Three signs altcoin season is dead and traders are betting on top 3 cryptos

- Altcoins are struggling and Bitcoin hovers close to the $105,000 support amidst rising geopolitical tensions.

- Derivatives data shows traders betting on Bitcoin, Ethereum and XRP even as large-scale liquidations hit exchanges.

- Altcoin prices could not keep up with capital inflows from institutional and retail investors even as sentiment improves.

The altcoin season is a time period during which 75% of the altcoins ranked in the top 50 cryptos by market capitalization outperform Bitcoin in a 90-day timeframe. Traders await the altcoin season every market cycle to take profits on alternative tokens as capital rotates from Bitcoin to other cryptos.

The ongoing market cycle has been different from the others as institutions back Bitcoin, Ethereum and top cryptocurrencies across various sectors of the industry, rather than rotating capital into altcoins. Meme coins, AI agent tokens and Ethereum Layer 2 chains have rallied in the last six months on different occasions, in a manner similar to the previous altcoin season.

The current market scenario with rising geopolitical tensions, mass market liquidations and Bitcoin price decline, could delay or potentially end the cyclical arrival of the altcoin season.

What went wrong with altcoins?

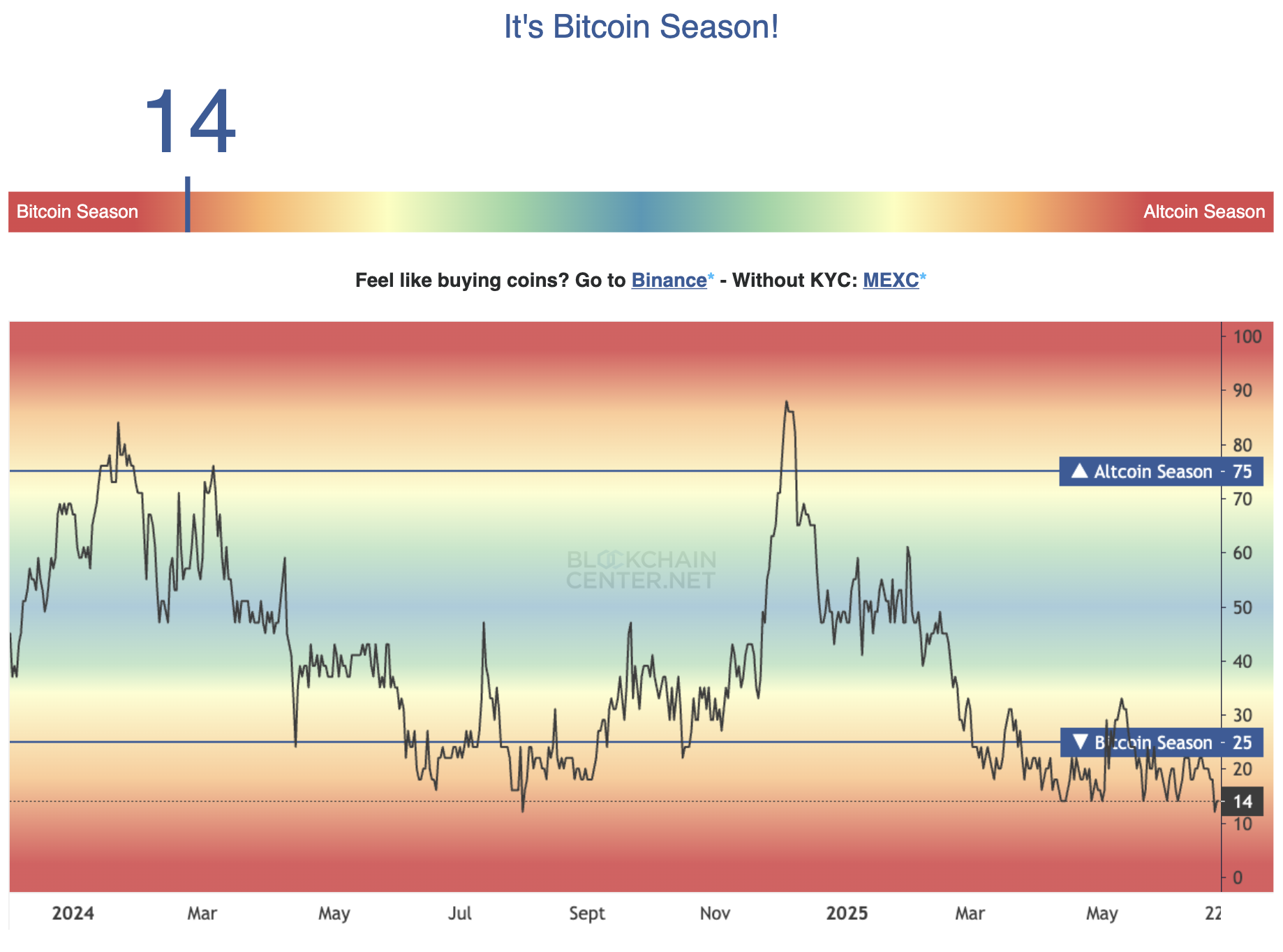

The altcoin season index, an indicator that measures on a scale of 0 to 100 whether it is altcoin season or not, reads 14. The value corresponds with a Bitcoin season where BTC gains are dominant for traders and Bitcoin outperforms altcoins ranked in the top 50.

When the indicator crosses 75, it is considered an altcoin season. The indicator shows that since mid-May, it has been Bitcoin season and the value is below 25.

Altcoin season Index | Source: Blockchaincenter

As of June 23, the index hit its lowest level in two years, marking a bottom and quashing hopes of market participants awaiting gains on their alt holdings.

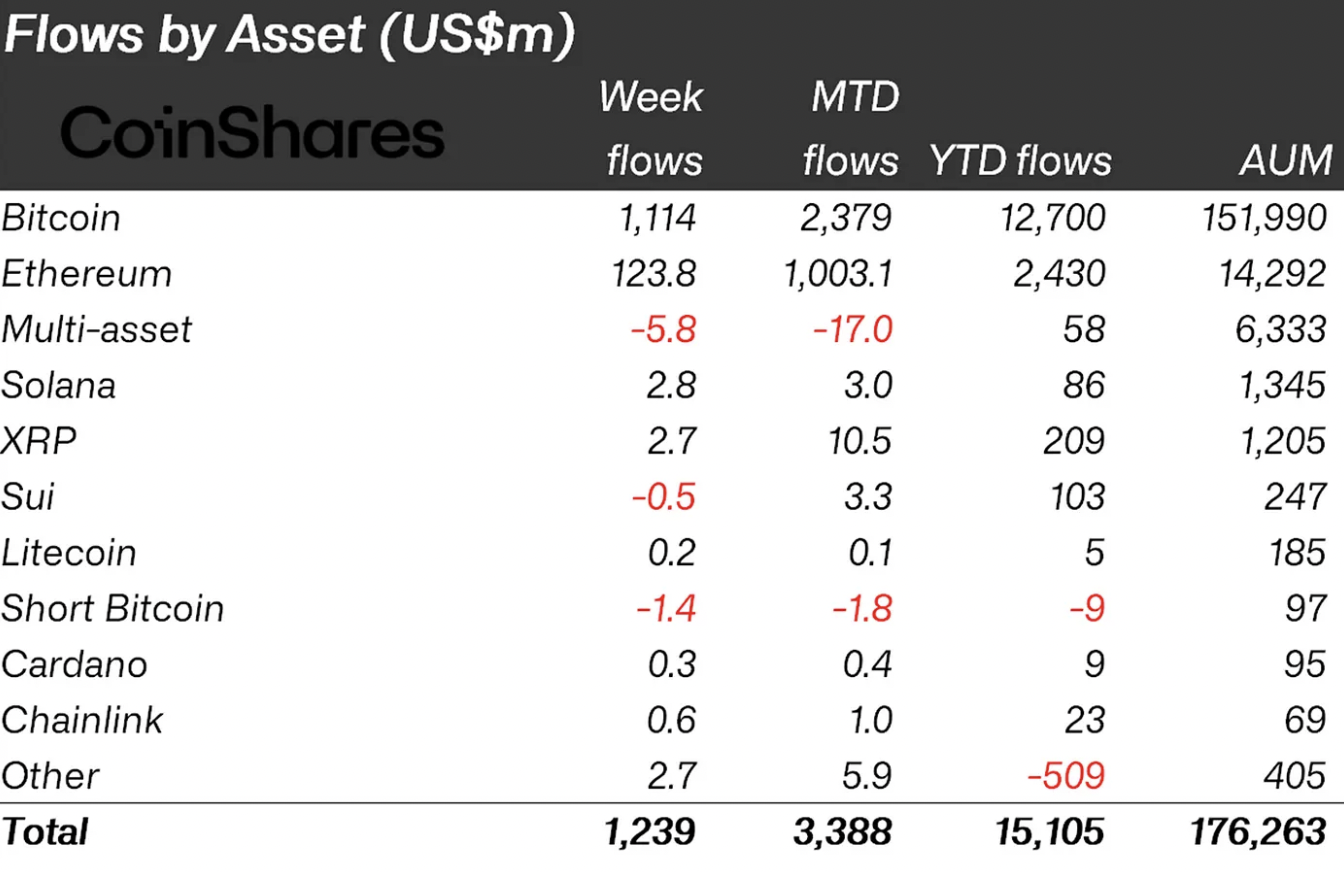

Instead of rotating capital into altcoins, institutions are deploying capital in top cryptos like Bitcoin, Ethereum and XRP investment funds and directing it to investment vehicles such as ETFs and other products. Digital Asset Fund Flows report shows that Bitcoin, Ethereum and XRP investment funds have attracted a large volume of inflows over the last week, month-to-date and year-to-date compared to the rest of the altcoins.

Digital asset fund flows | Source: CoinShares weekly report

While Ethereum, XRP and other cryptocurrencies on the list still qualify as altcoins, these tokens rank among the top cryptos by market cap and have gained from institutional capital rotation into their investment funds throughout 2025.

The fallout from the war, Bitcoin price drop and derivatives activity

Bitcoin held steady above the $100,000 milestone for nearly the entire last week, until the US strike on Iran that pushed BTC to the nineties. The largest cryptocurrency recovered from the drop and is holding steady above support at $105,000 on Tuesday.

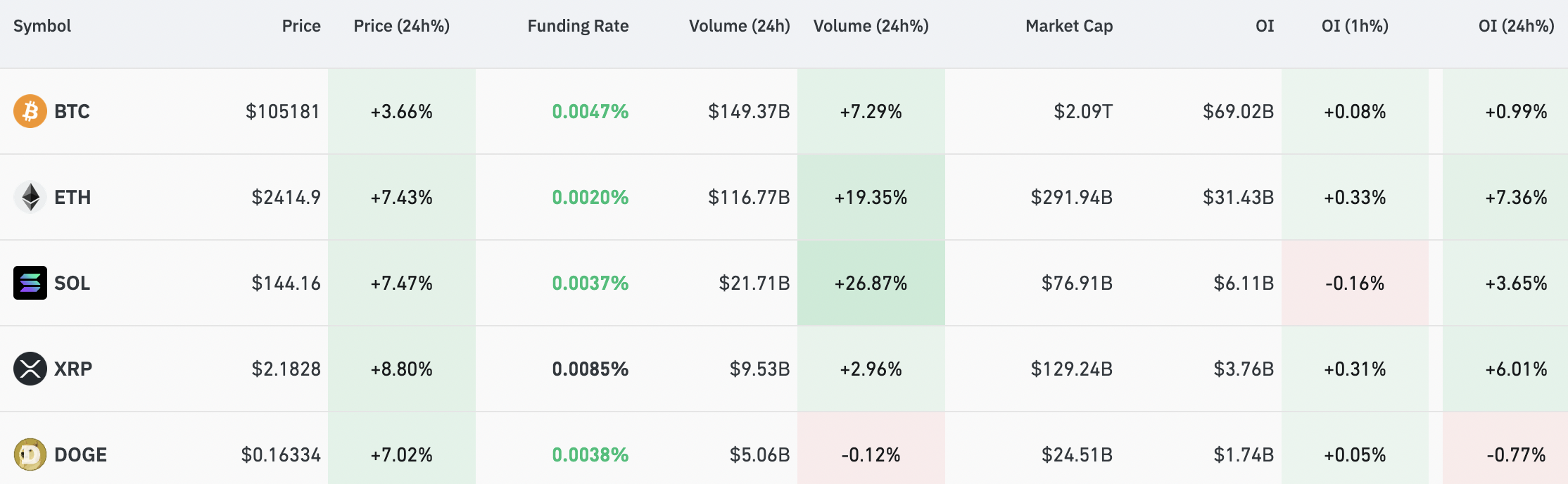

Derivatives data from Coinglass shows that liquidations in the crypto market crossed $470 million and traders are betting on Bitcoin, Ethereum and XRP, the top three cryptocurrencies. Open Interest (OI), a metric that tracks the value of all open derivatives contracts in an asset, observed an increase in BTC, ETH and XRP in the last 24 hours.

Top 5 cryptos derivatives activity | Source: Coinglass

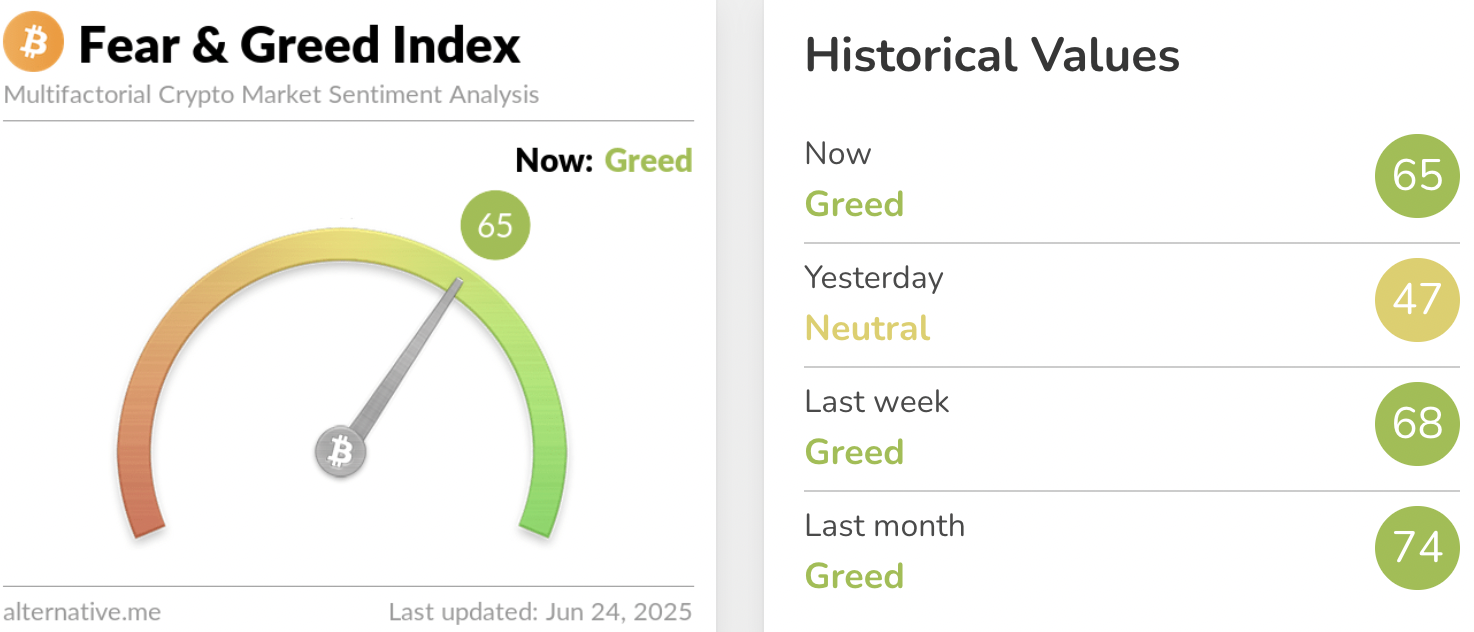

The Crypto Fear & Greed Index, that tracks the sentiment among traders, shows that traders are currently “greedy” and the sentiment has improved from neutral last week. “Greedy” corresponds to a value of 65, meaning there is an appetite for crypto among traders.

The tracker helps identify the demand for crypto and the sentiment among crypto traders during geopolitical crises and key events.

Crypto Fear & Greed Index | Source: Alternative

Bitcoin trades at $105,073 at the time of writing, losing 0.25% on the day.

You May Also Like

The Channel Factories We’ve Been Waiting For

Nasdaq-listed iPower reaches $30 million convertible note financing agreement to launch DAT strategy.