This Week In Crypto Asia: Nomura Targets Crypto Market Access In Japan Amid Growing Demand

Crypto adoption is surging in Japan, and newer players are locking in. Nomura Holdings, Japan’s largest investment bank and brokerage firm, is looking to expand its role in Japan’s growing crypto market.

Its wholly owned crypto subsidiary, Laser Digital, is now working with Japan’s Financial Services Agency (FSA) to get approval for offering crypto trading services to big investors in the country.

An article by Bloomberg, dated 3 October 2025, highlighted Laser Digital CEO, Jez Mohideen’s comment that the application underscores Nomura’s strong belief in Japan’s digital asset space and its long-term potential.

Japan’s crypto market has been on a tear this entire year. According to the data shared by the Japan Virtual and Crypto Assets Exchange Association, transaction value doubled to ¥33.7 trillion ($230 Bn) in just the first seven months of the year.

Furthermore, crypto momentum in Japan is being boosted by supportive global policies, especially in the US and domestic changes such as tax cuts and new rules for crypto investment funds.

EXPLORE: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

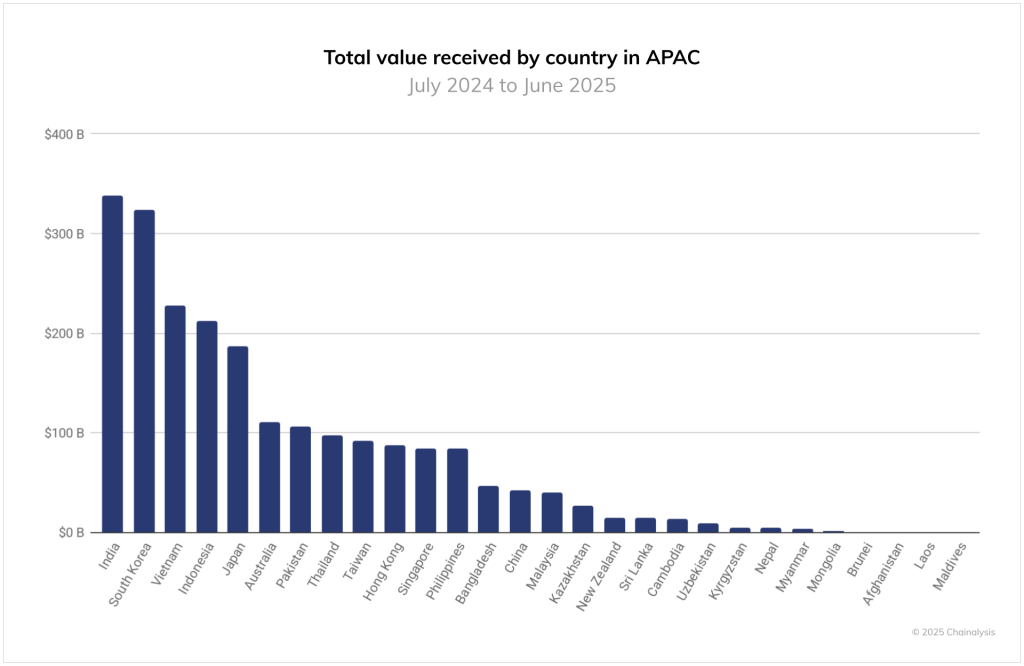

(Source: Chainalysis)

Meanwhile, crypto is also being mainstreamed in Japan and is now slowly gaining ground in Japan’s traditional finance (TradFi) sector.

Case in point, Daiwa Securities, the country’s second largest brokerage, revealed that customers at its 181 retail branches can now use Bitcoin and Ether as collateral to borrow Yen.

EXPLORE: Top 20 Crypto to Buy in 2025

With A 120% On-Chain Growth, Japan Opens Up For Institutional Crypto Trading

Credit where it’s due, thanks to Japan’s government reforms, the crypto market in the country has found its mojo now that it’s easier and more attractive to invest.

Tax cuts and clearer rules for crypto-focused funds are encouraging more people, particularly younger investors and big institutions, to include digital assets in their portfolios.

The growth hasn’t gone unnoticed. From June 2024 to June 2025, Japan saw a 120% jump in on-chain transaction value, edging out South Korea, India and Vietnam.

Moreover, new policies that increasingly treat tokens as investment-grade assets and the licensing of Japan’s first Yen-backed stablecoin issuer have fueled the growth.

Nomura launched its crypto arm, Laser Digital, in 2022 to offer services like asset management and venture capital.

In 2023, Laser Digital secured a full crypto license in Dubai and opened a branch in Japan. Now, it’s seeking approval to offer trading services to both traditional financial firms and crypto companies, including exchanges operating in Japan.

However, all’s not well in Laser Digital’s camp. Earlier this year, Nomura posted a loss in its European operations, which the company partly blamed on Laser’s underwhelming performance.

Mohideen had hoped the unit would be profitable within two years, but later admitted it might take longer to break even.

Despite these challenges, Nomura’s push into Japan shows it’s serious about growing its presence in a fast-changing crypto market.

EXPLORE: 20+ Next Crypto to Explode in 2025

Key Takeaways

- Japan’s on-chain transaction value jumped 120%, outpacing South Korea, India, and Vietnam

- Japan’s crypto market doubled to ¥33.7 trillion, driven by reforms and rising institutional interest

- Japan’s growth is fueled by new regulations and its first Yen-backed stablecoin

The post This Week In Crypto Asia: Nomura Targets Crypto Market Access In Japan Amid Growing Demand appeared first on 99Bitcoins.

You May Also Like

XRP Hits ‘Extreme Fear’ Levels - Why This Is Secretly Bullish

Tokyo’s Metaplanet Launches Miami Subsidiary to Amplify Bitcoin Income