XRP Price Prediction: Ripple Token Tumbles As Peter Brandt Eyes Short To $2.22

The XRP price edged down a fraction of a percent in the past 24 hours to trade at $2.81 as of 3:30 a.m. EST even as trading volume surged 17% to $5.1 billion.

Prominent commodity trader Peter Brandt says worse may be ahead for the Ripple token, which he’s picked as a top candidate to short, conditional upon it completing an ongoing descending triangle pattern.

If that bearish pattern is realized, Brandt suggest XRP may plunge almost 21% to $2.22

Meanwhile, J.A. Maartunn on X says that whale investors have offloaded roughly $50 million XRP per day on average over the past 30 days.

With the XRP price up 433% in the past year, can the bulls gain control again?

XRP Price Movements Indicate A Clear Bearish Scenario

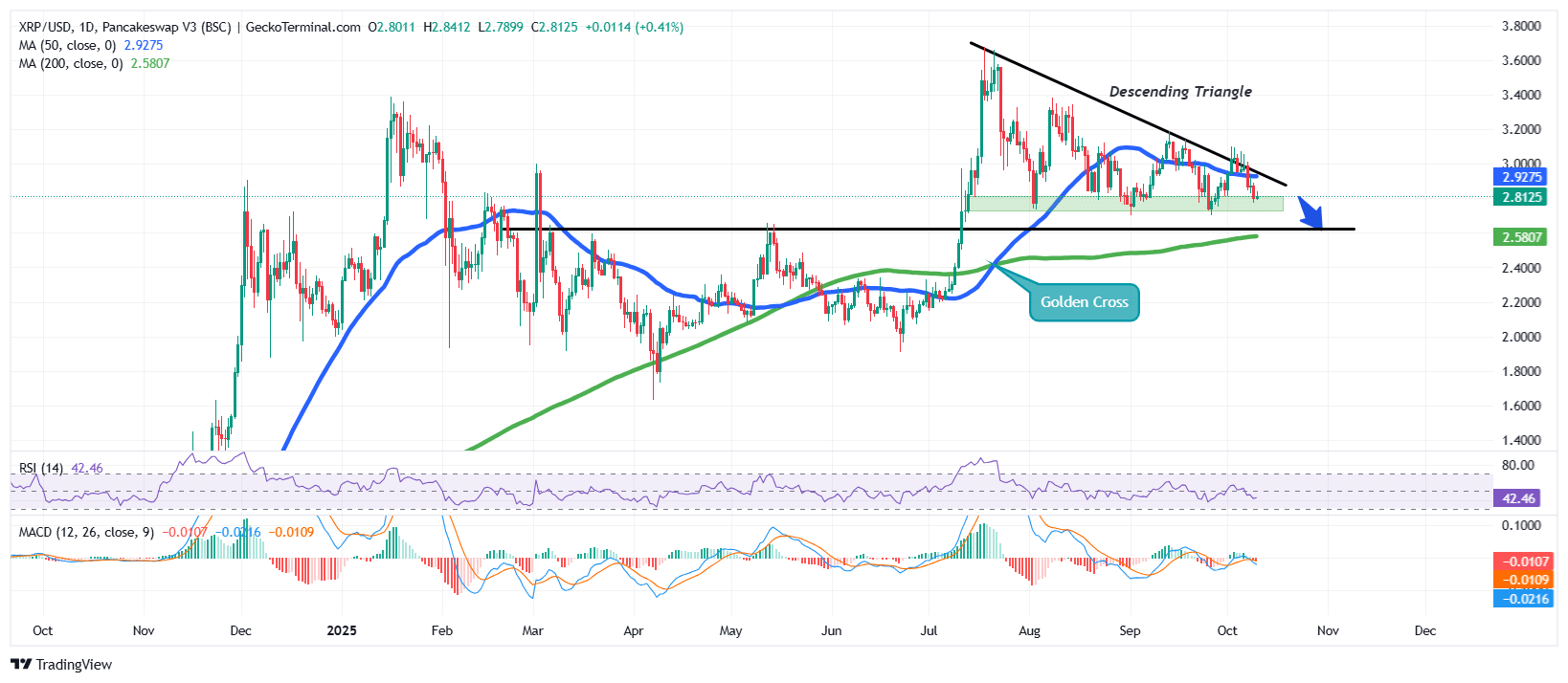

After a parabolic move in July that pushed the XRP price to a new ATH at $3.65, the bears used this resistance to stage a price retrace within the confines of a descending triangle pattern, with the bulls using the $2.74 support to try and hold off the bearish pressure.

However, as the Ripple token price nears the apex, the momentum shows that the asset is preparing for a breakdown.

As a result of the continued downtrend, the price of XRP has now crossed below the 50-day Simple Moving Average (SMA) at $2.92, confirming the current bearish sentiment. The 200-day SMA, however, is still holding strongly at $2.58, which could be the next key support area if the Ripple token price continues to drop.

XRP/USD Chart Analysis Source: GeckoTerminal

XRP/USD Chart Analysis Source: GeckoTerminal

Meanwhile, the Relative Strength Index (RSI) also supports the bearish narrative, with the RSI dropping towards the 30-oversold region, currently at 42.

The Moving Average Convergence Divergence (MACD) is also negative, with the orange signal line now crossing above the blue MACD line. The red bars on the histogram have also started forming, which also shows that momentum has turned to the negative side.

Ripple Token Price Aims For Support Around $2.64

According to the XRP/USD chart analysis on the daily timeframe, the Ripple token price is poised for a bearish trend continuation, with the price now nearing the lower boundary of the descending triangle.

If the bearish trend plays out, the price of XRP could continue dropping, with the immediate support area being $2.64, which was the previous resistance in March and May 2025.

The main technical indicators, including the RSI and MACD, support the bearish outlook, as the bears seem to have full control of the price.

Furthermore, according to TradingView data, XRP’s dominance has been in a clear downtrend, recently breaking toward the lower range near 4.1%, signaling that XRP is losing market share to other cryptocurrencies.

This decline in dominance typically indicates relative weakness, suggesting the price is likely underperforming compared to the broader crypto market.

However, if the bulls take charge and the price of the Ripple token climbs towards the upper trendline at $2.92 (around the 50-day SMA), XRP could soar even higher, as the bulls may target the strong resistance at $3.14.

This outlook is supported by Ali Martinez, who now says that XRP may find support at $2.73, allowing it to rise to the $3.10 level.

Related News:

You May Also Like

US-wed Irishman with no criminal record detained for months in 'traumatizing' conditions

U.S. government isn’t poised to sweep in with bitcoin buys, despite Jim Cramer rumor