Exclusive interview with Virtuals Protocol co-founder: Benchmarking Bittensor, the AI Agent counterattack behind the 100-fold increase in market value

Author: Nancy, PANews

Since the popular MEME coins such as GOAT, ACT and LUNA successfully warmed up the market, the AI Agent trend is accelerating from the technology circle to the crypto market. Gold diggers from all walks of life are flocking in, and the scene is very lively.

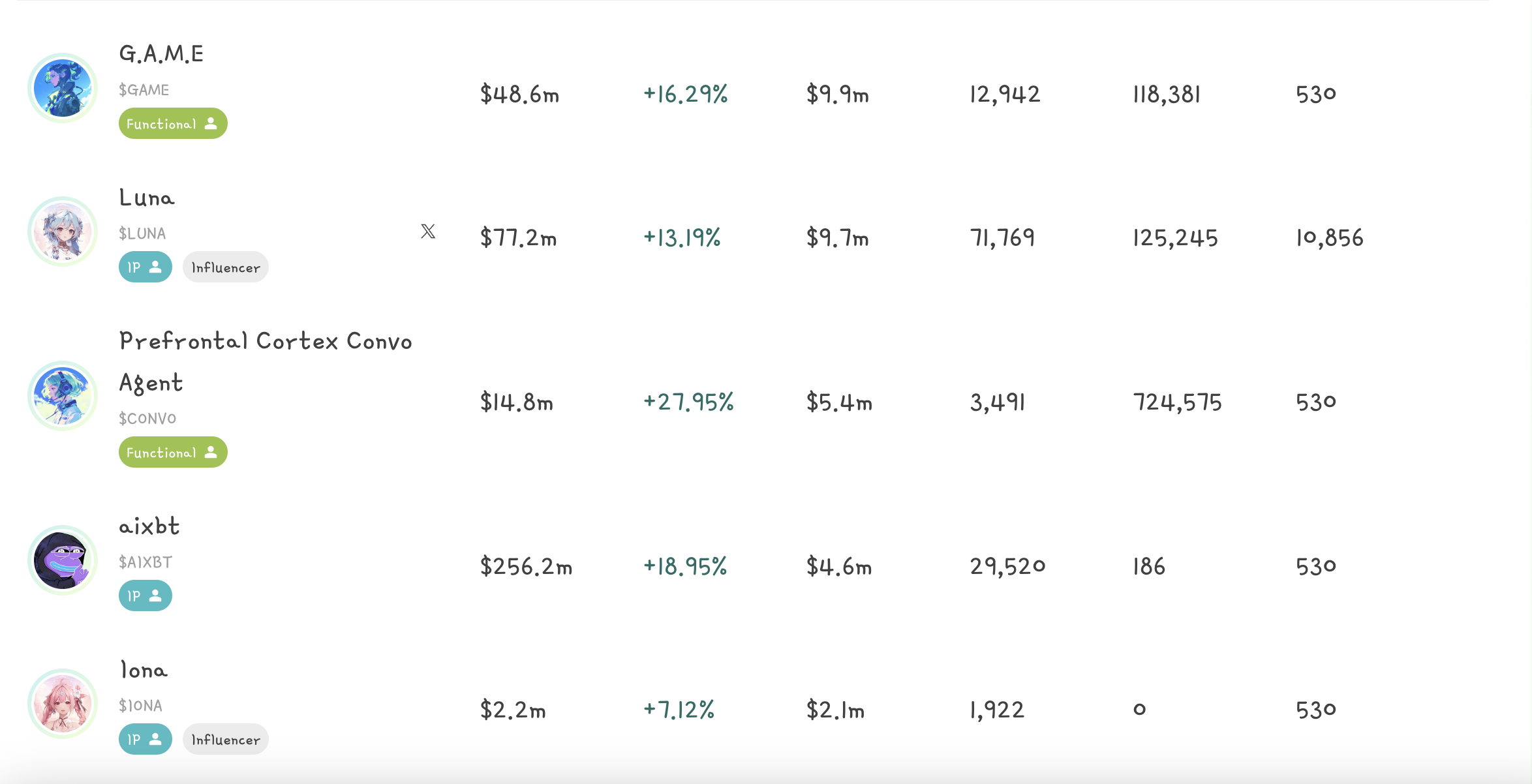

According to Coingecko data, as of December 6, the total market value of AI Agent tokens has exceeded $10.2 billion, accounting for about one-fifth of the total market value of the encrypted AI track. Virtuals Protocol is a star project in this trend. It is an AI Agent issuance platform for games and entertainment launched on Base in January this year. The market value of its token VIRTUAL has soared from tens of millions of dollars to more than $1.8 billion today in just over two months.

Recently, PANews interviewed Wee Kee, co-founder of Virtuals Protocol, and discussed in depth his entrepreneurial journey, product planning, and insights into the development trends of AI Agents.

Transformed from a gaming guild to an AI Agent platform, the price of the currency fell by 99% at its lowest point

In this halving cycle, the price of Bitcoin broke through the $100,000 mark, and believers once again ushered in a new stage of victory. The halving event is an important footnote in the history of Bitcoin's development. Each time it profoundly reshapes market perception and drives the industry forward.

2016 was the second halving of Bitcoin, and it was also the year when Wee Kee entered the world of cryptocurrency. That year, Wee Kee studied at Imperial College London and began to buy Bitcoin and Ethereum. This world-class technology university is also one of the early popularizers of Bitcoin. However, after graduating in 2017, Wee Kee did not immediately join the crypto industry, but chose to work in traditional well-known companies such as Boston Consulting Group.

Time flows to 2021, and the explosion of the blockchain game track has attracted the attention of people inside and outside the circle. Wee Kee also co-founded the game guild PathDAO at this time, which is also the predecessor of Virtuals, and successfully obtained $16 million in financing with a valuation of $600 million. But the road to entrepreneurship is always tortuous and profound. With the almost collective failure of the blockchain game track, PathDAO has also encountered severe tests. The price of the currency has plummeted by 99%, and the lowest market value is only $6 million. Subsequently, PathDAO began to explore multiple business lines, including project incubation, dating software development, sales of clothing combined with NFTs, and game production, but the market did not buy it, which also hit the team hard.

"The falling price of coins and the lack of market recognition of products have dealt a huge blow to team morale, but as a founder, I still have to boost team morale even if I am very confused inside." Wee Kee admitted in an interview that at many critical moments, founders need to show an irrational optimism.

In 2023, ChatGPT led AI technology to become popular around the world, showing great "money" prospects. Countless entrepreneurs were attracted by it, and Wee Kee also joined in and transformed into today's AI Agent platform. Currently, Virtuals' team has expanded to about 20 people, mainly located in Malaysia, and also gathered members from London, Singapore and other places.

The Japanese virtual UP host Vtuber is the inspiration for Virtuals. "If these virtual idols are combined with AI to further improve efficiency and value, does it mean there will be more room for profit?"

In Wee Kee's view, the advantage of combining encryption and AI Agent is that it can realize an innovative model of profit sharing. Users from all over the world can participate in the operation of AI Agent and profit from it by investing in specific cryptocurrencies, especially those who find it difficult to have traditional bank accounts can participate through encrypted wallets. Under such a framework, AI Agent can realize the flow of value around the world, and once it is profitable, it will bring considerable returns to investors. At the same time, AI Agent can have its own encrypted wallet, which brings it great potential and innovation, such as allowing each AI Agent to focus on its own field while collaborating with other AI Agents to gain benefits and create more possibilities.

Judging from Virtuals’ flagship AI virtual idol LUNA, the market value of this AI Agent token, which has over 500,000 fans on TikTok, has exceeded 66 million US dollars, and its market exploration model has been recognized by the market.

Comparing with Bittensor in AI model market, it is not the AI Agent version of Pump.Fun

Virtuals' success is due not only to its courage to transform resolutely and its deep insight into the AI market, but also to the right time, place and people.

In terms of timing, in the past two months, with the leap in the value of MEME coins such as GOAT and ACT, the market's focus has gradually shifted to the AI Agent track, and the market heat has reached an unprecedented high. The rise of this trend has also made platforms like Virtuals gradually enter the public eye, attracting more attention and investment.

However, the market attention shift caused by price fluctuations is also a challenge that cannot be ignored. "The MEME market rotates very quickly, but the core focus of the Virtuals community is not limited to MEME, but focuses on the practical applicability of the created AI Agent. Even in the face of price fluctuations, there are still users willing to pay for these agents with practical value, which provides a guarantee for the stability of its ecosystem.

In terms of public chain selection, Base provides a unique "geographical" advantage for the development of Virtuals. At the beginning of 2024, Virtuals decided to build on Base, when the latter's ecosystem was still in its early stages. Wee Kee shared several important reasons for choosing Base in the interview: First, Base was the only public chain backed by Coinbase, a US listed company at the time, and Trump's election as US president also provided greater development space for the development of encryption in the United States; secondly, Base did not issue its own tokens, which provided greater flexibility for the token empowerment of the Virtuals protocol; thirdly, although Base is currently not as good as Solana in terms of TVL and daily activity, Solana's competition is already quite fierce. In comparison, Base has greater room for growth. In addition, Wee Kee emphasized that Base attaches great importance to the builder culture, which is more attractive to technical teams like AI to join, and Base officials also provide technical and marketing support for Virtuals. He also revealed to PANews that Base still has a lot of room for construction, and there is no multi-chain deployment plan at present, but this possibility is not ruled out in the future.

The fact that Virtuals products have moved from the "testing ground" to the vast commercial "field" fully demonstrates the high recognition of its products. Due to the innovative application of token issuance to the deployment of AI Agents, Virtuals was once considered by the market to be the AI Agent version of Pump.Fun, but Wee Kee disagrees with this view. He said that the core KPI of Virtuals is not to issue as many tokens as possible, but to attract high-quality teams to participate.

In Wee Kee's opinion, from the perspective of community members, they prefer to find an excellent project and enter the market at a reasonable price to achieve value discovery. If the market is full of frequent hot spot changes and chasing, it will bring huge psychological pressure to community members. Therefore, Virtuals is more focused on how to attract and support excellent AI teams, and pays more attention to the construction of long-term value and stable ecological development, rather than simply chasing short-term market hot spots. In a sense, Virtuals' competitors are more inclined to Bittensor, the AI model market.

At the same time, Wee Kee also revealed that Virtuals will soon launch a new product called "Agent Society". According to his description, in this concept, each AI Agent has its own wallet and unique expertise, and they promote value exchange through transactions and collaboration to form a self-running economic cycle.

In order to enhance community activity and developer participation, Virtuals has also introduced the LaunchPad platform Agentstarter to provide creators with an efficient and fair way to introduce new AI Agents into its ecosystem. Currently, Virtuals is focusing on two important development directions: one is to find excellent AI teams and incubate more AI Agents with billion-dollar valuation potential; the other is to plan to go to Hong Kong, Paris, New York and other places next year to attract outstanding AI teams from around the world to join the Virtuals ecosystem.

At the end of the interview, Wee Kee shared some valuable experiences and suggestions for entrepreneurs and practitioners in the field of AI Agents: First, it is necessary to clarify the target user group of AI. Taking Virtuals as an example, it provides services to other AI Agents and directly observes the user needs in the Agent ecosystem to enhance its own visibility, because these users will actively explore and use the Agent you developed; secondly, it is necessary to strengthen exchanges with more encryption teams and deeply understand the culture and dynamics of the circle, so as to better integrate into the ecosystem and capture more growth opportunities.

You May Also Like

SEC urges caution on crypto wallets in latest investor guide

Crucial Fed Rate Cut: October Probability Surges to 94%