XRP On-Chain Data Hints the Selling Momentum Is Fading Fast

- XRP’s selling pressure is weakening as market absorption begins to stabilize short-term sentiment.

- The Taker Buy/Sell Ratio signals a potential shift as sellers lose control and demand gradually builds.

XRP’s market movement is starting to show interesting signs. In recent days, the selling pressure that had been weighing on the price appears to be easing.

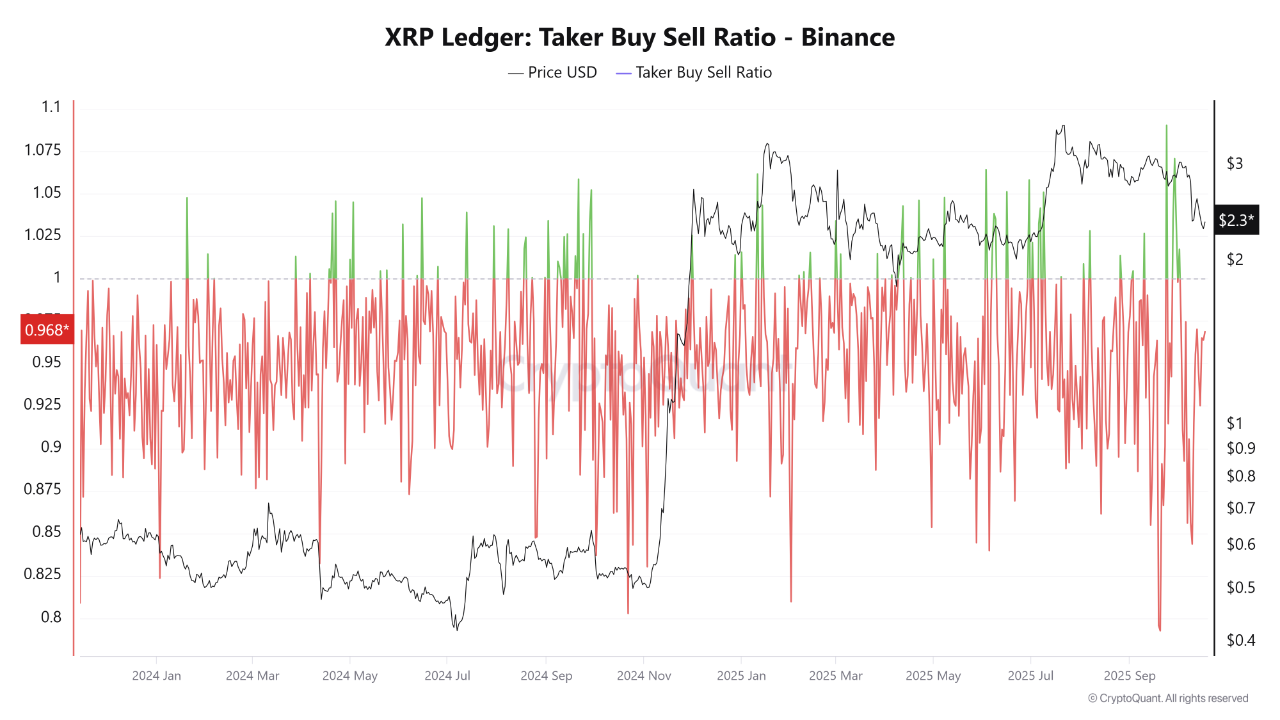

According to on-chain analyst PelinayPA, the Taker Buy/Sell Ratio is currently around 0.96, indicating that selling pressure remains present, but its strength is starting to wane.

Source: CryptoQuant

Source: CryptoQuant

At the time of writing, the price of XRP is around $2.4645, up 3.65% in the last four hours and 4.88% in 24 hours, with a market cap of $147.64 billion and a daily trading volume of around $1.06 billion.

PelinayPA explained that although selling pressure remains dominant, on-chain indicators show the market is beginning to “absorb” the pressure. The ratio occasionally dipping below 0.9 does indicate strong selling activity, but it is short-lived.

This, he believes, indicates that sellers are losing steam. More interestingly, the price of XRP is now forming a pattern of higher lows, which could be an early signal that the market is preparing for a recovery phase.

XRP Shows Signs of Recovery After Fading Sell Pressure

If the Taker Buy/Sell Ratio breaks above 1 again, it usually signals a short-term trend change. With prices stable in the $2.4–$2.5 range, the potential for a rally towards $2.8–$3 becomes increasingly likely.

However, if the ratio falls and remains below 0.95, a price correction back to $2.0 is possible. Therefore, PelinayPA advises market participants to remain cautious and adjust their positions gradually.

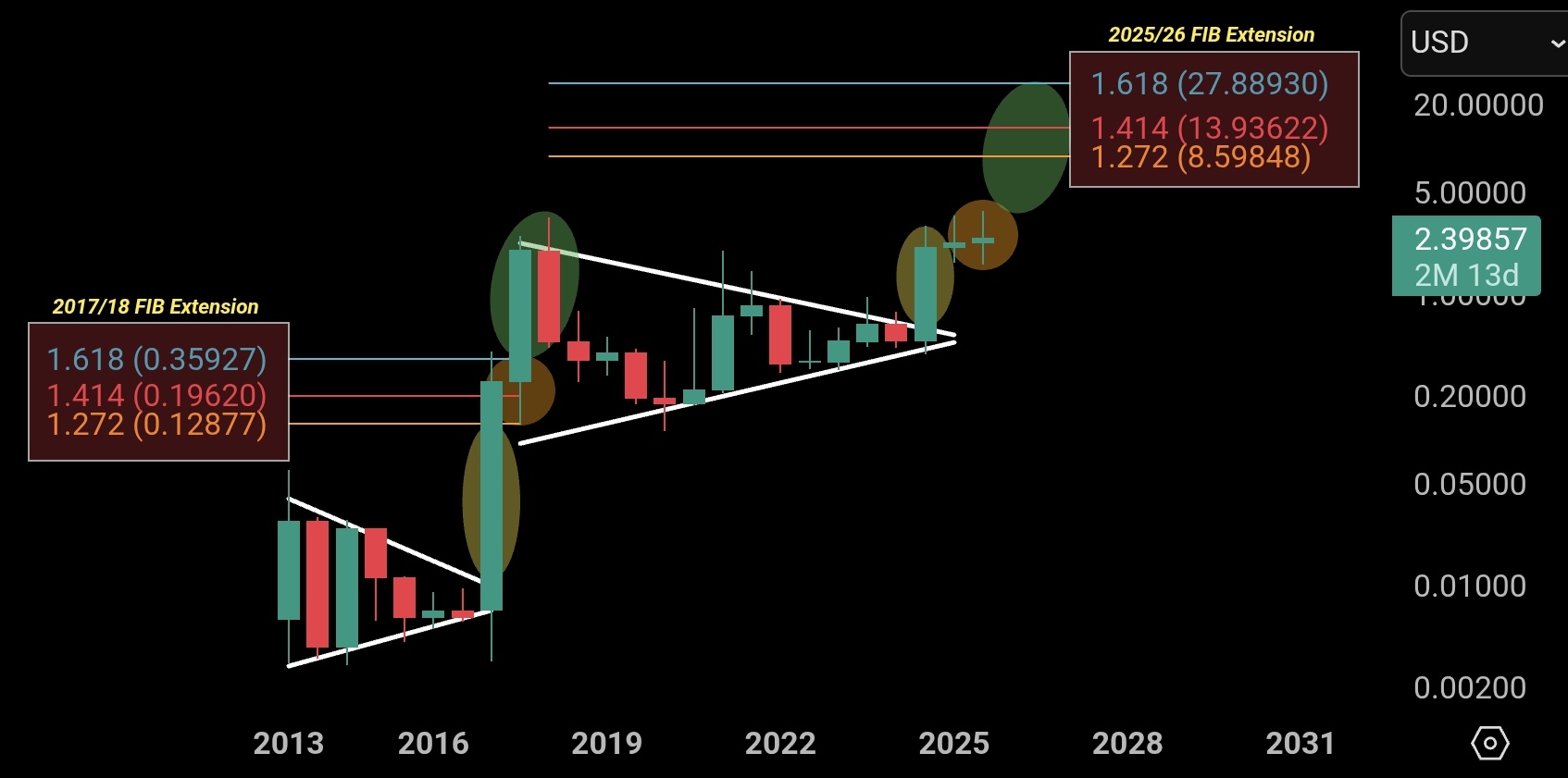

On the other hand, technical analyst ChartNerd believes that XRP’s major cycle is not over yet.

According to the analyst, even with the poor candle shadows, XRP’s six-month chart shows no signs of a bearish trend reversal.

“I expect a continuation to $5, then $8 to $13, and finally reaching the $27 target as the cycle top,” he said.

Source: ChartNerd on X

Source: ChartNerd on X

He believes that XRP’s macro movement is just beginning, and the current on-chain signals could be the trigger.

Not only that, CNF reported a few days ago that Ripple Labs is preparing a new fundraising round with the target of purchasing $1 billion worth of XRP to strengthen its treasury reserves.

This move comes amid growing investor interest in XRP, and with the reduced supply available in the market, the potential for price appreciation could increase.

Meanwhile, Ripple is also expanding its reach globally. The company recently partnered with Absa Bank in South Africa to launch digital asset custody services for financial institutions.

This move underscores Ripple’s ambition to solidify its position in the digital finance sector, especially in regions with rapid growth in crypto adoption.

Furthermore, Ripple’s stablecoin, RLUSD, continues to grow rapidly, with a supply now exceeding $700 million.

The company has even partnered with several African fintechs and humanitarian projects, demonstrating how its innovation is beginning to penetrate both traditional and social finance sectors.

You May Also Like

WTO report: Artificial intelligence could drive nearly 40% of global trade growth by 2040

Dragonfly Capital has deposited 6 million MNT tokens into Bybit in the past 7 days, worth $6.95 million.