Sei Blockchain Adoption Climbs as Price Struggles to Break $0.29

Sei’s DeFi ecosystem is booming even as its token price lags. Analyst Fabius DeFi notes record highs in DEX volume at $9.88 billion, net inflows of $2.43 billion, and app fees topping $32.9 million, while the price consolidates near $0.29.

Record On-Chain Growth and Trading Metrics

According to analyst Fabius DeFi, its decentralized finance activity is expanding even as the market price remains subdued. Data from DeFiLlama shows that on September 25, decentralized exchanges on the network processed a trading volume of $9.88 billion, while net inflows reached $2.43 billion and application fees totaled $32.9 million.

Despite these all-time highs, the token price continues to trade near $0.29, moving sideways instead of reflecting the network’s strong performance.

SEIUSD Chart | Source:x

The analyst views the gap between soaring network fundamentals and the stagnant token price as a key market development. Rapid expansion of decentralized exchange volumes and fees often points to sustained user adoption and higher protocol revenue. These trends can strengthen the foundation for future growth if user participation and capital inflows maintain their upward path.

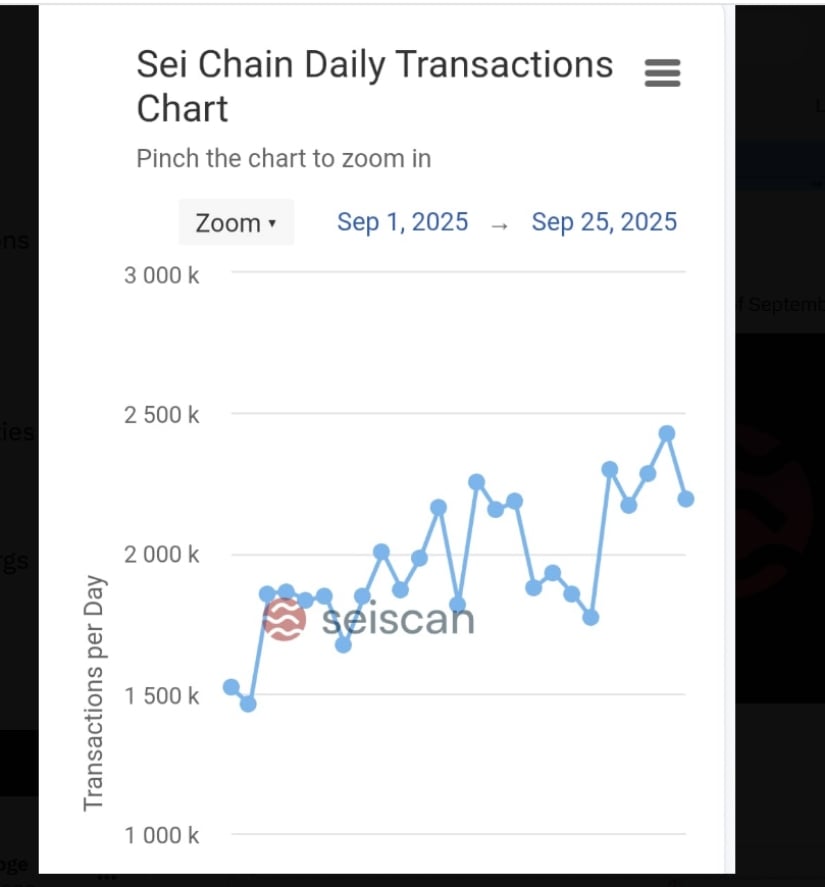

Transaction Activity Accelerates Across the Network

Additional data confirms growing activity on its blockchain. Reporter Marc Shawn Brown noted that daily transactions increased by 46% since September 1, moving from about 1.5 million to nearly 2.8 million by September 25. Charts from the Scan show a consistent pattern of higher highs throughout the month, indicating steady expansion in network usage.

SEI Chart | Source:x

This upward momentum in transactions suggests that a broader set of applications and users are engaging with the chain. Rising transaction counts can indicate increased demand for services such as decentralized finance protocols, trading platforms, and gaming projects. These factors support continued ecosystem development and can enhance its competitiveness among Layer-1 blockchain networks.

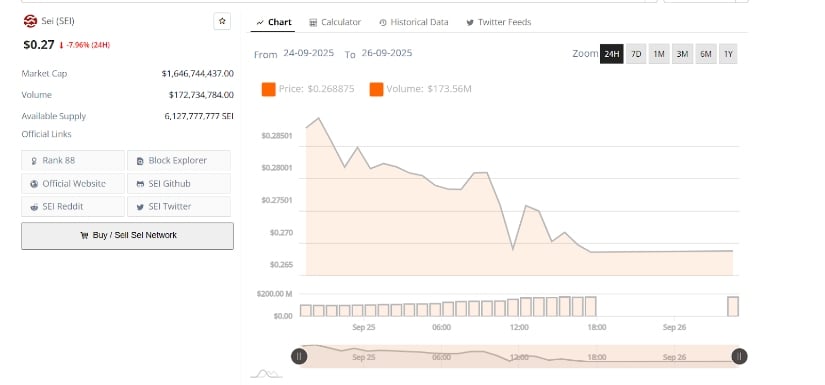

Market Price Holds Near Key Support Levels

While adoption grows, the market price shows limited movement. Over the past 24 hours, the token declined from around $0.285 to near $0.27, registering a 7.96% drop within the day. Trading volume stayed active at about $172 million, signaling continued market participation despite the downward pressure.

SEIUSD 24-Hr Chart | Source: BraveNewCoin

The price chart reveals repeated unsuccessful attempts to break above $0.28, with each rebound followed by renewed selling. Intraday lows have reached $0.2688, and analysts identify the next potential support near $0.26 if selling persists. A sustained close above $0.27 is viewed as essential to avoid deeper losses and to create conditions for a short-term rebound.

Outlook for Network Expansion and Market Response

If the token maintains strong trading volumes, high application fees, and continued transaction growth, the network could attract additional liquidity and developer interest. Expanding use cases and growing capital inflows provide a base for long-term ecosystem strength. Such fundamentals often form the groundwork for market repricing once investor sentiment aligns with on-chain performance.

However, the token’s struggle to stay above the $0.29 barrier shows that broader market factors are currently outweighing positive fundamentals. Continued network expansion combined with stable support levels could eventually influence its market valuation as adoption deepens.

You May Also Like

Husky Inu (HINU) Completes Move To $0.00020688

Mind Reading: Tay And Taylor Lautner Are Growing Their Mental Health Platform