Top 3 Cryptos to Watch in 2025: Ozak AI, Solana, and Ethereum

Crypto markets in 2025 are humming with possibility, and traders are paying near attention to projects that balance credibility with growth potential. While the spotlight regularly falls on Bitcoin, altcoins and presales are wherein much of the motion is. Among the most promising tokens to look at this 12 months are Ozak AI (OZ), Solana (SOL), and Ethereum (ETH). Each offers particular strengths, however for the ones looking for exponential upside, Ozak AI may be the challenge to maintain on the top of the list.

Ozak AI (OZ)

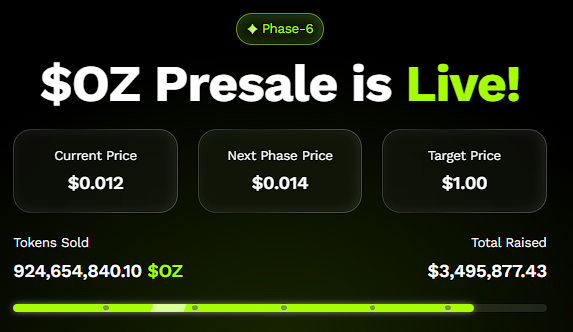

Currently in its 6th presale stage at $0.012 per token, Ozak AI has already raised more than $3.4 million and sold over 920 million tokens. Its mission is to merge artificial intelligence with blockchain through AI-powered prediction agents, tools designed to analyze data in real time and deliver actionable insights to traders, businesses, and developers.

Partnerships reinforce Ozak AI’s credibility. Perceptron Network provides access to over 700,000 AI-driven nodes, HIVE contributes 30ms market signals, and SINT delivers cross-chain bridges, SDK toolkits, and voice-driven AI interfaces. These collaborations build trust, speed, and interoperability into the ecosystem.

Partnerships reinforce Ozak AI’s credibility. Perceptron Network provides access to over 700,000 AI-driven nodes, HIVE contributes 30ms market signals, and SINT delivers cross-chain bridges, SDK toolkits, and voice-driven AI interfaces. These collaborations build trust, speed, and interoperability into the ecosystem.

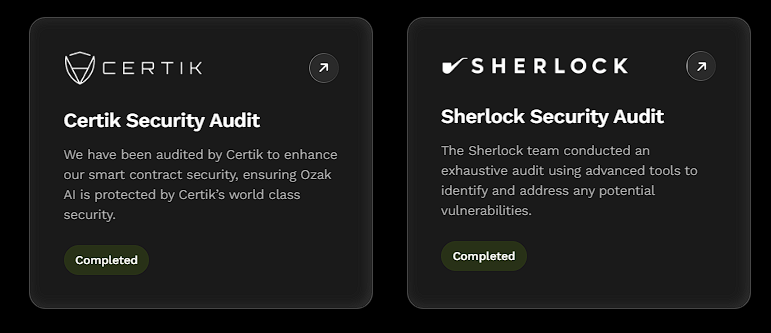

Security has also been prioritized with audits from CertiK and Sherlock. Combined with listings on CoinMarketCap and CoinGecko, Ozak AI has positioned itself as a credible project. At $0.012, analysts suggest it could climb to $1 by 2026, offering nearly 100x ROI—a level of upside far beyond what larger tokens can provide.

Solana (SOL)

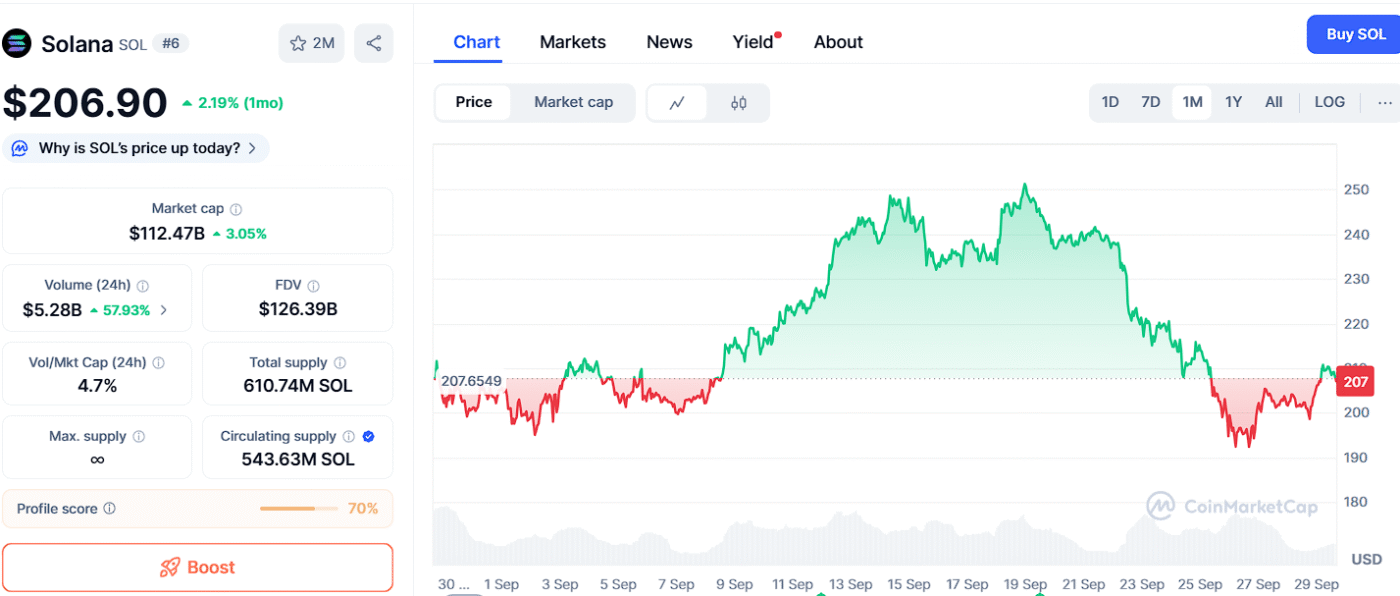

Solana (SOL) has end up one of the most vital Ethereum competitor, presenting high throughput, low costs, and a thriving ecosystem. Currently trading at $200, Solana indicates resilience because it eyes higher price targets.

Resistance lies at $240, $280, and $300, whilst guide may be found at $180, $160, and $140. These levels define Solana’s near-term range, with $200 appearing as a key pivot factor.

Solana maintains to attract builders in DeFi, NFTs, and gaming, with its speed and scalability giving it a competitive edge. Analysts accept as true as it may double or extra within the next cycle, but its upside is restrained in comparison to rising presales like Ozak AI.

Ethereum (ETH)

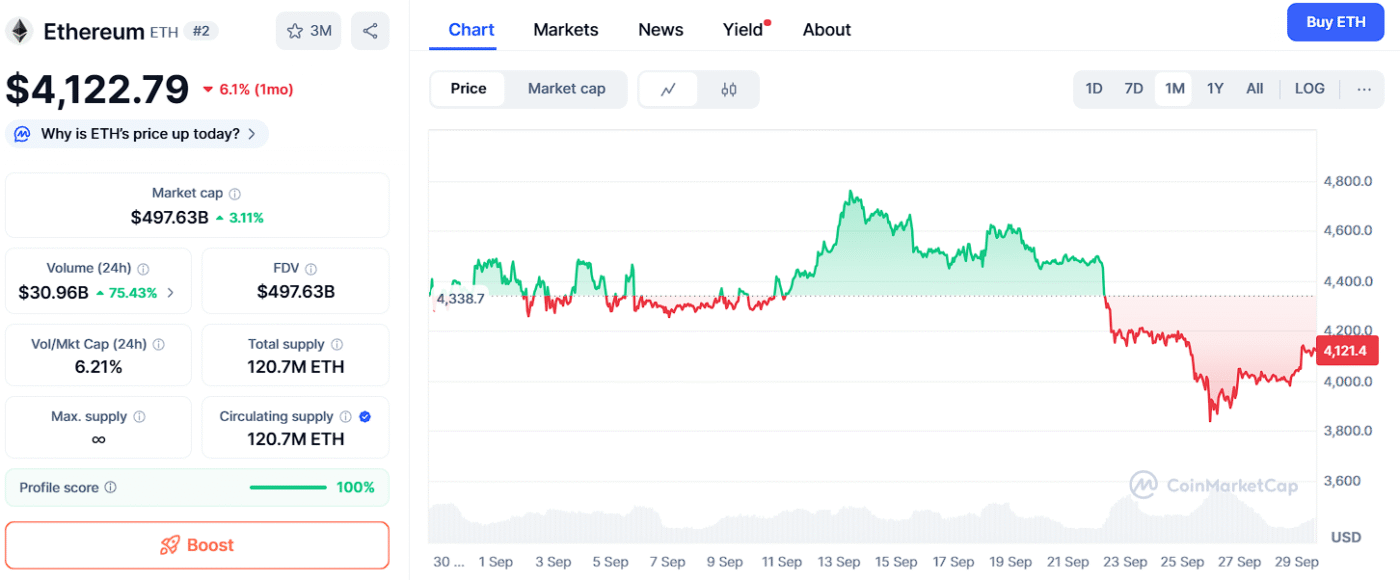

Ethereum (ETH) remains the backbone of decentralized finance and Web3 applications. Currently trading at $4,100, Ethereum is once again building momentum as scaling solutions and network upgrades strengthen its ecosystem.

Resistance is projected at $4,500, $5,000, and $5,500, with support levels around $3,800, $3,500, and $3,200. These zones highlight Ethereum’s path toward reclaiming all-time highs while offering traders clear technical markers.

Resistance is projected at $4,500, $5,000, and $5,500, with support levels around $3,800, $3,500, and $3,200. These zones highlight Ethereum’s path toward reclaiming all-time highs while offering traders clear technical markers.

Ethereum’s unmatched developer base and role in powering DeFi, NFTs, and enterprise blockchain adoption make it indispensable. However, like Solana, its growth is capped by a large market cap, meaning gains will be measured in multiples rather than exponential returns.

Why Ozak AI Stands Out

Ethereum and Solana are proven leaders, but their size limits their growth compared to smaller-cap tokens. Ozak AI offers investors something unique: the chance to get in at the ground floor of a project combining two megatrends — artificial intelligence and blockchain.

With over $3.4 million raised, a strong OZ presale community, and bold predictions of 100x ROI by 2026, Ozak AI has the ingredients to become one of the most talked-about tokens in the next bull run.

The top three cryptos to watch in 2025 each bring something valuable. Ethereum at $4,100 remains the foundation of DeFi and Web3, Solana at $200 delivers unmatched speed and scalability, and Ozak AI at $0.012 offers explosive early-stage potential.

The top three cryptos to watch in 2025 each bring something valuable. Ethereum at $4,100 remains the foundation of DeFi and Web3, Solana at $200 delivers unmatched speed and scalability, and Ozak AI at $0.012 offers explosive early-stage potential.

For investors seeking stability, ETH and SOL remain excellent choices. But for those chasing exponential gains, Ozak AI may well be the smartest bet of the year—a presale project capable of redefining the balance between innovation, utility, and life-changing upside.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter : https://x.com/ozakagi

The post Top 3 Cryptos to Watch in 2025: Ozak AI, Solana, and Ethereum appeared first on Blockonomi.

You May Also Like

Satoshi-Era Mt. Gox’s 1,000 Bitcoin Wallet Suddenly Reactivated

Bank of China Launches Cross-Border Digital RMB Payments in Laos