Ethereum Forecasts $4,500 By Year End While Digitap ($TAP) is Going Viral as “The Next PayPal” with 50x Potential

Ethereum (ETH) remains a dominant force in the crypto sector, with market analysts forecasting a potential year-end target of $6,800. This projection reflects growing institutional adoption, scaling upgrades, and continued activity in DeFi and NFTs.

Alongside Ethereum’s strong performance, Digitap ($TAP) has emerged as a project with both utility and growth potential. $TAP is being compared to PayPal due to its payment integrations and global account support, and analysts describe it as one of the best altcoins to buy in 2025.

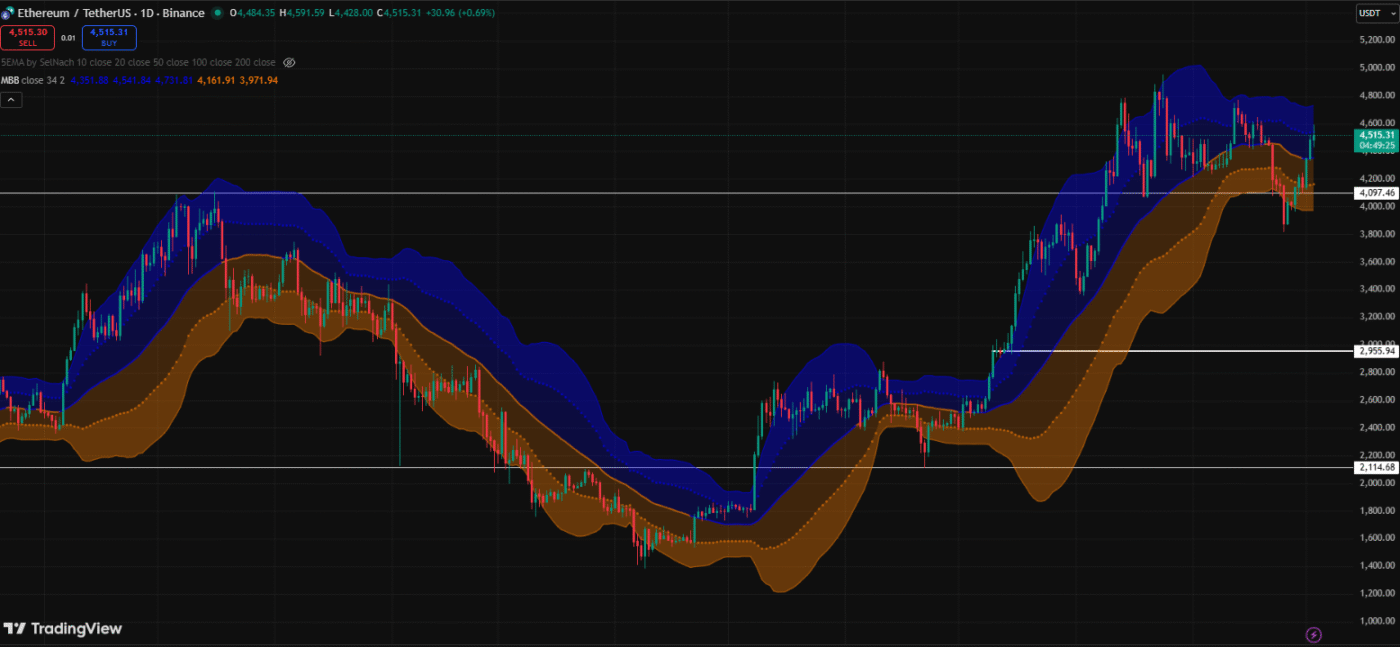

Ethereum’s Breaks $4,500: The Path to $6,800

Ethereum’s price forecast rests on multiple factors. The shift to proof-of-stake and ongoing scaling solutions is improving efficiency and reducing costs. Ethereum’s dominance in DeFi remains unmatched, with billions locked across lending, trading, and staking platforms. Institutional adoption is another driver, with more funds offering ETH exposure.

Currently trading above $4,500, analysts believe these conditions create the basis for ETH to test $6,800 before the end of the year. Long-term holders remain confident, even as short-term traders face volatility.

For investors, Ethereum represents both a reliable store of value in crypto terms and a platform with unmatched utility. With such a strong DeFi base, it is a strong long-term play with a $6,800 forecast being entirely reasonable over the coming months.

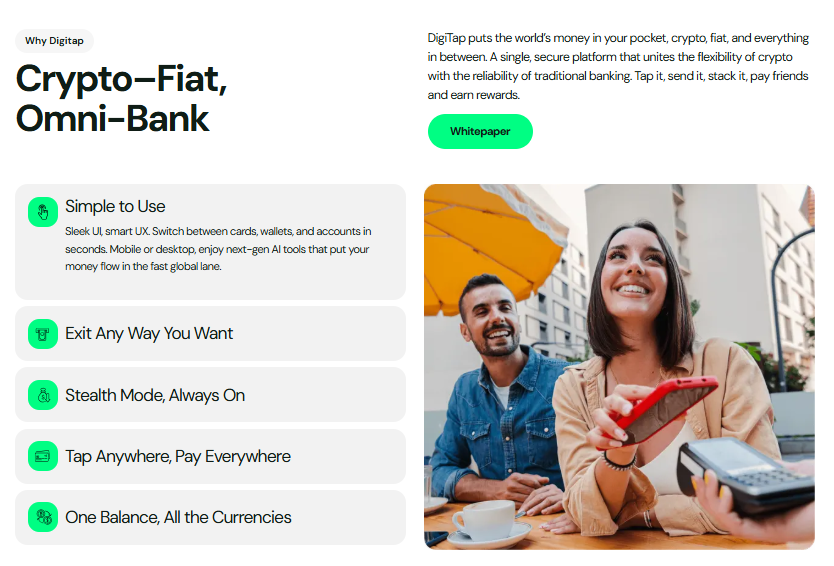

Digitap Gains Momentum as a Payment-Focused Project

While Ethereum maintains dominance, Digitap is capturing attention as a presale with unique features. $TAP’s roadmap includes global payment adoption through Visa, Apple Pay, and Google Pay, supported by multi-currency IBAN accounts. These integrations make it functionally similar to PayPal, but powered by blockchain.

For investors who missed early opportunities in Ethereum, $TAP offers a chance to enter a project before exchange listings. Its dual focus on usability and token value creation differentiates it from purely speculative ventures.

Digitap’s tokenomics are designed to be simple and transparent. There is no buy or sell tax, no hidden inflation, and no long vesting schedules, which means tokens are accessible immediately. The $TAP economy is deflationary as burn mechanisms remove tokens from circulation.

Viral Growth and Comparisons to PayPal

Digitap’s viral momentum stems from its vision of becoming a blockchain-powered payment gateway. With features resembling PayPal, the project highlights how digital assets can merge with global financial systems. The vision of being the world’s first omni bank could even dwarf the growth of PayPal, as it taps into new markets.

It aims to capture a large segment of remote workers and digital nomads who are fed up with the cost and headaches of traditional banking. Through a secure interface, globetrotters can easily access fiat or crypto, paying at any point of sale terminal in the currency of choice. Crypto and fiat are seamlessly integrated, something PayPal has yet to achieve.

$TAP’s early presale price of $0.0125 further makes it accessible to a wide audience, increasing demand. As word spreads across forums and social channels, TAP is being promoted as a project with 50x potential. This growth narrative mirrors other early success stories, where early participation produced outsized gains.

Zero KYC account access and 124% APY for staked $TAP represent incentives that cannot be matched by traditional payment processors such as PayPal, who are known to charge exorbitant, hard-to-understand transfer fees.

DigiTap As The Next PayPal?

Ethereum is expected to remain strong, with forecasts of $6,800 by year’s end reinforcing its importance in the market. Yet attention is shifting toward presale projects that combine low entry costs with high adoption potential. Digitap’s $500,000 presale achievement and payment-focused roadmap underline why it is gaining viral traction.

Comparisons to PayPal highlight its practical appeal, while staking and token burn mechanisms support long-term sustainability. For those looking for the best crypto to buy now, Digitap demonstrates how presales can compete with established giants by focusing on adoption. If momentum continues, $TAP could become one of the standout projects of 2025.

Even if it fails to become the next PayPal, a 10x, 20x, or even 50x is entirely possible.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

The post Ethereum Forecasts $4,500 By Year End While Digitap ($TAP) is Going Viral as “The Next PayPal” with 50x Potential appeared first on Blockonomi.

You May Also Like

Coinbase’s CEO Armstrong Highlights Support for Crypto Clarity Act

Why losing THIS support could drag XRP toward $1