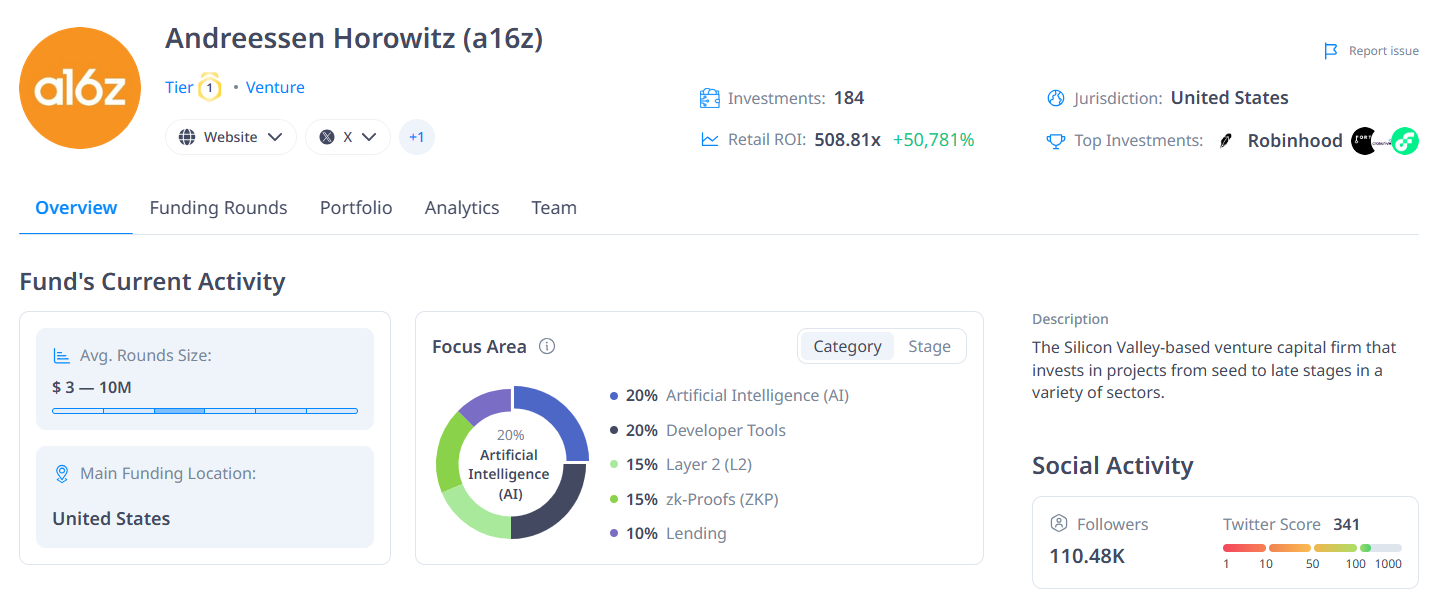

According to CryptoRank statistics, a16z has invested in 184 crypto projects.

- Leading 106 projects

- 55% of the investments were between US$3 million and US$10 million

- The most popular co-investor is Coinbase Ventures (32 co-investments)

- Retail ROI: 508.81 times (+50,781%)

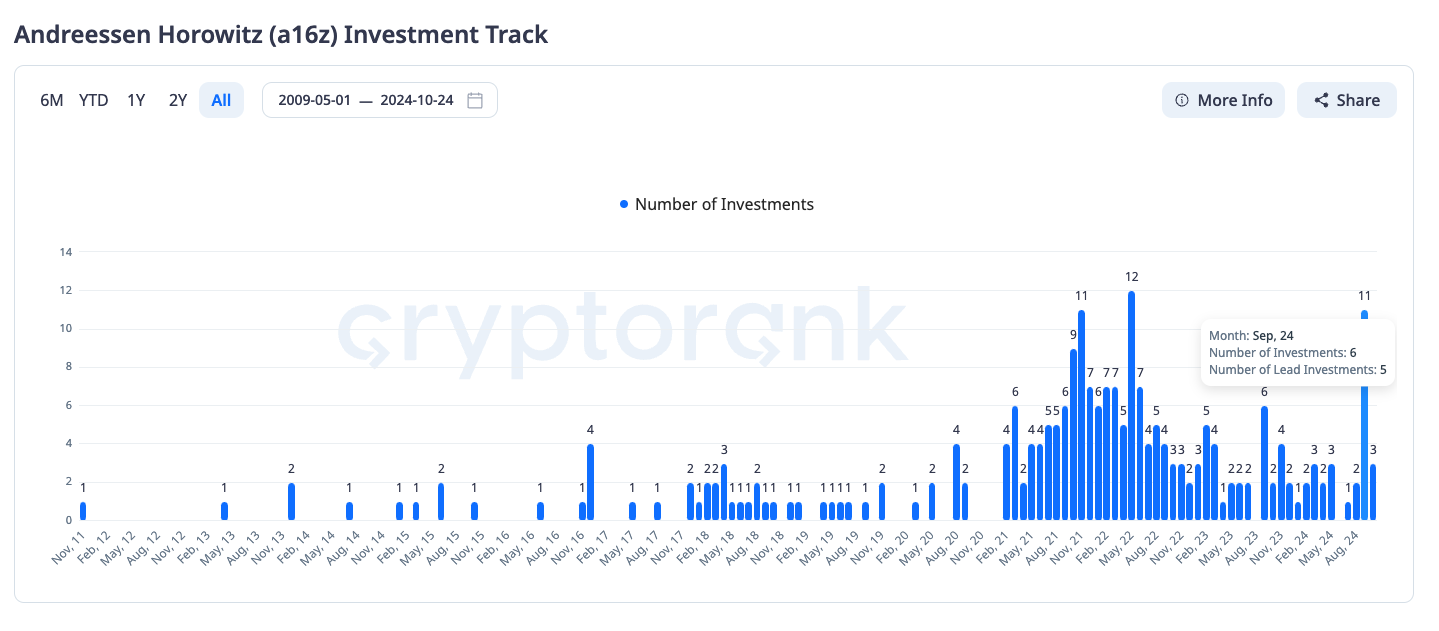

2021 and 2023 are their "active investing" years:

- Completed 128 investments

- Leading 84 projects

As the crypto market situation changed in 2023, a16z's investment activities dropped significantly. On September 24, they returned strongly with 11 investment activities.

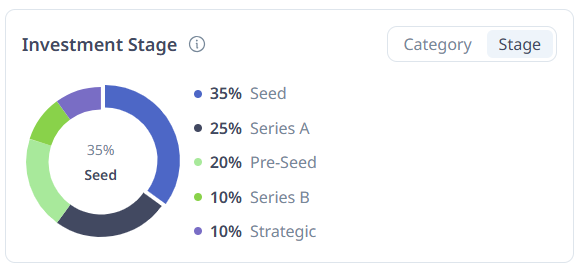

Overall, a16z has participated in various rounds of investment. However, like most other crypto venture capital firms, seed, A and pre-seed rounds still dominate. 35% of the investments are seed rounds, and A rounds account for 25%. They start participating in projects very early and provide firm support for projects from the start-up stage.

From a16z’s portfolio, we can see:

- L1 is one of their favorite areas

- Although AI and RWA are two of the hottest topics in 2024, they seem to be less interested in these

- Diversified portfolio includes LSD, gaming and infrastructure

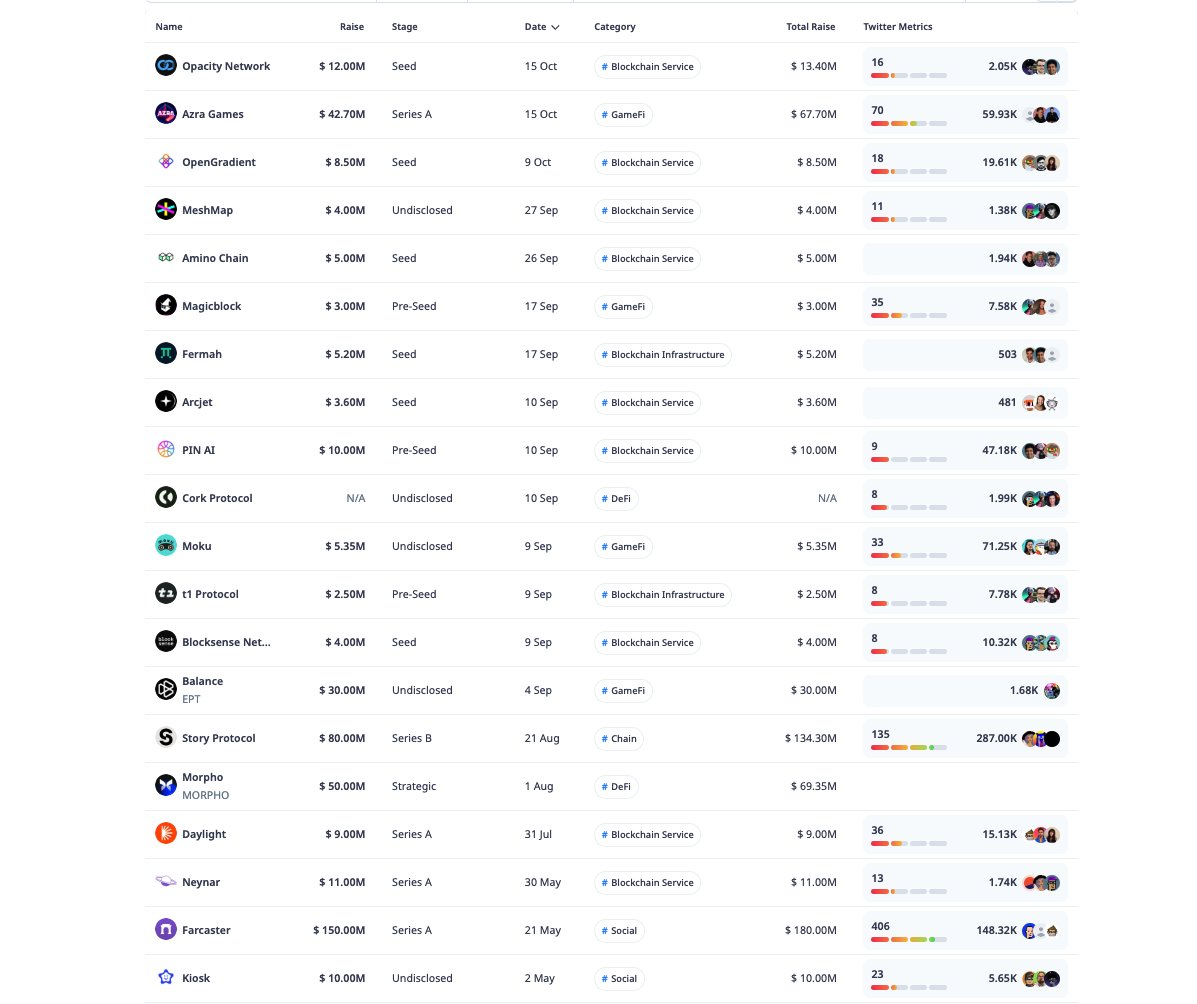

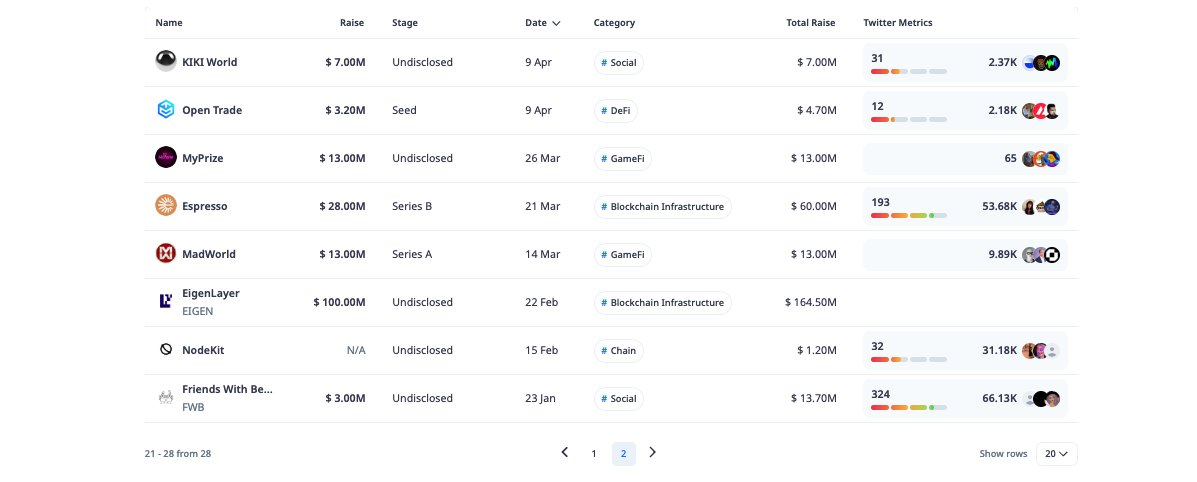

In 2024, a16z invested in 28 projects:

- 6 game projects

- 4 blockchain infrastructure projects

- 9 blockchain service projects

- 9 other projects

These include: EigenLayer, Story Protocol, Morpho Labs, Farcaster, etc.

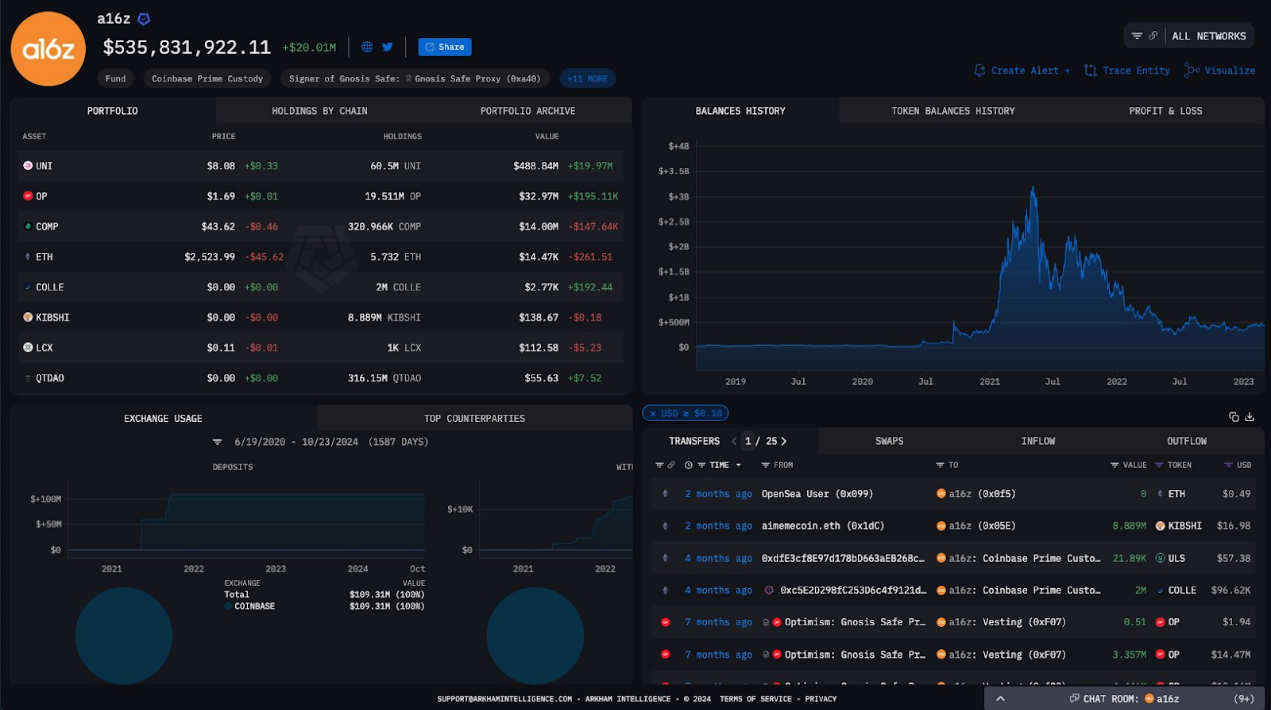

The a16z portfolio is now valued at over $535 million, including:

- UNI is their largest holding, with 60.5 million UNI

- OP is their second largest holding, valued at $32.97 million

Source: Arkham

Summarize

a16z has always been considered the top venture capital firm. They have been involved in projects very early and have provided unwavering support from the start-up stage. Their investment focuses include infrastructure projects such as L1s/L2s, as well as many of the hottest trends such as AI and RWA.

Following the investment footsteps of top VCs such as a16z seems to be a wise strategy. But you also need to carefully study the current market conditions and trends. Let a cool head and a warm heart guide your investment decisions.

Related reading: Is the Binance listing effect weakening? Market, project quality and narrative are the three key factors for the rise in coin prices

You May Also Like

XRP Ledger (XRPL) averts critical security flaw with AI

Sonic Holders Accumulate Millions as Price Tests Key Levels