EOS failed to "leave the market": renamed Vaulta to transform into "Web3 bank" to prepare for the ecological project exSat

Author: Frank, PANews

EOS, once known as the "Ethereum killer", officially announced its brand upgrade to Vaulta, starting a strategic transformation with Web3 Bank as the core. From public chain infrastructure to institutional banking business narrative, the EOS Foundation found inspiration through exSat to reconstruct the Bitcoin ecosystem, and also took the opportunity of brand reshaping to completely cut off historical baggage.

Behind this transformation, is it the frustration of losing the competition in the public chain track, or the ambition to bet on the compliance of Web3 finance? When Vaulta tokens replaced EOS, RAM scarcity surpassed the native token, and exSat's independent ecology became the main guest, a backdoor ecological transformation has quietly begun.

Can the entry of Canadian asset custodians complete the transformation of Web3 banks?

EOS has several key points in its latest brand upgrade plan. The first is about the next Web3 bank brand narrative, the second is about the path to achieve this narrative, and the third is about some potential changes in token economics.

First of all, in terms of brand upgrade, the announcement highlighted several reasons for doing Web3 banking business. One is the continued increase in the global adoption rate of cryptocurrencies. The second is the continued increase in the market value of stablecoins. The third is the market potential of RWA. From these starting points, EOS's next new goal seems to be to become another XRP. This transformation seems to be related to the external environment of the crypto market.

In addition, Vaulta also announced the launch of a banking advisory committee. However, it did not mention the current status and specific role of this banking advisory committee in ecological governance.

Judging from the backgrounds of the members of the Bank Information Committee, these institutions are not actually traditional banks, but mainly asset custodians. They are also very regional, all from Alberta, Canada. Among them, ATB Financial is the largest financial institution in Alberta, founded in 1938, with assets of US$65.5 billion and serving more than 830,000 customers. The others are digital asset custodians established within a few years, and the specific scale of assets under management has not been disclosed.

However, overall, although the cooperating financial institutions hold Canadian compliance licenses, it remains to be seen whether their regional attributes match Vaulta's global Web3 banking vision.

The upgrade called EOS is actually a wedding dress for exSat

In the new announcement, Vaulta mentioned four major business directions as core pillars, namely wealth management, consumer payments, securities investment, and insurance. Among these four businesses, the focus can be on the exSat business launched to institutions in wealth management.

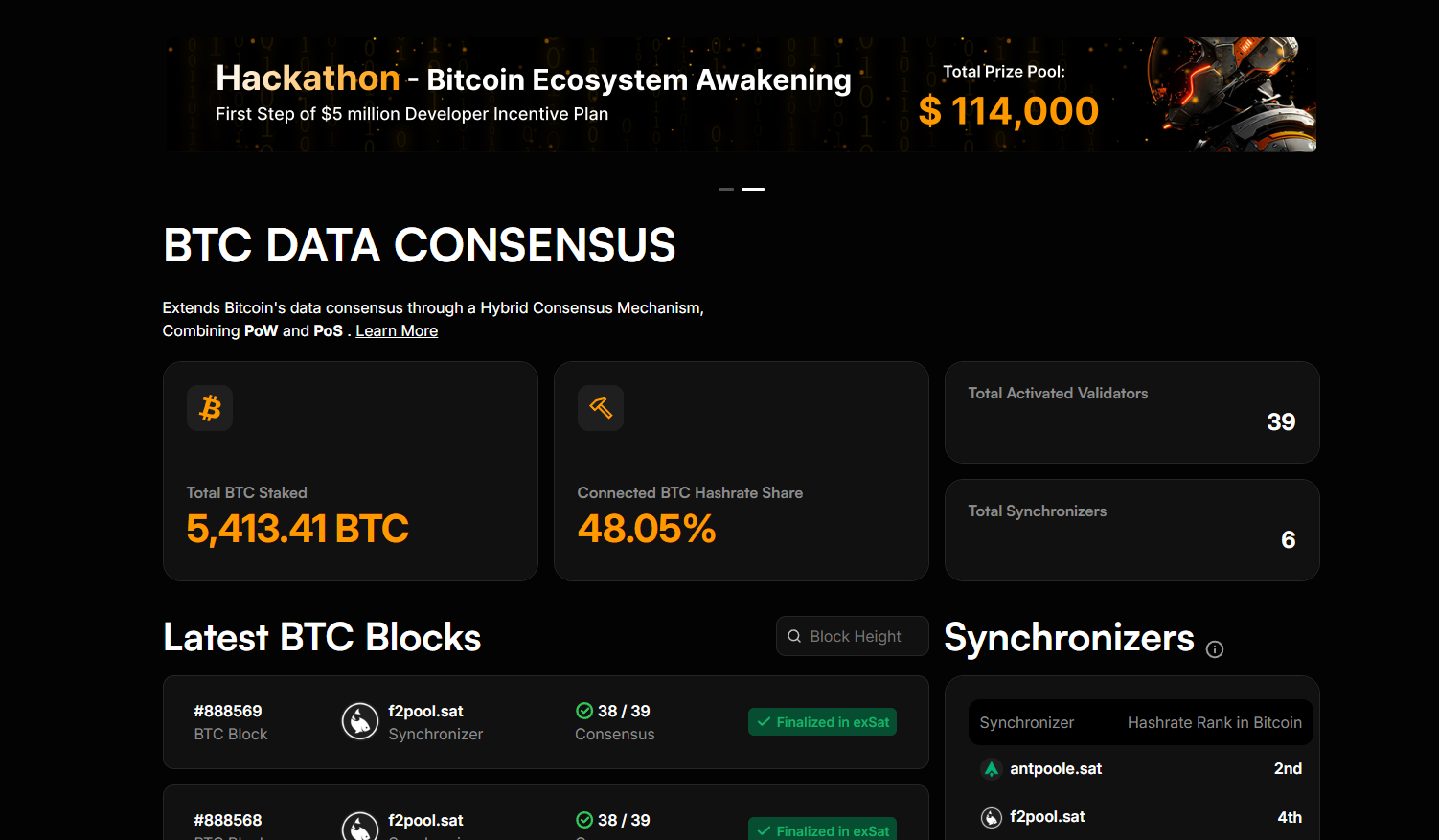

exSat is a Bitcoin scalability project launched by the EOS ecosystem in 2024. As a "Docking Layer" connecting the Bitcoin main chain with the layer 2 expansion solution, it uses EOS RAM to store and process Bitcoin data, enhancing Bitcoin's performance and interoperability. Its main function is to enable faster and lower-cost Bitcoin transactions and provide space for the Bitcoin ecosystem to carry out DeFi business.

This project seems to have achieved an influence that exceeds that of EOS itself. As of March 20, the amount of Bitcoin staked on exSat was 5,413 BTC, and the TVL had reached US$587 million, far exceeding the US$174 million of the EOS mainnet.

Therefore, in the brand upgrade plan, it is not difficult to see why the focus is basically on exSat rather than EOS. In fact, exSat has an independent consensus mechanism (a combination of POS+POW+DPOS), and currently has 39 validators, among which some well-known cryptographic institutions can be seen participating, such as Certik, Hashkey, Bitget, F2pool, OKX, Matrixpt, Tron, etc. From various characteristics, exSat seems to have become another independent public chain grown from EOS, but it still uses EOS's RAM and block space.

Vaulta tokens will be launched, tokens will be weakened, RAM will be more scarce

In terms of token economics, Vaulta will also replace EOS tokens with Vaulta tokens. But it is obvious that the new Vaulta tokens will be greatly weakened in terms of governance functions. Just as this brand upgrade plan was not launched through a voting proposal but was directly released by the EOS Foundation, the governance of the EOS network seems to be dead in name only.

The announcement states that "Vaulta token holders stake tokens and receive rewards, actively participate in governance, and vote for block producers responsible for managing network consensus and security. As Vaulta grows, token holders of all sizes can participate in discussions and proposals." From this description, we can see that the main benefit for token holders is that they can stake rewards. Regarding governance, it seems that they only vote for block leaders, which is the consensus mechanism design of DPOS and does not fall into the category of governance. As for when token holders can participate in substantive governance, the right of interpretation is still in the hands of the foundation.

However, judging from the current EOS token price and TVL, this block reward seems to only meet the normal operation of the infrastructure. It seems that no one is actively promoting the expansion of the EOS ecosystem, but is just doing infrastructure work for exSat. In addition, this announcement states that EOS tokens can be exchanged for Vaulta tokens at a 1:1 ratio, but it does not specify whether Vaulta tokens will be issued in addition to the current EOS tokens.

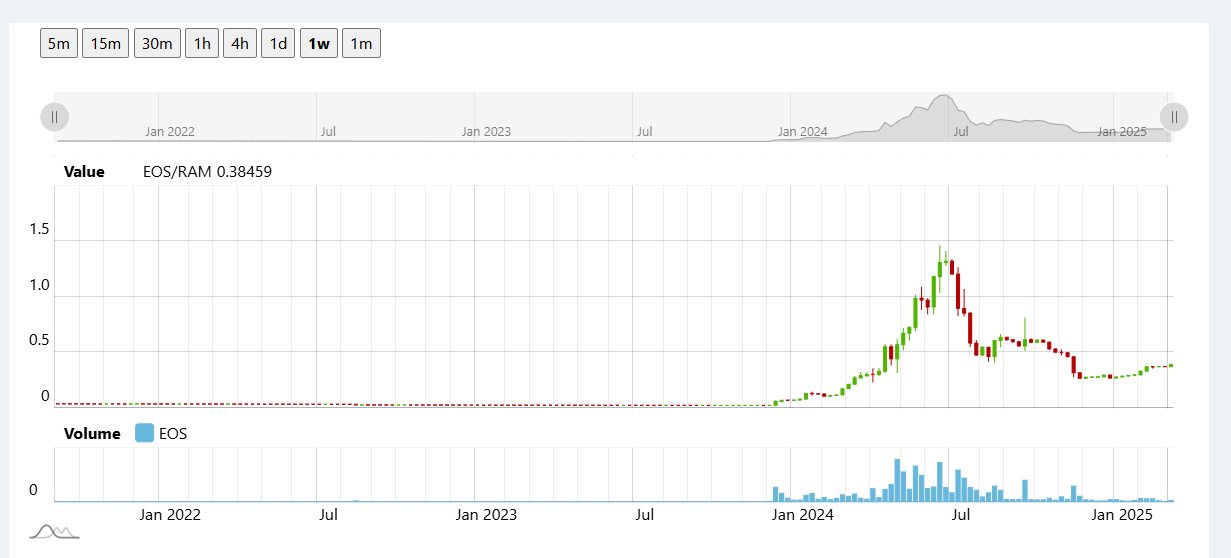

And with this brand upgrade, the importance of RAM seems to be even more scarce than EOS tokens. "As Vaulta expands its role in decentralized finance and Web3 banking, RAM's inherent scarcity and growing demand puts holders in a unique advantage position."

RAM is the operating memory within the EOS network. All products running on the EOS network need to rent memory. exSat is no exception. Since the total amount of RAM is currently designed to have stopped inflation, as a strategic resource in the network, the practicality and value potential of RAM seem to be higher than the token itself.

Judging from the price trend, RAM's price trend is much more stable than that of EOS tokens.

The 4 billion ICO financing giant has left the stage of history in frustration

Essentially, the biggest change in this brand upgrade seems to be that EOS's original route has been completely abandoned. Due to the failure of ecological construction in recent years, EOS has failed in the direction of grabbing land in the public chain competition. But fortunately, EOS has never had any problems in terms of performance. The new Vaulta brand seems to be an integration of EOS's existing infrastructure and the exSat network that was launched last year and has achieved good results. It is still unknown whether Vaulta's Web3 bank will be successful. But what will definitely happen is that the EOS brand will completely exit the stage of history.

In fact, for users who entered the crypto field earlier, the end of EOS seems to be a pity. In 2017, EOS raised $4 billion through ICO, setting a record in crypto history. At that time, the founder of Solana was still struggling for financing and finally received only $3.17 million in seed round support.

In 2018, the influence of EOS, which was launched on the mainnet, was at its peak. Just like Solana’s suppression of Ethereum today, the market was full of voices that EOS would become the new king of public chains. Its price also rose to $15.6 at its highest, and its market value once approached $18 billion, ranking third in the market. Currently, the market value of EOS tokens is only $870 million, and its ranking has dropped to 97th.

The biggest reason for this huge gap is the inaction of Block.one, the project party that received huge financing. Several official projects have all fallen into oblivion. With the resignation of founder Daniel Larimer as Chief Technology Officer of Block.one, the community's trust in EOS has further disappeared.

Although the new EOS Network Foundation was established later, and several economic model adjustments and infrastructure upgrades were made in 2024, it seems that none of them have made waves in the market. With the launch of exSat at the end of 2024, EOS unexpectedly achieved some success in the construction of the Bitcoin ecosystem. But what's interesting is that the EOS network has never included exSat's data in its own ecological data, and it seems that it has intentionally made a distinction from the beginning. Perhaps this Vaulta upgrade is not a temporary plan, but has been planned for a long time.

The brand effect of EOS seems to have become worthless, so the EOS Foundation chose to almost completely abandon the upgrade (although the brand name Vaulta may not be more intuitive and easy to remember).

Back then, a popular saying in the EOS community was: "You will never see EOS below 100 yuan again." With this brand transformation, this saying has finally come true. However, this time it has nothing to do with the market trend, but that we will never see EOS again.

You May Also Like

Why 2026 Could Be a Dream Year for Investors: And Where Bitcoin Fits In?

Public trust at stake as gov’t falls short of detaining ‘big fish’ in flood control mess