QMMM Stock Soars 2,300% on $100M Crypto Treasury Pivot

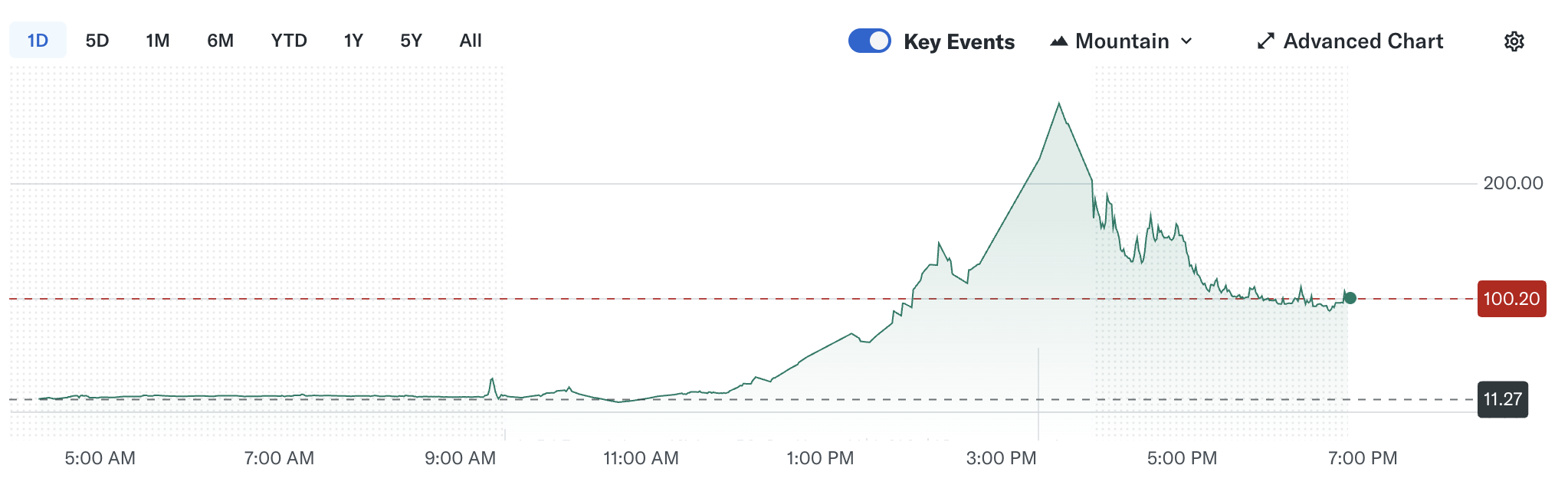

Shares of Hong Kong–based media company QMMM Holdings (QMMM) surged as much as 2,300% on Tuesday before closing 1,737% higher at $207 on Nasdaq. The rally followed the company’s announcement of a $100 million digital asset treasury anchored by Bitcoin, Ethereum, and Solana.

The extraordinary stock move underscored retail-driven momentum and speculation, though volatility quickly reappeared. Its shares dropped nearly 50% in after-hours trading to around $105.

QMMM Crypto Treasury Anchored by Bitcoin, Ethereum, and Solana

QMMM Holdings is a Hong Kong–based and Nasdaq-listed digital advertising and media firm now pivoting to blockchain and AI. As announced on Tuesday, the company confirmed it will build a diversified $100 million digital asset treasury across Bitcoin, Ethereum, and Solana.

Bitcoin will be the cornerstone of its resilience and market credibility. Ethereum’s smart contract architecture is expected to power AI-driven agents and decentralized applications, while Solana’s speed and scalability will support real-time analytics, metaverse interactions, and Web3 infrastructure.

The company’s January SEC filing showed only $497,993 in cash and a net loss of $1.58 million for fiscal 2024, leaving questions over how QMMM will finance its crypto accumulation. No further funding details were disclosed, and representatives did not respond to requests for clarification.

QMMM Stock Performance Over the Past Day / Source: Google Finance

QMMM Stock Performance Over the Past Day / Source: Google Finance

From Digital Media to Web3 Autonomous Ecosystem

Previously a digital advertising business, QMMM has recast itself as a blockchain-native firm. It announced plans for a decentralized data marketplace that uses AI-driven analytics to support investors, developers, and creators. The company aims to provide DAO treasury management tools, smart contract vulnerability detection, and metaverse enhancements.

Mr. Bun Kwai, founder of QMMM, became CEO and Chairman in June 2023 after years of leading subsidiaries. He holds a bachelor’s degree in digital graphic communication from Hong Kong Baptist University.

Analysts, Including Benzinga, Call It “Narrative-Driven Upside”

QMMM’s explosive surge outpaced moves across the sector, diverging from Canadian peer Sol Strategies, which fell 42% in its Nasdaq debut the same day.

Analysts noted the speculative nature of QMMM’s valuation jump, with Benzinga reporting one description as “narrative-driven upside” tied to crypto adoption rather than fundamentals.

Despite the initial enthusiasm, shares retraced heavily in after-hours trading, reflecting broader investor caution. With minimal institutional coverage and limited financial transparency, QMMM remains a high-risk play. Its pivot signals ambition to lead in Web3, but execution risks and funding challenges leave its long-term trajectory uncertain.

You May Also Like

XRP stuck in range as descending channel caps upside momentum

Why informal crypto markets offer a 1–2% premium?