Optimism Slides Toward $0.45 as Momentum Weakens and Sellers Retain Control

The asset has entered a prolonged downtrend, showing little sign of recovery as bearish momentum dominates the charts. With open interest cooling and market sentiment subdued, the coin now faces the challenge of defending its multi-month support region to avoid deeper losses in the coming weeks.

Highlights Breakdown Below “Dead Zone” Support

Analyst Lamatrade noted on X that $OP has dropped below its critical “dead zone”, a level that had previously served as structural support. The weekly chart reveals that the coin has consistently formed lower highs under a descending trendline since mid-2024, confirming a well-defined bearish structure.

The yellow-marked zone around $0.48–$0.58 has now flipped from support to resistance, marking a critical failure point for the token.

Source: X

Lamatrade emphasized that the extended rejection from the trendline and the breakdown below the Ichimoku cloud indicate that buyers are losing control of the mid-term structure. The RSI hovering around the mid-40 range further reflects weakening momentum.

Unless the coin can reclaim the $0.58 resistance area, it risks extending its downward leg toward $0.45, the next significant support identified on higher timeframes.

Market Data Confirms Persistent Downtrend

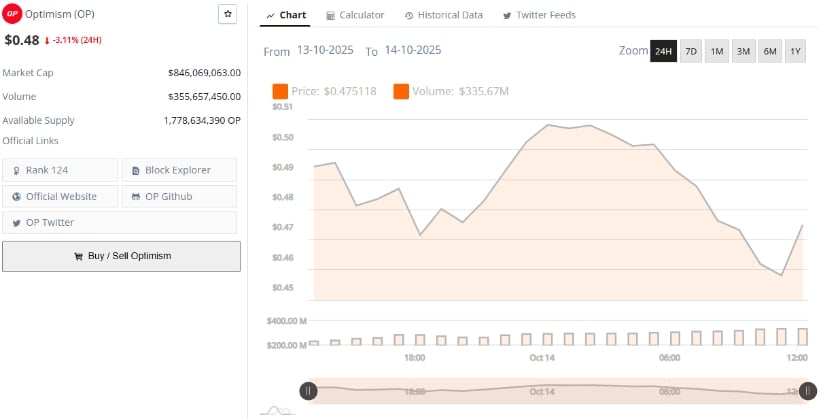

On one hand, BraveNewCoin data show Optimism is currently priced at $0.48, marking a 3.11% decline over the past 24 hours. The network holds a market capitalization of $846.06 million and records a trading volume of $355.65 million over the same period.

With an available supply of 1.77 billion tokens, the project ranks 124th in global market standings, reflecting a sustained period of underperformance relative to other Layer-2 assets.

Source: BraveNewCoin

Despite maintaining solid liquidity levels, the consistent price erosion suggests waning speculative demand. Trading volume spikes during sell-offs indicate that short-term holders may be exiting positions, while long-term participants appear to be waiting for clearer market signals before re-entering.

For the coin to regain momentum, it must reclaim the $0.50–$0.58 resistance corridor and establish higher lows on the weekly chart. Failure to do so would likely keep sentiment bearish heading into late October.

TradingView Indicators Reinforce Bearish Outlook

At the time of writing, OP/USDT is trading at $0.4732, showing a daily loss of approximately 5.76%, according to TradingView data. The chart reflects a sharp intraday decline, with large candlestick wicks on both ends, signaling elevated volatility and heavy selling pressure.

Source: TradingView

The Chaikin Money Flow (CMF) remains slightly positive at 0.10, hinting that some buyers are attempting to accumulate at discounted levels. However, the MACD histogram at -0.0262 and the signal line at -0.0349 confirm persistent bearish momentum, with sellers maintaining dominance. This setup suggests any short-term rebounds are likely to face strong resistance near $0.50 before the broader downtrend resumes.

Overall, the coin’s technical landscape paints a cautious picture. With the token trading below major resistance levels and momentum indicators leaning bearish, the immediate focus will be on whether bulls can stabilize price action around $0.45. A sustained recovery above $0.58 remains the key threshold that would signal the beginning of a potential trend reversal.

You May Also Like

BitGo expands its presence in Europe

Top political stories of 2025: The Villar family’s business and political setbacks