Viewpoint: This decline is just a regular market shock

Author: @0xChainMind , Crypto KOL

Compiled by: Felix, PANews

CZ predicted the recent crash as early as 2020. In addition, Fed Chairman Powell also said that the Fed cannot hold Bitcoin, and Trump's government reserve plan was blocked. Today's market conditions may be unclear to many people. What is the "truth" behind the current market decline?

The past two days have been a nightmare for all cryptocurrency investors, with Bitcoin falling by about 15%, bringing down the entire crypto market. Market sentiment quickly shifted from "the bull market has come" to "the bull market is over." But few people know that this may be part of the government's plan to "drive away" all undetermined holders from the market.

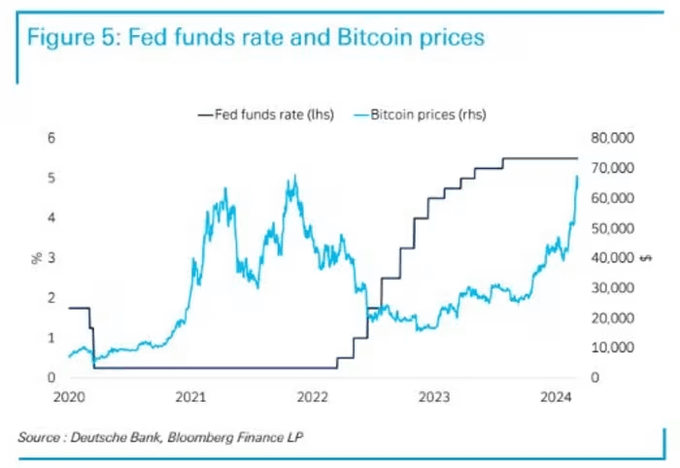

The market began to see a slight correction after Powell's speech, in which he said the pace of fighting inflation has slowed.

These words mean that they are not planning to lower interest rates. As we all know, low interest rates are the key driver behind the bull market.

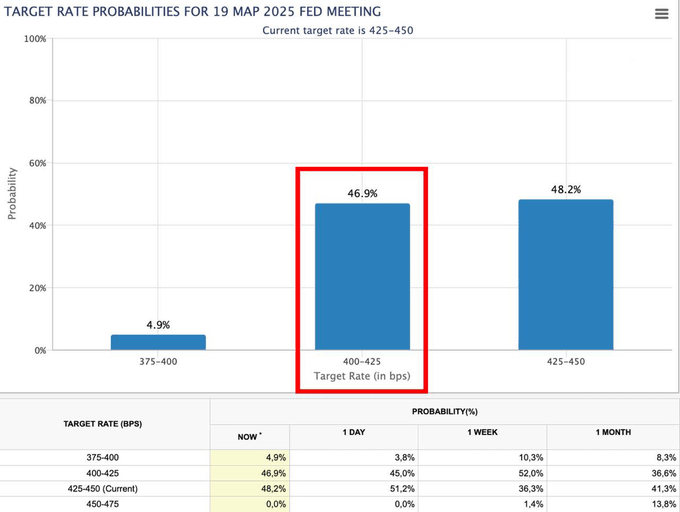

Inflation information was also released, and it was lower than everyone expected. As a result, the probability of a rate hike in March rose to 46.9%. But something seems to be wrong.

This negative macroeconomic factor seems to be the only reason for the decline.

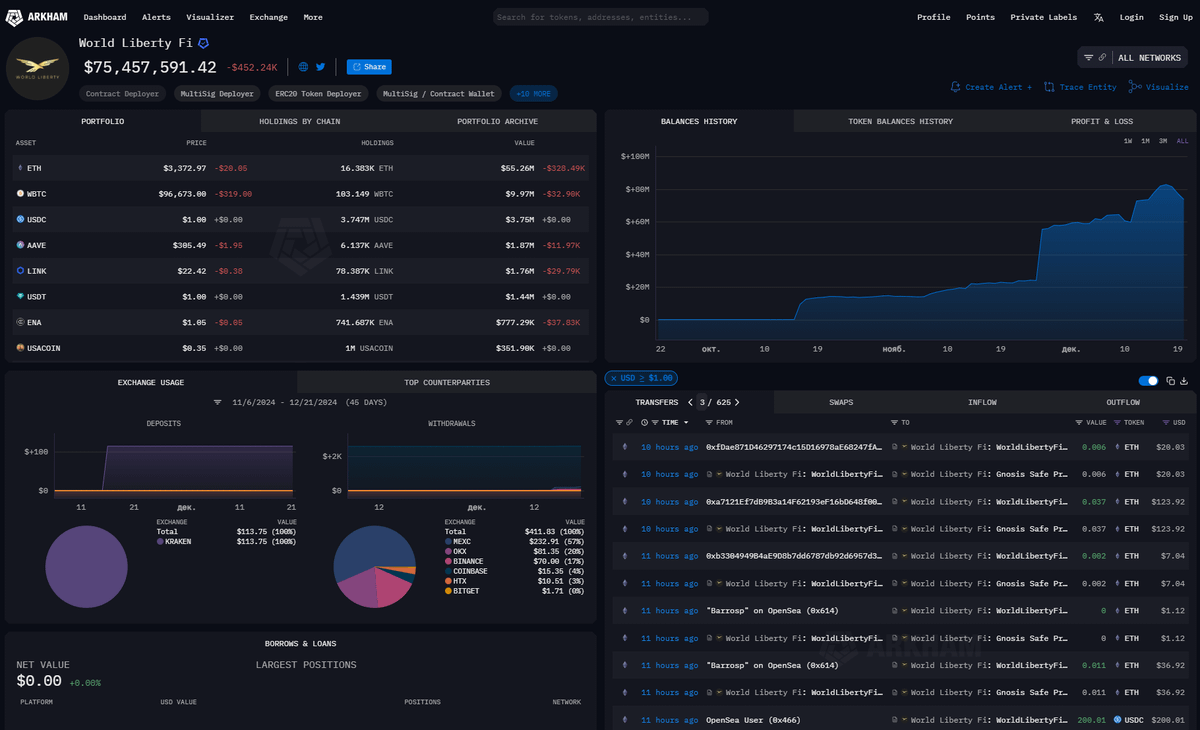

The Trump campaign has been actively hoarding assets during the decline. In just two days, they bought more than $70 million worth of ETH, WBTC, and other altcoins.

This can't help but raise questions about potential market manipulation.

The market was overheated and it was obvious that the government decided to cool it down.

This is good for both the market and the government because it is much easier to hoard Bitcoin when the price is lower.

If you think that the beginning of this article is just to attract readers, you are wrong.

As early as 2020, CZ said in a tweet: Waiting for new headlines: #Bitcoin "plunges" from $101k to $85k.

Now CZ has posted again: “Waiting for new headlines: #Bitcoin hits new all-time high again.”

This tweet clearly shows CZ’s optimism and clear understanding of what is going on.

The only other thought that came to the author’s mind after CZ’s tweet is that the price could also pullback to $85K. That is why it is important to be cautious in trading now and avoid taking unnecessary risks.

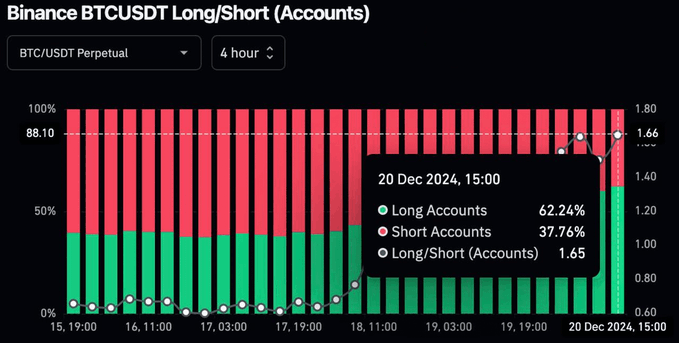

However, as the chart below shows the long-short ratio, this price level may be bought up quickly.

Taking all the information into consideration, it is obvious that this decline was just a regular shock. This is necessary for the market because when everyone is just holding, the market cannot continue to rise, and a new wave of buying is needed.

As mentioned above, it is not recommended to trade blindly at this time. It is an unnecessary risk, especially if you already have a position. The only thing you can consider is to buy Bitcoin cautiously in the $85,000-$87,000 range.

Related reading: As the market falls, how do top traders view the market outlook?

You May Also Like

Elon Musk’s net worth hits record $749B after legal win restores massive Tesla compensation