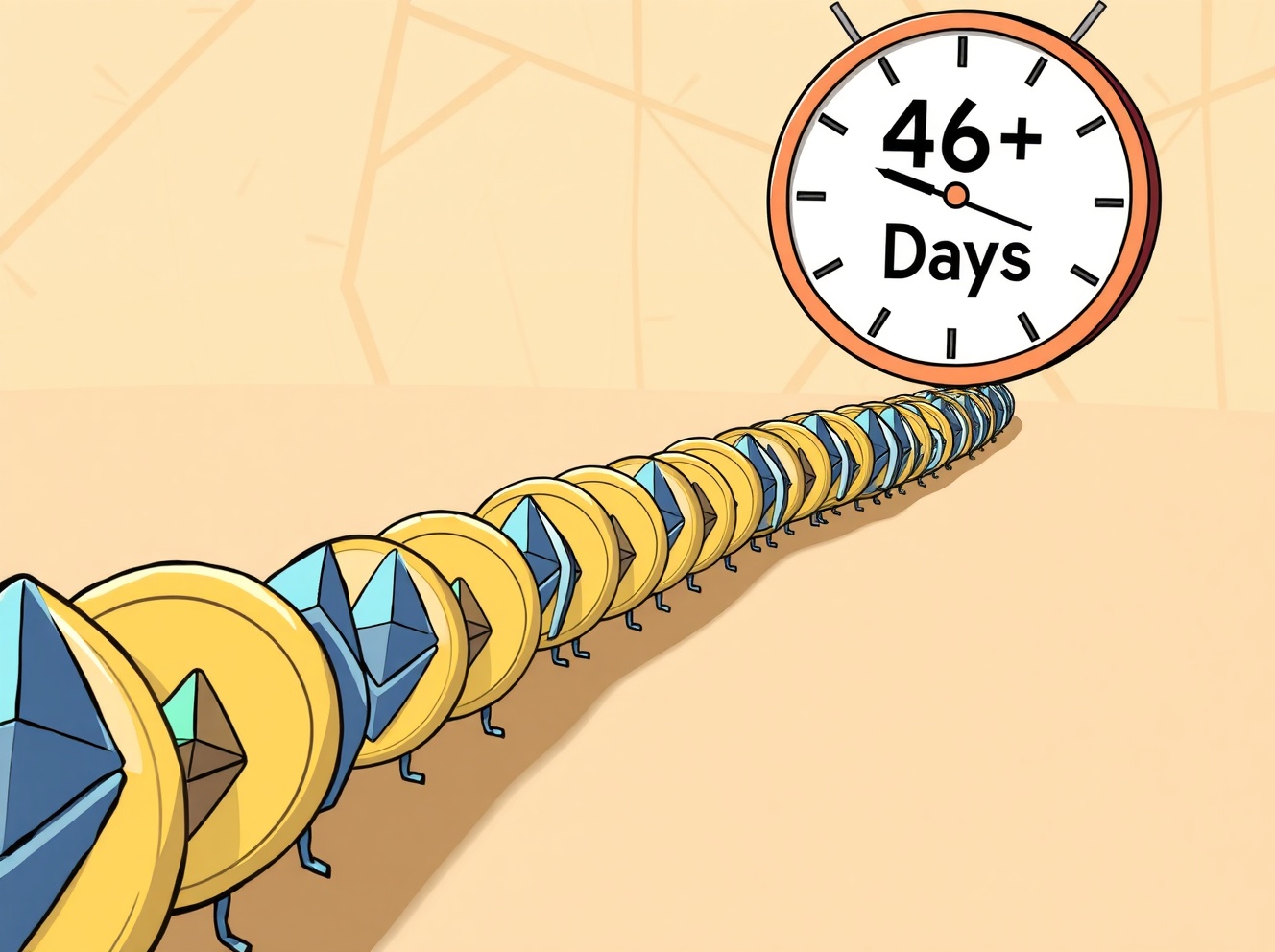

Ethereum Unstaking Wait Time Hits Unprecedented 46-Day Surge

BitcoinWorld

Ethereum Unstaking Wait Time Hits Unprecedented 46-Day Surge

For those deeply involved in the world of decentralized finance, a significant development has emerged that demands attention: the Ethereum unstaking wait time has reached an unprecedented peak, now extending to over 46 days. This isn’t just a minor delay; it’s an all-time high for the network, marking a substantial increase from the previous record of approximately 18 days set just last August. Currently, a staggering 2.5 million ETH, with an estimated value of $11.25 billion, finds itself caught in the network’s exit queue. This extended wait time is undoubtedly causing ripples across the Ethereum ecosystem, affecting stakers and the broader market alike.

What’s Behind the Staggering Ethereum Unstaking Wait Time?

The primary catalyst for this dramatic surge in the Ethereum unstaking wait time can be traced back to a specific incident on September 9. This event involved Kiln, a prominent staking platform that plays a crucial role in the Ethereum network. Following an exploit that impacted the crypto trading and analysis application SwissBorg, Kiln made a decisive move to protect its users and the network.

- Kiln opted to sequentially halt all its validator activities on the Ethereum network.

- This strategic decision, though aimed at security, had a profound immediate effect on the unstaking queue.

- Approximately 1.6 million ETH were abruptly added to the withdrawal queue in one fell swoop as validators exited.

This sudden influx of withdrawal requests created an immense backlog, pushing the network’s processing capabilities to their limits and directly contributing to the record-breaking wait times we are observing today. It highlights the interconnectedness and potential ripple effects within the crypto ecosystem.

How Does This Impact Ethereum Stakers and the Market?

An extended Ethereum unstaking wait time carries several implications for individual stakers and the wider market. For many, staking Ethereum is a long-term commitment, but the expectation of being able to unstake within a reasonable timeframe is fundamental to managing their digital assets. When that timeframe stretches significantly, it can lead to concerns about liquidity and flexibility, altering investment strategies.

- Liquidity Concerns: Stakers may find their capital locked up for much longer than anticipated, limiting their ability to react quickly to market changes or reallocate funds to other opportunities.

- Investment Decisions: The uncertainty surrounding withdrawal times could influence future staking decisions, potentially deterring new participants or encouraging existing ones to seek alternative, more liquid opportunities.

- Market Sentiment: While not a direct threat to Ethereum’s underlying technology, prolonged operational issues like this can sometimes impact investor confidence and market sentiment, especially if not managed effectively with clear communication.

Understanding these impacts is crucial for anyone holding or considering staking ETH, as the current scenario highlights the inherent risks and operational realities of decentralized networks. It’s a stark reminder of the importance of due diligence.

Navigating the Current Ethereum Unstaking Landscape

Given the current extended Ethereum unstaking wait time, what can stakers do, and what should they consider? It’s important to approach this situation with a clear understanding of the network’s design and the available options. The Ethereum network is intentionally designed with built-in mechanisms to handle unstaking requests in a controlled manner. This capacity limitation helps maintain network stability and security, preventing a sudden flood of withdrawals that could destabilize the system. However, in situations like the Kiln incident, these protective measures can lead to significant backlogs.

- Patience is Key: For those already in the queue, patience is the primary strategy. The network will process requests sequentially, and there’s no way to expedite an individual withdrawal. Regularly check the status through your staking provider.

- Monitor Developments: Stay informed about network updates and any resolutions or improvements introduced by staking providers or the Ethereum Foundation. The community is always working towards optimizing network performance.

- Consider Liquid Staking: For future staking, explore liquid staking derivatives (LSDs). These protocols allow you to stake your ETH and receive a tokenized representation (e.g., stETH, rETH), which offers liquidity even while your underlying ETH is locked. However, it’s crucial to understand that LSDs come with their own set of smart contract risks, potential de-pegging, and counterparty risks.

- Diversify Staking Providers: To mitigate risks associated with a single provider, consider diversifying your staked ETH across multiple reputable platforms. This reduces exposure to a single point of failure.

Making informed decisions is paramount in such dynamic environments. Always conduct thorough research and understand the trade-offs involved in different staking strategies, especially when dealing with prolonged Ethereum unstaking wait time scenarios.

The Broader Implications for Ethereum’s Ecosystem

Beyond individual stakers, the record-high Ethereum unstaking wait time raises broader questions about network resilience, the decentralization of staking, and the future evolution of the network. While the Kiln incident was a specific trigger, it underscores the importance of robust infrastructure and diversified staking solutions within the ecosystem. The Ethereum community and developers are continuously working on improving the network’s efficiency and security, learning from such events to build a more robust system.

This event serves as a reminder that even mature blockchain networks can face operational challenges. It highlights the ongoing need for:

- Enhanced Decentralization: Encouraging a wider distribution of validators across numerous independent entities to reduce reliance on any single point of failure, thereby increasing network robustness.

- Improved Security Protocols: Continuous innovation in preventing and mitigating exploits that could impact staking providers, ensuring the integrity and safety of staked assets.

- Scalability Solutions: Ongoing efforts to scale Ethereum’s transaction processing capabilities through upgrades like sharding and layer-2 solutions, which indirectly contribute to smoother operations across the network, including unstaking efficiency.

- Transparency and Communication: Clear and timely communication from staking providers and the Ethereum Foundation during incidents helps manage community expectations and maintain trust.

Ultimately, such challenges, while inconvenient in the short term, often drive innovation and lead to a stronger, more resilient, and more decentralized network in the long run. The community’s response and subsequent improvements will be key in reinforcing confidence in Ethereum’s staking mechanism.

The surge in Ethereum unstaking wait time to over 46 days is a notable event, primarily driven by the Kiln incident and its subsequent impact on the network’s withdrawal queue. While this presents immediate challenges for stakers regarding liquidity and flexibility, it also serves as a crucial learning experience for the broader Ethereum ecosystem. It highlights the importance of robust security, diversified staking practices, and the continuous evolution of blockchain infrastructure. As the network works through this backlog, the incident reinforces the need for stakers to remain informed and strategic in their engagement with decentralized finance.

To learn more about the latest crypto market trends, explore our article on key developments shaping Ethereum price action.

Frequently Asked Questions (FAQs)

1. What is the current Ethereum unstaking wait time?

The current wait time to unstake Ethereum has surged to over 46 days, marking an all-time high for the network.

2. Why has the Ethereum unstaking wait time increased so dramatically?

The dramatic increase is primarily attributed to an incident on September 9 involving the staking platform Kiln. Following an exploit affecting SwissBorg, Kiln halted its validator activities, adding approximately 1.6 million ETH to the withdrawal queue at once.

3. How does the extended wait time affect ETH stakers?

Extended wait times can lead to liquidity concerns, as stakers’ capital is locked up for longer than anticipated. It can also influence future investment decisions and impact overall market sentiment.

4. What can stakers do about the long wait times?

For those already in the queue, patience is key. For future staking, consider monitoring network developments, exploring liquid staking derivatives (LSDs) for liquidity, and diversifying staking providers to mitigate risk.

5. Is this a sign of a problem with the Ethereum network?

While the extended wait time presents operational challenges, it’s a result of specific incidents and the network’s built-in stability mechanisms. It highlights areas for improvement in infrastructure and decentralization, but not a fundamental flaw in Ethereum’s core technology. The community actively works on solutions and improvements.

If you found this insight into Ethereum’s current unstaking challenges valuable, consider sharing this article with your network. Your engagement helps spread awareness and fosters a more informed crypto community. Stay ahead with the latest blockchain developments by following us on social media!

This post Ethereum Unstaking Wait Time Hits Unprecedented 46-Day Surge first appeared on BitcoinWorld.

You May Also Like

In 2025, global cryptocurrency investors will rush to purchase Pioneer Hash smart cloud mining contracts, allowing you to earn a daily incomethatneverstops!

MakinaFi suffered an attack that resulted in the loss of approximately 1299 ETH, with some funds being preemptively processed by MEV.