Ripple CEO Drops Truth Bomb On XRP Vs. RLUSD Rumors

Ripple CEO Brad Garlinghouse moved to puncture speculation that the company’s new US dollar stablecoin, RLUSD, has displaced XRP at the core of the company’s strategy, telling Crypto in America reporter Eleanor Terrett that XRP remains foundational even as it routes transactions over multiple assets depending on corridor economics and customer needs.

Ripple CEO Sets The Record Straight: XRP Vs. RLUSD

In a November 5 interview, Terrett pressed Garlinghouse on social media debates over whether the launch of RLUSD and Ripple’s push beyond cross-border payments have diluted XRP’s role. Garlinghouse’s response was unambiguous: “XRP sits at the center of everything Ripple does.” He framed the recent discourse as a byproduct of “a lot of misinformation and sometimes disinformation in crypto Twitter,” adding that narratives suggesting Ripple has “given up on XRP” “just don’t make sense.”

Garlinghouse situated XRP within a broader, multi-rail payments and treasury stack, pointing GTreasury and Ripple payments. In his telling, the firm’s routing logic is asset-agnostic and driven by corridor specifics—currency pair, liquidity depth, cost, and reliability—rather than ideology. “Some of those go through stablecoins. Some of it goes through XRP,” he said. “We want to deliver the best possible product to a customer at the best price, and sometimes that may be a stablecoin. Sometimes it may not.”

In one of the interview’s most striking disclosures, Garlinghouse said that during the “first part of ’23,” Ripple’s institutional payment activity was significant enough that “Ripple was minting 20 percent of all USDC.” He presented that figure as evidence of a pragmatic approach in which Ripple used what worked for specific institutional flows: “We also used USDC. We also used XRP.” The point, he argued, is that customers buy solutions, not tokens, and the firm’s job is to select the “right technologies” for defined problems. “We are not XRP maximalists. There’s going to be different chains for different solutions and different technologies.”

Garlinghouse tied XRP’s role to its performance characteristics—“very scalable, very fast and very inexpensive on a per transaction basis”—but he avoided absolutism, acknowledging that those attributes make XRP “good for some things and probably less good for other things.”

The presence of RLUSD in Ripple’s toolkit does not negate XRP’s value proposition, he suggested; rather, it expands the company’s ability to optimize routing. In corridors where a fiat-denominated stablecoin provides better pricing or liquidity conditions, flows can shift there; where XRP’s speed-to-finality and low unit costs are decisive, XRP can carry the traffic.

Crucially, Garlinghouse framed market share as secondary to total throughput growth across Ripple’s platforms. He said the objective is to scale from “tens of billions of dollars of payment transactions to hundreds of billions… to trillions,” and that XRP’s success tracks the overall pie. “If XRP doesn’t have 100 percent of that pie, but the pie is growing very quickly, like that’s great. I’m happy. That’s a really good place to be.”

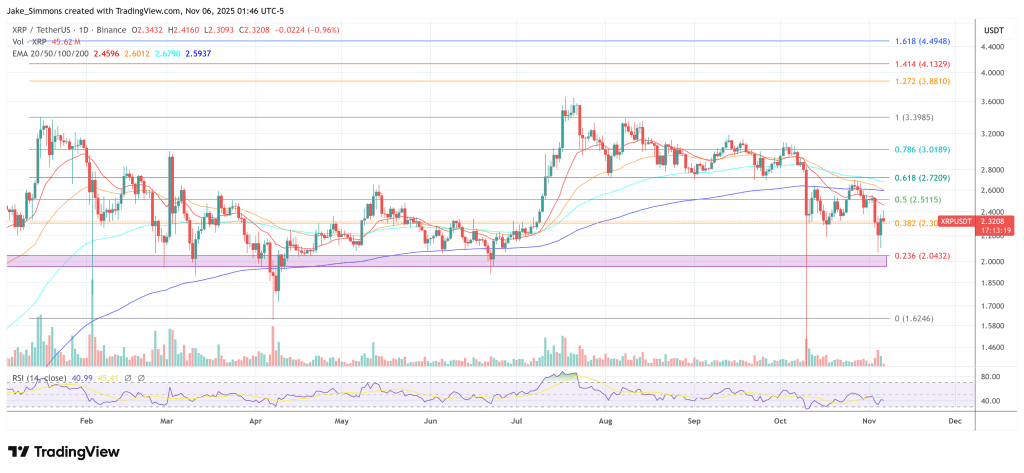

At press time, XRP traded at $2.32.

You May Also Like

The Channel Factories We’ve Been Waiting For

Superstate Raises Over $82 Million to Develop Onchain Capital Markets