The AI Agent track has rebounded strongly. Here are 10 emerging AI Agent projects that have attracted much attention

Author: Nancy, PANews

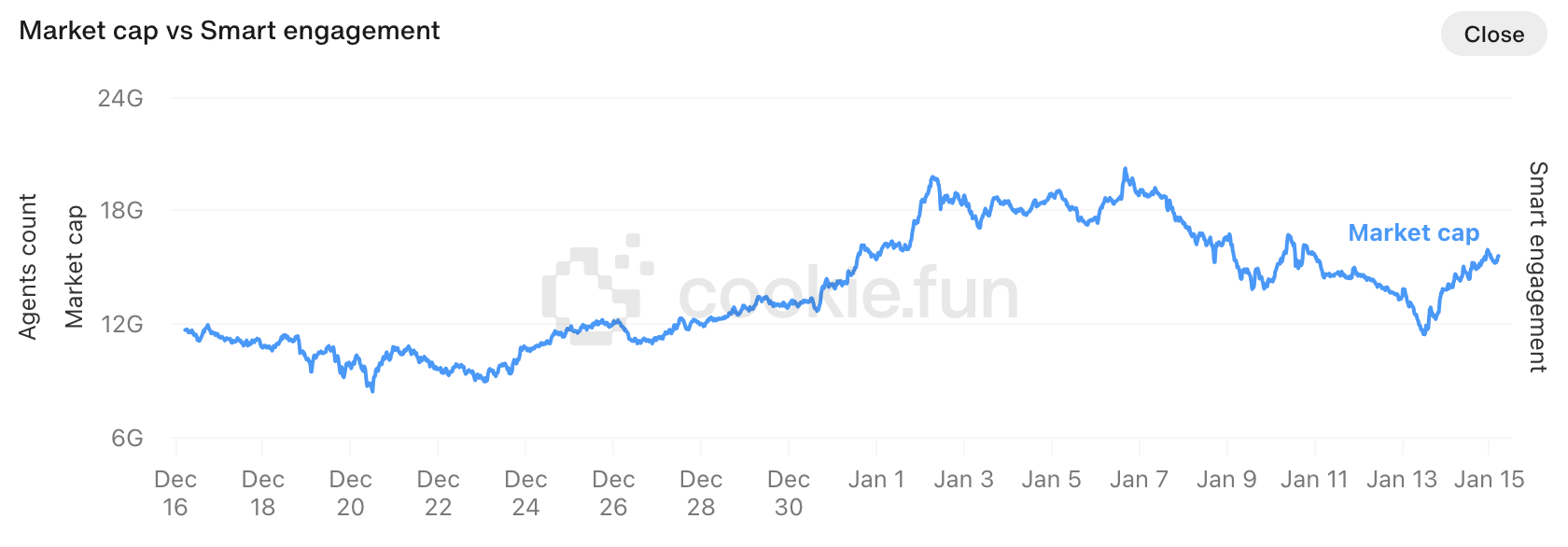

After several days of deep correction, the AI Agent track has seen a collective rebound, showing strong resilience. According to cookie.fun data, in the past week, the market value of AI Agent has rebounded from a low of about US$11.4 billion to nearly US$15.6 billion, an increase of 36.8%.

In this round of market recovery, in addition to the leading projects, the AI Agent ecosystem has also been further improved and innovated due to the injection of fresh blood. In this article, PANews lists 10 emerging AI Agent projects that have attracted much attention in the market recently. These projects are all from the Solana and Base ecosystems, and have attracted a lot of attention and participation from funds within just a few days of going online, with a significant increase in market value.

Moemate (MATE)

Moemate is a platform designed to empower technical and non-technical users to create and manage advanced AI agents. It focuses on entertainment, media and productivity applications, and mainly provides tools for building AI-driven personalization. These personalized agents can play a role in social platforms, AR/VR environments and game ecosystems. Currently, Moemate has more than 6 million users and 500,000 agents, and has been recognized by TechCrunch and a16z. The products and services it provides include the code-free agent and simulation framework Genesis, the flagship AI Agent Nebula (MOE), the AI content creation platform Moegen, and the AI Agent trading platform mates.lol. Moemate has received investments from companies such as 1confirmation, boostVC, Libertus, and Flamingo DAO.

DEX Screener data shows that as of January 15, MATE’s market value has reached US$155 million after its launch today.

Aiccelerate DAO (AICC)

AiccelerateDAO is an investment and development DAO focused on accelerating the development of decentralized open source AI. It focuses on promoting decentralized, open source AI development and supporting high-potential projects in different ecosystems. The list of development consultants includes ai16z founder Shaw, Virtuals Protocol core contributor EtherMage, EigenLayer developer relations director Nader Dabit, and Story Protocol co-founder Jason Zhao. Recently, Aiccelerate revealed that it is developing its first AI agent and will use 100% of its treasury funds for DAO investment and community. However, AiccelerateDAO has also caused great controversy in the community due to whitelist fundraising and the rapid sale of tokens by participants after the project was launched. For this reason, the project promised to implement a token lock mechanism, and many early participants also announced that they would re-buy or donate tokens.

DEX Screener data shows that as of January 15, AICC's market value has reached US$65.9 million since its launch on January 11.

Moby AI ( MOBY)

Moby AI is an AI assistant focused on the crypto space, designed to help users improve trading decision-making efficiency and optimize investment strategies. Its functions include finding potential transactions, analyzing portfolios, and on-chain behavior analysis. Moby AI's initial model is based on the Whale Watch dataset and is in collaboration with AssetDash and Griffain.

DEX Screener data shows that as of January 15, MOBY’s market value had reached US$47.4 million three days after its launch.

AIOS (AIOS)

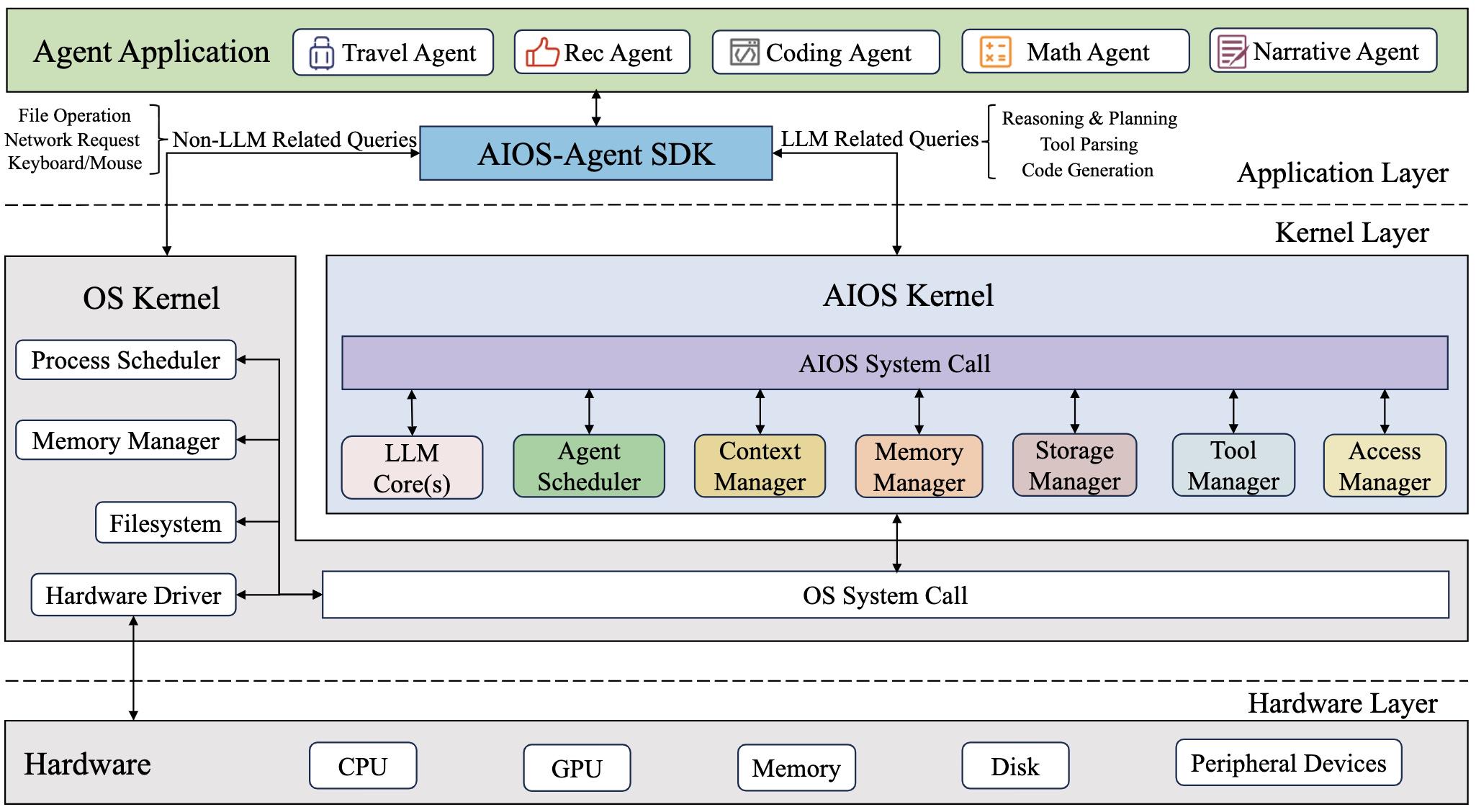

AIOS is an AI agent operating system that embeds large language models (LLMs) into the operating system and promotes the development and deployment of LLM-based AI agents. It aims to solve problems in the development and deployment of LLM-based agents (such as scheduling, context switching, memory management, storage management, tool management, agent SDK management, etc.), and provide a better ecosystem for agent developers and agent users. On January 15, the AIOS Foundation completed the destruction of 66.61% of the total token supply.

DEX Screener data shows that as of January 15, AIOS’s market value has reached US$40 million in less than a week after its launch.

Holozone( HOLO )

Holozone is a next-generation AI agent framework designed to allow users to create, own and monetize cutting-edge AI agents called Holos, developed by former Google DeepMind staff Pascal. Unlike traditional AI agents, Holos is fully functional and capable of real-time multimodal interaction, including text, voice, and possible visual capabilities in the future.

DEX Screener data shows that as of January 15, HOLO’s market value had reached US$23.4 million within three days of its launch.

DTRXBT ( DTRXBT)

DTRXBT is an AI agent issued on Virtuals Protocol, which aims to find excess returns in the market and has been hotly discussed due to large-scale airdrops.

DEX Screener data shows that as of January 15, DTRXBT’s market value had reached US$24.2 million within two days of its launch.

Byte Ai( BYTE )

Byte Ai is the first fully autonomous fast food AI agent issued by Virtuals Protocol, designed to deliver food to 8 billion people around the world and support any cryptocurrency payment.

DEX Screener data shows that as of January 15, BYTE’s market value has reached US$18.2 million after its launch yesterday.

Sora Labs (sora)

Sora Labs is an organization focused on applying AI in the Solana ecosystem. Its products include Zen, an open source AI agent framework built on Go, AI agent Hana, and toolkits, aiming to create new experiences and opportunities for developers and users.

DEX Screener data shows that as of January 15, Sora’s market value has reached 10.6 million US dollars after its launch today.

DeFAI ( DEFAI)

DeFAI is an AI-driven DeFi platform that aims to achieve a new product form and interaction mode based on traditional DeFi by introducing AIAgent technology. It can provide multi-chain portfolio aggregation, AI-driven recommendations and autonomous investment, AI-managed DAO fund Titan vault, etc.

DEX Screener data shows that as of January 15, DEFAI’s market value reached US$7.1 million within two days of its launch.

DWAIN (DWAIN)

DWAIN is an AI agent powered by ONLYFAINS that specializes in a variety of fields, especially sports betting, gaming, and event commentary. It won the special award of Holoworld AI in the latest Solana hackathon.

DEX Screener data shows that as of January 15, DWAIN’s market value reached US$6.9 million within two days of its launch.

You May Also Like

Token allocations on Binance are still a small share of total supply

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings