How Agentic AI Will Change Real Estate in 2026?

How Agentic AI Will Change Real Estate in 2026?

The real estate industry has always been shaped by innovation, from the advent of online property listings to virtual tours and AI-powered valuation tools. Now, Agentic AI a new generation of autonomous, decision-making artificial intelligence is poised to transform the real estate sector in unprecedented ways. As 2026 approaches, businesses and investors alike are asking: How will Agentic AI change real estate? This article explores the impact, opportunities, and practical applications of Agentic AI in real estate.

1. Agentic AI and Its Role in Real Estate

Agentic AI refers to artificial intelligence systems that act autonomously to perform complex tasks, make decisions, and interact with humans and environments. Unlike traditional AI, which may simply analyze data or provide recommendations, Agentic AI can take initiative, execute actions, and optimize processes without constant human supervision.

In real estate, Agentic AI can be integrated into multiple areas:

Property search and recommendation: AI agents can analyze buyer preferences, predict property value trends, and match clients with the right properties.

Transaction automation: From contract preparation to closing procedures, AI agents can streamline processes while reducing errors.

Investment analysis: AI-driven analytics help investors identify high-potential properties and optimize portfolios.

Property management: Automated maintenance scheduling, rent collection, and tenant communication can all be managed by Agentic AI.

With these capabilities, Agentic AI is more than just a tool — it is becoming a strategic partner for real estate professionals.

2. Agentic AI in Property Buying and Selling

Buying or selling property is often a complex process involving multiple stakeholders, paperwork, and time-sensitive decisions. Agentic AI can simplify this process by:

A) Personalized Property Matching

Agentic AI can analyze user preferences, previous purchase history, and market trends to recommend properties that best fit a client’s needs. For example, a family looking for a new home can receive a curated list of properties that meet criteria such as school district, commute time, and budget.

B) Dynamic Pricing

Traditional property pricing relies on market averages and human judgment. AI in real estate can leverage predictive analytics to determine optimal pricing based on historical trends, nearby property sales, and economic indicators. This ensures sellers maximize profit while remaining competitive.

C) Virtual Tours and AI-Driven Insights

Agentic AI can generate virtual property tours, highlight potential improvements, and even simulate future renovations. Buyers can make informed decisions faster, while agents spend less time manually guiding tours.

3. Enhancing Real Estate Investment Decisions

Investing in real estate has always involved risk. With Agentic AI, investors gain access to data-driven insights and predictive analytics:

Market trend prediction: Agentic AI can forecast property value trends months or even years in advance.

Portfolio optimization: AI agents can recommend which properties to acquire, sell, or renovate to maximize ROI.

Risk assessment: AI evaluates potential risks such as neighborhood decline, regulatory changes, or environmental hazards.

These AI-driven real estate solutions reduce guesswork and allow investors to make more strategic decisions.

4. Transforming Property Management

Property management involves repetitive tasks that are time-consuming for landlords and managers. Agentic AI automates key functions:

Tenant communication: AI agents can handle inquiries, schedule maintenance requests, and send payment reminders.

Predictive maintenance: Using IoT and AI, properties can detect issues before they become costly repairs.

Rent optimization: AI can suggest optimal rental rates based on demand, seasonality, and local trends.

By automating these tasks, property managers can reduce operational costs, improve tenant satisfaction, and focus on strategic growth.

5. AI in Real Estate Marketing

Marketing is critical to real estate success, and Agentic AI can redefine property promotion:

Targeted advertising: AI agents can segment audiences and deliver personalized ads to the right buyers.

Content creation: AI can automatically generate property descriptions, virtual staging images, and social media posts.

Lead scoring: AI identifies high-value prospects, ensuring agents focus on leads with the greatest conversion potential.

This real estate automation ensures marketing efforts are efficient, measurable, and highly effective.

6. Reducing Costs and Increasing Efficiency

The adoption of Agentic AI offers significant financial advantages:

Lower operational costs: Automated processes reduce the need for large support teams.

Faster transactions: AI agents handle multiple tasks simultaneously, shortening buying and selling cycles.

Error reduction: Automation reduces human errors in contracts, property listings, and payments.

Scalable operations: AI allows agencies to manage more clients and properties without proportional increases in staff.

These benefits demonstrate why AI in real estate is no longer optional — it’s becoming a necessity for competitive firms.

7. Improving Customer Experience

One of the most noticeable impacts of Agentic AI in real estate is on customer experience:

24/7 availability: AI agents can answer inquiries, schedule viewings, or process applications at any time.

Personalized recommendations: Buyers receive tailored property suggestions based on their preferences and behavior.

Faster response times: Automation eliminates delays and ensures clients feel valued.

Satisfied clients are more likely to refer friends, leave positive reviews, and complete transactions faster, creating a cycle of growth and trust for real estate businesses.

8. Challenges and Considerations

Despite the benefits, Agentic AI adoption in real estate comes with challenges:

A) Data Privacy

Handling sensitive information such as personal data and financial details requires strict compliance with privacy laws like GDPR or CCPA.

B) Integration with Existing Systems

Legacy property management or CRM systems may require upgrades to fully support AI integration.

C) High Initial Investment

Developing custom Agentic AI solutions can be costly, though ROI potential often outweighs upfront expenses.

D) Human Oversight

While AI agents can operate autonomously, human oversight is still essential to handle complex or exceptional cases.

9. The Future of Agentic AI in Real Estate

By 2026, Agentic AI is expected to reshape the real estate landscape completely:

Fully automated transactions: AI agents could handle property listings, pricing, negotiations, and closings with minimal human intervention.

AI-driven smart cities: Real estate planning may integrate AI to optimize land use, traffic patterns, and infrastructure development.

Enhanced predictive analytics: Agents will anticipate market shifts, investment opportunities, and buyer preferences with unprecedented accuracy.

Collaboration with humans: Agents and humans will work together, combining AI speed and data accuracy with human empathy and judgment.

10. Conclusion: Is Agentic AI Worth Investing in Real Estate?

The integration of Agentic AI into real estate is more than a trend — it is a strategic imperative. From streamlining property management to enhancing investment decisions and marketing, the potential benefits are enormous:

✦Faster, more efficient transactions

✦Reduced operational costs

✦Improved customer experience

✦Data-driven decision-making

✦Scalable and automated operations

While initial development costs and integration challenges exist, the ROI of Agentic AI in real estate is likely to be significant. By 2026, businesses that adopt Agentic AI early will gain a competitive advantage, while those that delay may fall behind in an increasingly automated and intelligent real estate market.

How Agentic AI Will Change Real Estate in 2026? was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.

You May Also Like

Why Following Sui Crypto News Gives Early Insight Into Cross-Chain and Interoperability Trends

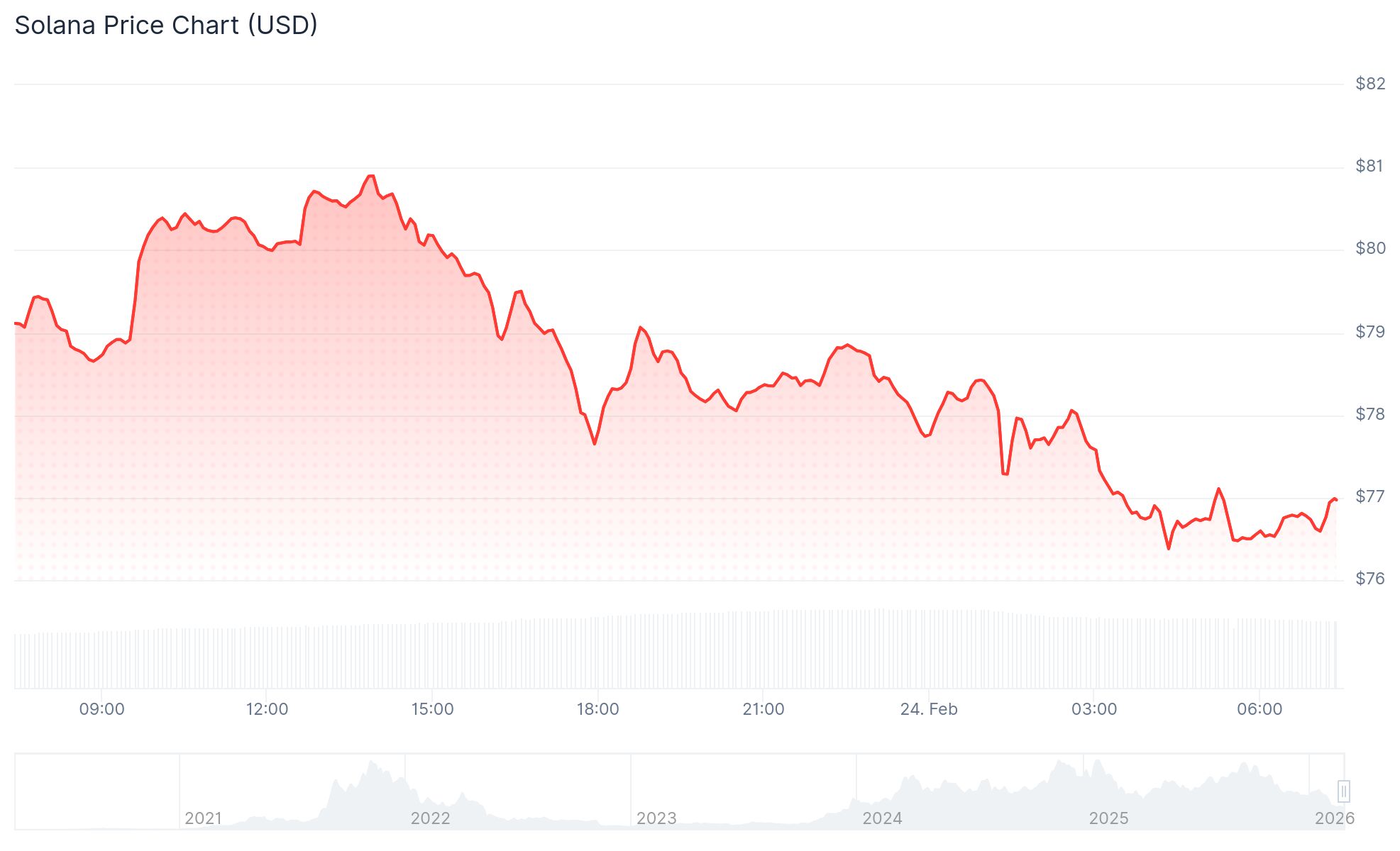

Solana (SOL) Price: Most SOL Holders Are Underwater as Token Drops to $76