The first community sale exceeded expectations by 15 times and was forced to be postponed. Will Solayer, which has a few more narratives, become a dark horse?

Author: Frank, PANews

At the beginning of 2025, the new issuance activities of Solana's SVM track frequently set off various hair-pulling groups. First, the Sonic SVM airdrop triggered discussions on social media, and then another Solana ecological project Solayer announced that it would soon launch a community sale, which once again triggered the market's fanatical imagination of the code of wealth.

According to many social media accounts, due to Solayer's KYC rules, accounts that resell overseas KYC information in the market have increased their prices, and many bloggers have jokingly posted pictures of collecting KYC information in African countries. Faced with such popularity, Buidlpad, the partner of Solayer in this sale, urgently announced on January 13 that the Solayer community sale would be postponed for 3 days to January 16 to ensure fair distribution because the number of registrations far exceeded expectations.

Is Solayer’s popularity a result of the market’s new expectations for the SVM track or does the project itself have the potential to be a dark horse?

From re-staking to hardware acceleration, three narrative updates in one year

Solayer is a relatively young project, founded in 2024. In less than a year since its creation, Solayer has completed multiple narrative transformations, and it seems that it has hit the mark every time.

At the beginning of its creation, Solayer was positioned as a re-pledge protocol. After the mainnet was launched in August, it became a hot re-pledge protocol on the Solana chain. It successfully completed a $12 million seed round of financing that month. This round of financing was led by Polychain Capital, with Binance Labs and Arthur Hayes' family office Maelstrom participating in the investment. The post-investment valuation reached $80 million. Previously, Solayer also completed a round of Pre-Seed financing of an undisclosed size, with investors including Solana co-founder Anatoly Yakovenko and Polygon co-founder Sandeep Nailwal.

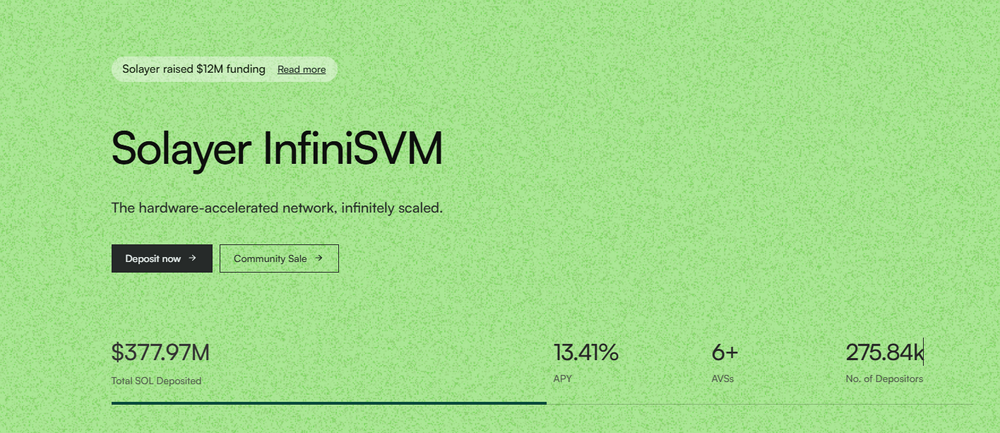

In the field of re-staking, Solayer has also achieved impressive results. As of January 13, its official data showed that the current TVL amount has reached 370 million US dollars, the number of depositors is about 275,000, and the average annualized rate of return has reached 13.41%. It ranks ninth among Solana's TVL and sixth among all re-staking protocols.

However, re-staking does not seem to be Solayer's ultimate goal. In October, Solayer launched the RWA narrative and launched the synthetic stablecoin Solayer USD, which is also a stablecoin asset based on government bonds. It is similar to the USD0 launched by Usual some time ago. The current market value of this stablecoin is about 30 million US dollars, ranking sixth in the Solana ecosystem. Of course, this volume is still relatively small in the entire network, ranking only 46th.

In December, Solayer quietly updated an article titled "Software Expansion Has Reached Its Limit - The Future Lies in Hardware Expansion" in his blog. The article pointed out that with the problems of state fragmentation, throughput limitation, delay and cost, system complexity, etc., the software upgrade of Ethereum EVM Layer 2 network has reached a bottleneck period, and the high performance of Solana and Sui also comes from the characteristics of software simplification and hardware acceleration. However, in this article, Solayer did not disclose his next plan to become the fastest network in the entire network by upgrading hardware.

Millions of TPS, 100Gbps, technical narratives are still effective

Until January 7, Solayer released its 2025 roadmap. Through hardware expansion, Solayer will launch the first novel hardware expansion SVM, which can achieve 1M TPS and 100Gbps. PANews learned from the white paper that Solayer proposed the technical principle of achieving millions of TPS and 100Gbps bandwidth. The core of the technology comes from a hardware acceleration technology called Infiniband RDMA, which can achieve microsecond-level cross-node communication. This technology can be divided into two parts. One part is Infiniband (wireless bandwidth), which is a high-performance network architecture used to efficiently connect computing nodes, storage systems and other devices, and is widely used in supercomputers and data centers.

Another core technology is RDMA (Remote Direct Memory Access), which allows devices to directly access the memory of remote nodes without the intervention of the operating system. This "zero-copy" communication method greatly reduces the CPU load and communication latency. It is understood that these two technologies are currently mainly used in high-performance computing (HPC), artificial intelligence and machine learning, finance and distributed storage. Solayer should be the first to be adopted in blockchain networks. At present, it is not certain whether this technology can be realized.

From the team's experience, Solayer's founder Rachel Chu was a core developer of Sushiswap, and another co-founder Jason Li graduated from Berkeley University with a degree in computer science and previously created the non-custodial Web3 wallet MPCVault. In addition, on January 8, Solayer also announced the acquisition of Fuzzland, a smart contract hybrid fuzzer company. It is reported that one of the tasks of this acquisition is to focus on building a hardware-accelerated SVM chain.

Community sales spark participation boom

On January 9, Solayer announced the first community sale in cooperation with Builder. According to the information released, the total issuance of LAYER tokens is 1 billion, and this sale is 30 million, with a total fundraising of US$10.5 million. The average price of the token is about US$0.35, which is a token valuation of US$350 million. 100% of the LAYER tokens in the community sale will be unlocked on the day of the Token Generation Event (TGE).

In addition to the token sale, Solayer also released a debit card called the Solayer Emerald Metal Card, a virtual + physical debit card in partnership with Visa that can be used online and offline for export and legal spending. The exact timeline for this product will be announced separately by Solayer. Users who participate in this sale have the opportunity to receive the Solayer Emerald Metal Card. Previously, it was often seen that token sales would issue whitelists to users who own certain hardware or products, but Solayer's model of buying coins and giving cards is relatively rare.

Regardless of the reasons, various bot studios and many crypto KOLs have posted KYC registration tweets on social media. Taking the newly launched Sonic SVM as an analogy, the current market value of SONIC tokens is about $240 million, and the fully diluted market value is about $1.6 billion. In addition, the market seems to have higher expectations for Solayer. Even at the $1.6 billion market value expectation, LAYER's expected appreciation seems to have 4 to 5 times the space.

As expected, the KYC subscription of LAYER was extremely popular. According to Buidlpad, the current number of registered people is more than 15 times the expected number, and they also noticed a large number of robots and furry studios. Therefore, they had to suspend registration and postpone the sale to January 16.

Of course, we cannot predict the performance of LAYER after it goes online. From the development history of Solayer in just one year, from re-staking to RWA, to hardware acceleration and encrypted payment cards, at least in terms of narrative and rhythm control, we can see that this team has a lot of experience, and has taken a route similar to Hyperliquid, which is to deliver products first and then deliver technology. If the technical strength and operational strength behind it can be matched synchronously, the goal of millions of TPS can be achieved, and the new technological milestone of millisecond-level transaction speed can be achieved, Solayer will truly become the next rising star that cannot be ignored. The result of all this depends on when Solayer can bring its products to market.

You May Also Like

Huang Licheng Holds Controversial 25x ETH Long Position

Crucial Fed Rate Cut: October Probability Surges to 94%