Kelsier Ventures, the issuer of Libra, is accused of paying money to bribe the president’s sister and is the mastermind behind multiple “Rug Pulls”. Where does it come from?

Author: Weilin, PANews

Argentine President Mile has recommended LIBRA tokens many times on the social media platform X, and the token price has plummeted due to the deletion of tweets. As the Libra coin issuance farce fermented for several days, the token market maker Kelsier Ventures and its CEO Hayden Davis, who are behind the operation, surfaced and were accused of being the co-founders of the LIBRA token. With the exposure of more information such as insider trading, political involvement and multiple operation plans, Hayden Davis was accused of being a "rugger", including deep operation of Trump's wife's MEME MELANIA and other tokens with the same name. In a recent video interview, Hayden Davis responded to various issues related to the creation of LIBRA.

Hayden Davis is one of the core figures in the controversy surrounding the Argentine president’s currency issuance. This article will take a closer look at Hayden Davis and Kelsier Ventures to learn about their backgrounds and the roles they played in the Libra scandal.

Hayden Davis denies accusation of bribery of president's sister

Hayden Davis is accused of paying bribes to get into the inner circle of Argentine President Javier Milei.

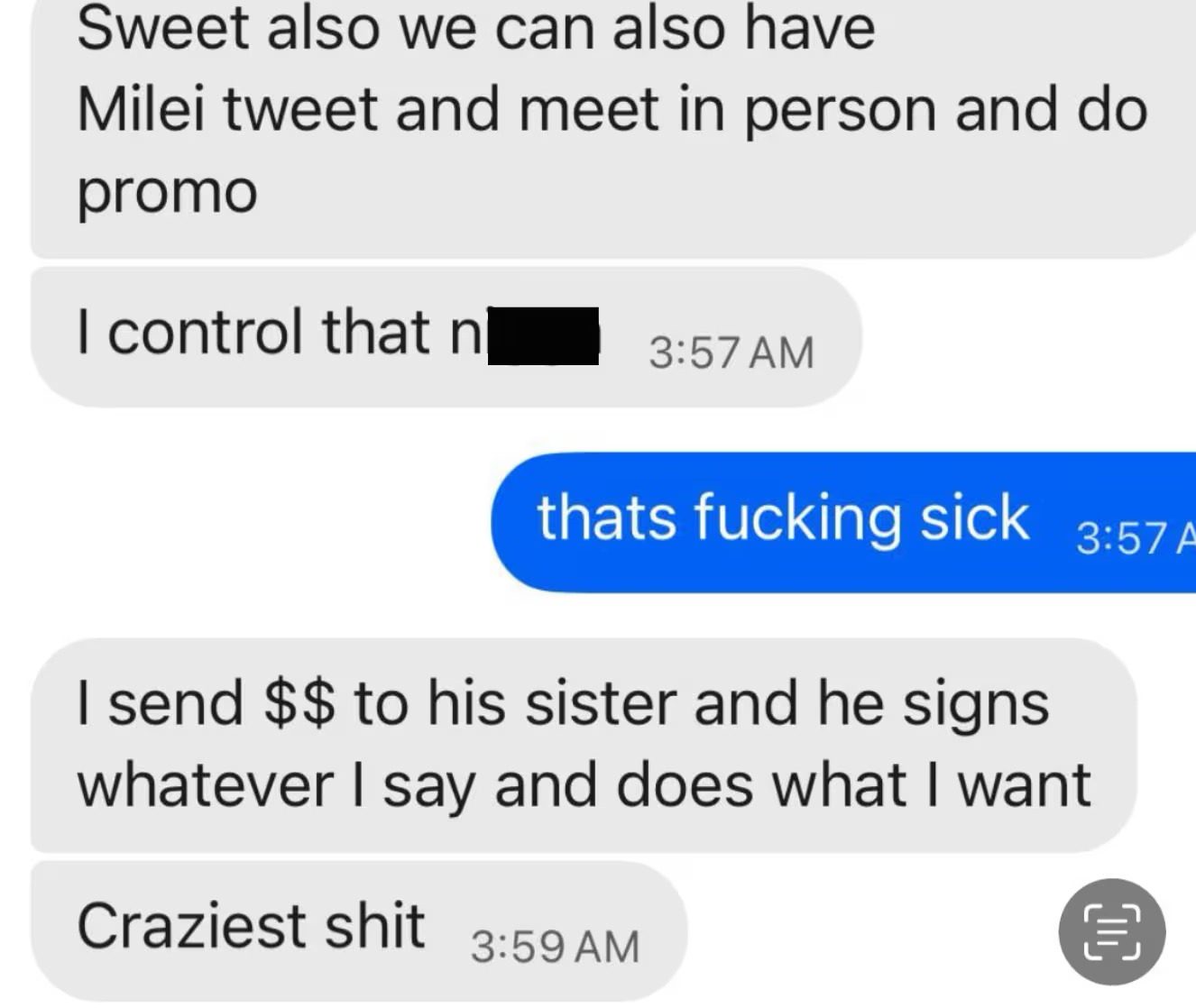

On February 19, Coindesk reported that Hayden Davis said in a text message in December last year that he could "control" Argentine President Milei because he had been sending money to Milei's sister Karina Milei (currently the Secretary General of the Argentine Presidential Palace). "I send money to his sister, and he will sign whatever I say and act according to my wishes." This information disclosure is the latest development in the LIBRA token scandal that has been fermenting for several days.

However, Davis' spokesman Michael Padovano immediately responded that the media reports were "politically motivated" and that he did not remember sending such text messages and there was no relevant record on his phone.

The incident dates back to the morning of February 15, when Mile recommended a little-known token $LIBRA on the X platform. Within half an hour, the market value rose to $4.24 billion and then fell to $827 million. However, as more insider addresses made huge profits, Mile deleted the post a few hours later and denied any connection with the cryptocurrency, after which the price of the coin quickly fell to $0.2. The farce of the president issuing coins has intensified, and multiple projects including Kelsier Ventures, KIP Protocol, Meteora, and Jupiter have also been implicated.

Among them, Kelsier Ventures, as the issuer of Libra, was pointed out to be involved in insider trading of various meme tokens such as MELANIA, ENRON, and BOB, reaping more than US$200 million.

The large scale of losses caused to investors by Libra has further pushed Kelsier Ventures to the forefront.

According to El Eonomista, 44,000 users were affected by the "rug pull" incident. According to crypto lawyer wassielawyer, the number may reach nearly 75,000 users, with a total loss of about $286 million. However, Argentine President Milley said that it was false to say that 44,000 people were affected, and at most only 5,000 people were affected. The possibility of involving Argentines is very small. According to a survey by PANews, nearly 30% of large investors took over at high prices, and early buyers became the hardest hit by losses.

Participating in multiple "rug pulls", the restaurant owner transformed into a crypto family business

On February 17, blockchain data company Bubblemaps posted on the X platform: "The team behind LIBRA, MELANIA and other short-lived tokens is the same group of people. After analyzing cross-chain transfers and time patterns, we are highly confident that this speculation is correct. It all started with our investigation into sniper activities on MELANIA." On-chain analysis shows that Kelsier Ventures' wallet played a central role in scams involving MELANIA, TRUST, KACY, VIBES, and the recently hyped HOOD token.

Kelsier Ventures has previously remained a mystery. Nevertheless, an industry insider recently contacted by PANews said that "this Kelsier market maker is a well-known meme rugger in Dubai."

Currently, Kelsier Ventures is still active, but its location is uncertain. BoDoggos Entertainment CEO Nick O'Neil's investigative video revealed that he received an offer. Kelsier Ventures' service process is divided into these steps:

- Wash, deploy, snipe

- Market making

- Dump the market make tokens (20%)

- Wash & extract

90% of the "snipers" come from within Kelsier Ventures. They distribute tokens to friends or set up operations for their own robots. Kelsier Ventures set a 2% token allocation and a maximum daily sales limit of 0.1%. In addition, the daily fee is $3,000 or 20% of the withdrawal amount, whichever is higher.

According to Kelsier Ventures’ official Twitter account, the company “invests, consults and brings cutting-edge technologies in blockchain, cryptocurrency and artificial intelligence to market.” Currently, its official website has deleted the team information, and its homepage does not seem to be much different from other Web3 projects.

According to public information, Kelsier Ventures was founded in 2021 and is headquartered in Delaware, USA. The company focuses on investing in companies in the financial services industry. Since its establishment, Kelsier Ventures has completed five investments, including DeFiTuna, Scallop Group and UpRock. In addition, in November 2023, Kelsier participated in the financing of Saturn, a Bitcoin non-custodial P2P order book service provider. On June 1, 2024, E Money Network announced on the X platform that the project had completed a $3.3 million bridge round of financing, with Kelsier Ventures as one of the lead investors. Kelsier Ventures' latest investment took place on January 26, 2025, in DeFiTuna, a company in the financial services industry.

Kelsier Ventures' official website previously showed that Hayden Davis' father, Tom Davis, is the company's chairman. He once served a prison sentence and later ran a chain of restaurants on the East Coast of the United States. When he visited Dubai to expand his business, he read the news that Dubai planned to establish a "Crypto Valley" and came up with the idea of starting a blockchain company in Dubai. Subsequently, he began to contact top figures in the encryption field, build connections, and get involved in venture capital funds, investing in multiple early projects. In the early days, Tom once called himself the CEO of Kelsier Ventures. Kelsier Ventures team COO Gideon Davis is presumed to be Hayden Davis' younger brother. In 2022, as a college student, he had already begun to get involved in the encryption industry, working in the DeFi project Unlock and its metaverse project NeoNexus. However, the project claimed in March 2022 that it had run out of funds and failed to continue operations, and the community accused it of "soft rug".

Hayden Mark Davis' LinkedIn page is currently inaccessible. However, according to public reports, his previous profile shows that he has been the CEO of Kelsier since October 2020. Since May of the same year, he has become the founder of Luxury Drip, a company in an unknown industry. According to Davis, he has been a business owner since August 2017, operating a company called Leaders Elevate, which appears to be another family business of the Davis family.

Admits involvement in MELANIA attack, says Libra is not a Rug but a failed plan

In addition to releasing a video statement after the incident, Hayden Mark Davis also accepted an interview with crypto blogger Coffeezilla. He said, "In the original LIBRA launch plan, Mile would post another video, and then some other high-profile people would interact with it. So at the time, our idea was, can we drive away the 'snipers' by extracting liquidity, while retaining funds to prevent the project from completely collapsing after the price drops, and then let Mile post a second video and reinvest the funds to replicate the TRUMP-like 'explosion feast'. I don't know why Mile deleted the first post. I guess he was under great political pressure, which caused him to panic. Considering his position, I can completely understand his feelings."

Despite the token crash, he said, “People are saying this is another rug, which is not an objective fact. There are still tens of millions of dollars of liquidity locked up, and the token market value is still $300 million. This is not a rug, it’s just a plan that failed. As a custodian, I still hold $100 million in the account I control, but I really hope someone tells me what to do with it. I don’t want to be the target of public criticism. I didn’t benefit from this, but my life is in danger because of it.”

When talking about insider trading, host Coffeezilla said that people's frustration is that they are not angry because you are good at trading, but because you know information that the public does not know and use this information to trade. In the open market, this is illegal and is insider trading.

Hayden Davis said, "But this is not illegal in the meme market. This is what happens in every transaction. This is the rule here, people know it, agree to it, and make money from it. If you want to blame this, you have to blame everything else. To be honest, I don’t actually disagree with this. But I think that the vast majority of people who bet on meme tokens, especially for retail traders who are in the early stages, this is the rule of the game in this market. This is not a capital market, this is a casino."

During the interview, Davis also admitted to participating in the attack on MELANIA, the presidential first lady’s token.

The investment project refunds to avoid suspicion, and legal storms may ensue

Affected by the Libra coin scandal, on February 17, Moty, the founder of DefiTuna, publicly announced through the X platform that DefiTuna had refunded Kelsier, an investor who invested $30,000 in the project on January 16, 2025, and severed all ties with him.

Not only that, the Libra incident also raises legal risks. On February 15, the Argentine presidential palace announced that Millet had instructed the Anti-Corruption Office to immediately participate in the investigation to determine whether any member of the Argentine government, including Millet himself, had engaged in improper behavior in this incident. The opposition plans to impeach Millet.

On February 17, an Argentine law firm filed a criminal complaint with the U.S. Department of Justice (DOJ) and the Federal Bureau of Investigation (FBI), accusing the mastermind behind the collapse of the LIBRA token and requesting an investigation into the role of Argentine President Milei. In another legal battlefield, the Citizens Alliance ARI also filed a criminal complaint on February 17, asking the Department of Justice to investigate allegations of bribery and fraud allegedly promoted by President Milei, adding that "the government cannot be both a player and a referee."

As the LIBRA token scandal continues to ferment, the roles and motives of Hayden Davis and Kelsier Ventures have become the focus of public and regulatory attention. Although Davis tried to clarify his position and emphasized that his actions were in line with market rules, the outside world's doubts about his suspected market manipulation and insider trading have not dissipated. As more evidence emerges, this incident may have a profound impact on the regulatory environment of the cryptocurrency market. PANews will continue to track and pay attention to the latest developments.

You May Also Like

Top Altcoins To Hold Before 2026 For Maximum ROI – One Is Under $1!

Robert W. Baird & Co. Discloses Core AI Design Parameters and Launches Public Testing of Baird NEUROFORGE™ Equity AI