The Week Ahead: Jobs Report Could Make or Break Fed Rate Cut Dreams

TLDR

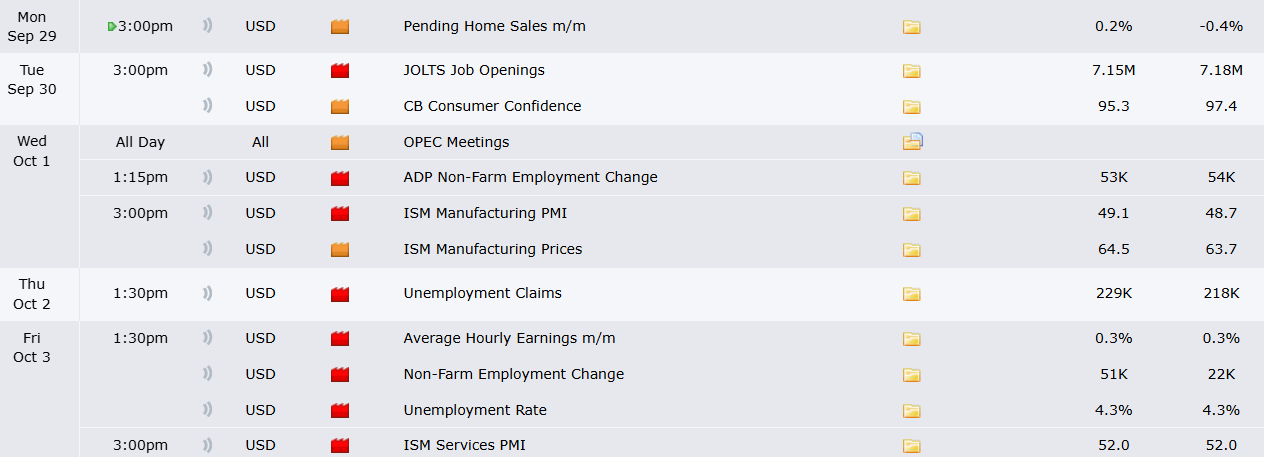

- September jobs report on Friday will reveal labor market strength after Fed cut rates due to unemployment concerns

- Key economic data includes ISM Manufacturing PMI (Wednesday) and ISM Services PMI (Friday) measuring business conditions

- Government shutdown deadline is Tuesday night, which could delay essential economic data publication

- Nike earnings on Tuesday will show progress on turnaround efforts under new CEO Elliott Hill

- Tesla delivery numbers expected Thursday as consumers rush for EV tax credits expiring at month-end

The coming week brings critical economic data that will help determine the Federal Reserve’s next policy moves and test market sentiment as investors await clarity on the labor market’s true health.

S&P 500 INDEX (^SPX)

S&P 500 INDEX (^SPX)

Friday’s September employment report stands as the week’s most important release. The Bureau of Labor Statistics data comes after Fed officials cited unemployment concerns as a key factor in their first interest rate cut this year.

Labor Market Under Fed Microscope

August’s jobs report showed the economy added just 22,000 positions, weaker than recent months. Unemployment also ticked higher during the period.

Forex Factory

Forex Factory

Fed Chair Jerome Powell described the central bank’s position as “challenging” given rising unemployment alongside inflation remaining above target levels. Several Fed officials are scheduled to speak this week, including New York Fed President John Williams and Cleveland Fed President Beth Hammack.

The labor market data takes on extra importance as the Fed weighs its next policy decision. Officials have signaled a more cautious approach to rate cuts than some investors hoped for.

Core PCE inflation data released Friday matched expectations. This reinforced hopes for additional Federal Reserve rate cuts while showing contained price pressures.

Key Economic Indicators This Week

Wednesday brings the September ISM Manufacturing PMI at 10 AM. This report measures business conditions in the manufacturing sector and serves as a leading economic indicator.

The September ISM Services PMI follows on Friday. The services sector contributes over 70% of U.S. GDP, making this data particularly important for economic assessment.

Both PMI indices help economists anticipate changing economic trends. The direction and rate of change in PMIs usually precede shifts in the overall economy.

Government Shutdown Risk Looms

Investors face additional uncertainty from potential government shutdown negotiations. The Tuesday night deadline could disrupt essential economic data publication if no deal is reached.

Historically, shutdowns have limited economic impact. The bigger risk involves delays in publishing data like jobs reports and inflation indexes ahead of the next Fed meeting.

Such delays could prevent the Fed from making decisions even as markets hope for more rate cuts. This uncertainty adds to investor concerns about policy timing.

Corporate Earnings in Focus

Nike reports quarterly earnings Tuesday as investors watch turnaround efforts under CEO Elliott Hill. The company posted smaller-than-expected profit and sales drops in its most recent report.

Tesla delivery numbers expected Thursday could surprise to the upside. Some analysts anticipate a boost from consumers rushing to claim EV tax credits before they expire at month-end.

Carnival reports Monday as the cruise operator looks to continue recent success. ConAgra Brands reports Wednesday after the food maker saw 4% sales decline in the prior quarter.

U.S. GDP growth for the second quarter was revised upward to 3.8% from 3.3%. Personal income and spending data also exceeded expectations, pointing to continued economic momentum in the current quarter.

The post The Week Ahead: Jobs Report Could Make or Break Fed Rate Cut Dreams appeared first on CoinCentral.

You May Also Like

Pippin (PIPPIN) Price Prediction 2026–2030: Can PIPPIN Hit $0.70 Soon?

Will Cardano Reach $10 by 2030? Analysts Break Down ADA’s Growth Cycles