NCA insider busted for stealing £4.4 crypto seized from Silk Road

A former National Crime Agency officer has been jailed for stealing 50 BTC seized during the investigation of Silk Road 2.0, exploiting his insider access to access the funds.

Paul Chowles, 42, a former NCA officer, has been jailed for 5.5 years after stealing 50 Bitcoin (BTC), worth just over £59,000 at the time, and now valued at over £4.4 million. Chowles exploited his privileged access during a major 2014 investigation into Silk Road 2.0, a darknet marketplace that was spun up after the FBI shut down the original Silk Road marketplace.

Chowles was responsible for extracting data and cryptocurrency from devices seized from Silk Road 2.0 administrator Thomas White. In May 2017, he quietly transferred 50 of the 97 seized Bitcoins from a “retirement wallet” using private keys found on White’s device.

The theft went unnoticed for years and was initially blamed on Thomas White himself. Investigators assumed he had accessed the wallet, given his technical knowledge. By late 2021, the missing 50 BTC was written off as untraceable.

The breakthrough came in 2022 when White, now released from prison, told Merseyside Police he believed someone inside the NCA had taken the Bitcoin because only NCA officers had access to the wallet’s private keys, which triggered a new investigation.

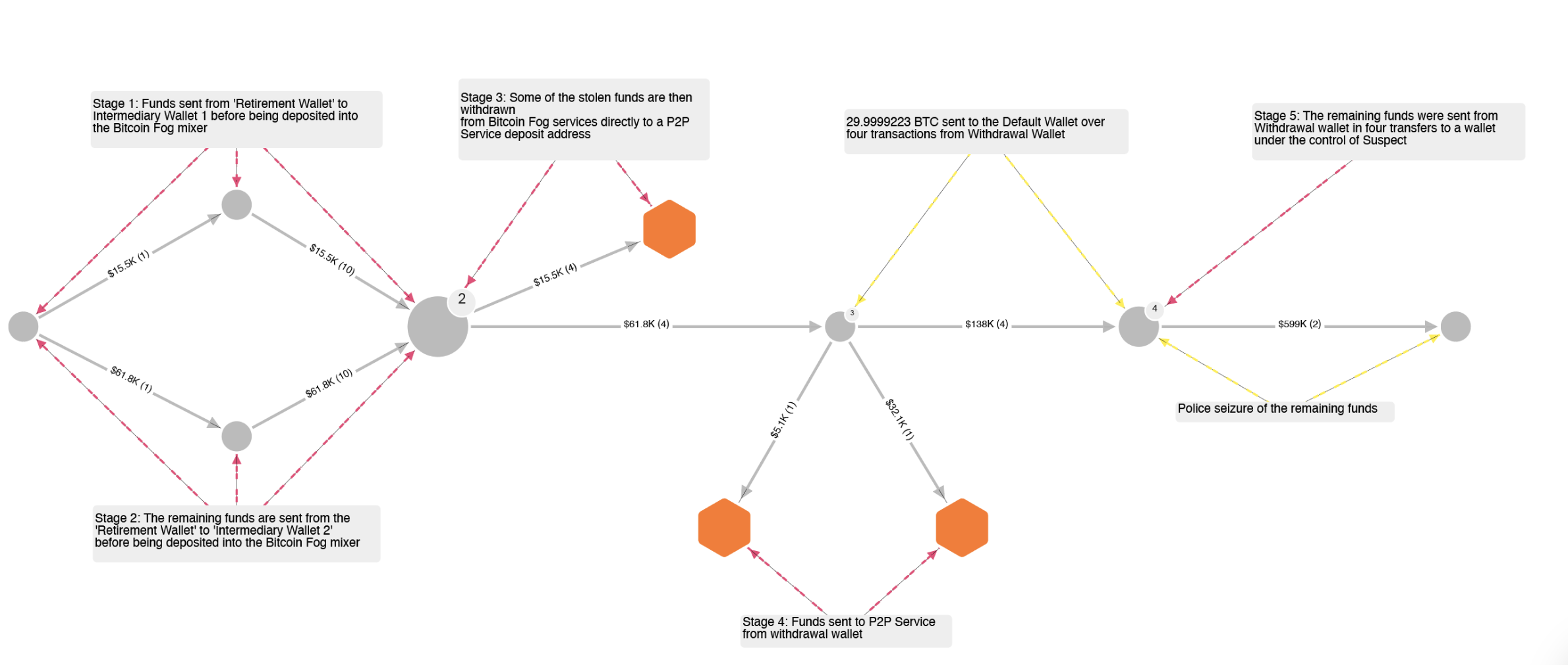

Investigators then partnered with blockchain analytics firm Chainalysis to trace the flow of the stolen Bitcoin. Despite Chowles using Bitcoin Fog, a mixing service known for obfuscating crypto transactions, Chainalysis’s advanced tools successfully mapped the complex transaction trail across multiple wallets.

Using Chainalysis Reactor, investigators visualized the movement of the funds through various stages of laundering, eventually linking the transactions back to Chowles’s accounts. They also uncovered a “default wallet” holding about 30 BTC that had remained dormant for nearly five years. Private keys to this wallet were recovered from a device found during the police search of Chowles’s residence.

Chowles pleaded guilty in May 2025 to theft, transferring criminal property, and concealing criminal property. He was dismissed from the NCA shortly before sentencing.

You May Also Like

MFS Releases Closed-End Fund Income Distribution Sources for Certain Funds

BlackRock boosts AI and US equity exposure in $185 billion models