Bitwise Files S-1 for Aptos ETF, CEO Cites ‘Momentum in Aptos Ecosystem’

Crypto asset manager Bitwise has filed an S-1 registration for an Aptos ETF to formalize its proposal, following initial administrative steps to register the trust entity in the state of Delaware.

An S-1 registration is a formal document required by the U.S. Securities and Exchange Commission (SEC) for a new security, like a crypto ETF, to be offered to the public.

The Bitwise Aptos ETF filing is just the initial step, and the approval timeline can take several months or longer.

Bitwise Aptos ETF Faces SEC Review: Approval Could Take Months

The SEC will carefully review the application, assessing factors such as market risk, investor protection, and regulatory compliance before making a decision.

Bitwise CEO Hunter Horsley confirmed the filing in a recent X post, which revealed that the Aptos Layer-1 blockchain has led development activities among new blockchain entrants by over 897%.

Horsley added that he can’t say more about the Aptos ETF during the quiet period, “But fired up about the momentum in the Aptos ecosystem.”

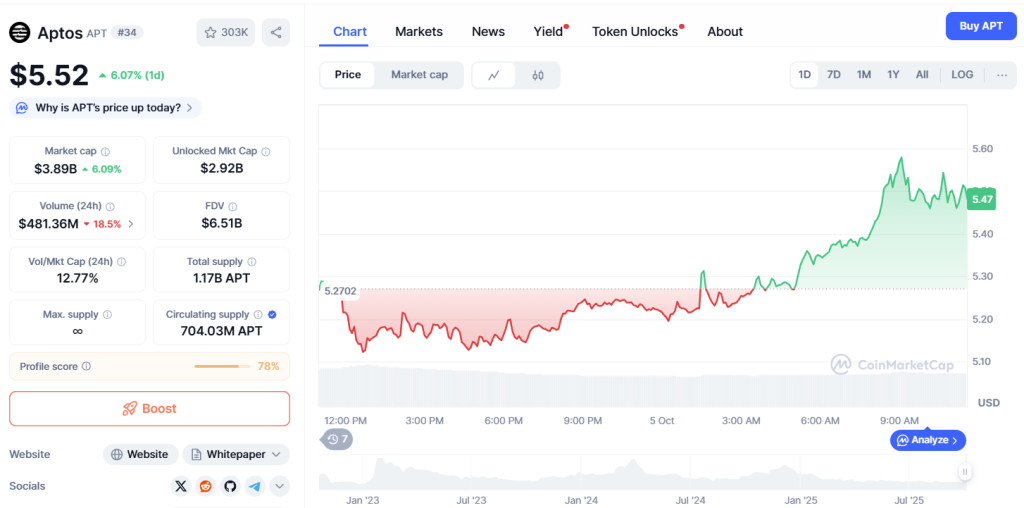

Within hours of the filing announcement, Aptos surged from $4.63 to a high of $5.65 before settling around $5.52 at press time.

Source: CoinMarketCap

Source: CoinMarketCap

Trading volumes also exceeded $3.98 billion, marking a three-month high for both price and volume.

Recall that Aptos Labs CEO Avery Ching is officially part of the Commodity Futures Trading Commission’s (CFTC) Digital Assets Global Markets Advisory Committee (GMAC) subcommittee.

The CFTC specifically pointed out that Ching will collaborate with other leaders from Web3 and financial services to help shape digital asset regulations.

Many believe his appointment could help facilitate internal discussions with regulators on the need for an Aptos ETF.

For European investors, Bitwise already has a similar product listed in Switzerland, on the SIX Swiss Exchange, which shows growing confidence that the U.S. counterpart might see an Aptos ETF go live before the end of 2025.

When asked about the gap that Aptos fills in the Layer-1 blockchain space, where the likes of Ethereum, Solana, BNB Chain, Sui, and Tron have already dominated, Horsley responded that Aptos is favored by institutions because it offers maximum speed and cost efficiency.

The claim of institutional preference for Aptos appears to be genuine.

BlackRock’s $2B BUIDL Fund Backs Aptos Ahead of ETF Decision

In November 2024, BlackRock, the world’s largest asset manager, expanded access to its tokenized real-world asset fund, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), to include Aptos.

Securitize’s CEO, Carlos Domingo, cited that the choice for Aptos was about broadening the accessibility of what has become the largest money-market token of its kind.

According to him, “we’ll start to see more investors looking to leverage the underlying technology to increase efficiencies on all the things that until now have been hard to do.”

When it comes to transaction speed and cost, Aptos, a layer-1 blockchain platform developed by former Facebook employees, recently set a new record in blockchain transactions.

In May, Aptos surpassed Solana by recording an astounding 115.4 million transactions in a single day, far exceeding Solana’s 31.7 million, according to Aptoscan.

The surge not only shattered previous records but also surpassed the L1 record of over 65 million held by Sui Network by an impressive margin of over 50%.

Aside from transaction volume, Aptos has also been showing growth in stablecoin activities.

According to data shared by the Aptos protocol, native USDT activity on Aptos has now surpassed $30 billion in volume, making it the fourth-largest layer-1 blockchain by net circulation of native USDT, valued at approximately $830 million.

The blockchain’s stablecoin dominance extends beyond USDT to include USDC and USDe, creating a comprehensive ecosystem that has attracted significant user engagement.

You May Also Like

CME Group to Launch Solana and XRP Futures Options

Algorand (ALGO) Foundation Taps Ex-FinCEN, MoneyGram Execs for New US-Based Board