El Salvador: The Making of a Sovereign Nation

Bitcoin Magazine

El Salvador: The Making of a Sovereign Nation

I spent the past week in El Salvador for the third time in one year, and it’s clear the country is undergoing a real transformation. Not theoretical, not surface-level — a shift in how people live, think, build, and imagine their future. And the moment that crystallized this transformation came at the end of the week, during a private dinner with President Nayib Bukele, which I was privileged to take part in.

I’ve followed his work for a few years. I’ve interviewed nine Salvadorans and expats living in the country on my podcast — as well as merchants, builders, grassroots organizers, and everyday citizens. A year ago, I tweeted that my dream was to meet him one day.

I didn’t expect that when I approached him at the end of the dinner to take a photo and said, “Hi, I’m Efrat,” he would answer immediately, before I could explain who I am:

“I know you, I’ve seen your podcast.”

It was one of those moments you don’t forget, because it made the entire week feel connected to something larger unfolding in this country.

The Three Layers of a Nation in Motion

Three events took place during the week — Reclaiming Health, Adopting Bitcoin, and Bitcoin Histórico — each revealing a different layer of El Salvador’s trajectory.

“Reclaiming Health Symposium” led by Salvadoran Dr. Kenneth Fernández-Taylor, explored the intersection of sound health and sound money. Some of the conversations centered on how unsound money and high-time preference shape stress, uncertainty, and long-term health. In a country that has reclaimed public safety and is now reclaiming economic freedom, the connection between health and money didn’t feel abstract, it was intuitive. Four years ago, when the world was gradually going insane during an “end of the world pandemic”, a health symposium with truth-seeking, freedom-loving doctors, healers, and experts felt like a distant dream. But in El Salvador, dreams are coming true.

At “Adopting Bitcoin”, I saw the grassroots engine of this transformation. Circular economies like Bitcoin Beach (El Zonte) Berlin in El Salvador, and MurphLife, are real-life demonstrations of what happens when people earn, spend and save in sats. Communities like “Bitcoin Babies”, “Les Femmes Orange” or the Argentinian “La Crypta” emphesize that bitcoin is for everyone. Merchants accept Bitcoin naturally. Kids are growing up around it. “My First Bitcoin” announced its next chapter: supporting 70+ projects across 40 countries with materials, frameworks, and guidance for community-led Bitcoin education. The startup floor was filled with founders who have opened offices here and are building from El Salvador. The common theme I kept hearing was simple: you can do things here.

Photo: Michael Hollomon Jr. | https://x.com/unkle_skunkle/status/1989823319093240030/photo/1

Photo: Michael Hollomon Jr. | https://x.com/unkle_skunkle/status/1989823319093240030/photo/1

Historic Moment For Bitcoin & El Salvador

But the highlight of the week, the moment that framed everything else, was “Bitcoin Histórico”. It was the first government-led Bitcoin conference in the world, organized by the government’s Bitcoin Office, a world-first led by Stacy Herbert and team, and held inside the National Palace and the National Theater. These are two very symbolic landmarks, and the decision to host a Bitcoin conference in such royal setting said more than any speech could. The halls were filled with ministers, entreperneurs, and international speakers; voices from the U.S., Europe, Latin America, and Africa. Guests received booklets titled “El Salvador is Bitcoin Country” with Bukele’s photo on the cover, and it is clear that Bitcoin is not a side project here, it is a national direction.

Photo: Efrat Fenigson

Photo: Efrat Fenigson

Outside, in Plaza Gerardo Barrios, the conference spilled into public space; the sessions were screened with Spanish translation to the locals: families, students, elders. Shops and stalls accepted sats. Bitcoin was in its natural habitat, part of everyday life in the city, and the public was part of the conference.

Several announcements underscored the country’s trajectory: The Ministry of Agriculture signed a cooperation agreement with The Beef Initiative to strengthen local cattle production. Steak ’n Shake announced its targeting El Salvador as first Latin American location, accepting Bitcoin from day one.

Photo: Translating El Salvador | https://x.com/TranslatingES/status/1989744516228673658/photo/4

Photo: Translating El Salvador | https://x.com/TranslatingES/status/1989744516228673658/photo/4

The government unveiled the purchase of Nvidia B300 chips, compute powerful enough to train and run advanced AI models locally, with the support of Hydra Host. It’s a step toward sovereign compute infrastructure that reduces reliance on Big Tech data centers and positions El Salvador to build its own AI capabilities inside the country. Mempool announced it is incorporating in El Salvador, following a recent $17m investment. And with support from Lina Seiche and the Bitcoin Office, 500 classrooms will be renovated for Bitcoin and financial education as part of the country’s wider “Two Schools a Day” initiative to modernize and expand educational infrastructure at scale. Together, these moves form a consistent pattern: a country building its future across multiple layers at once.

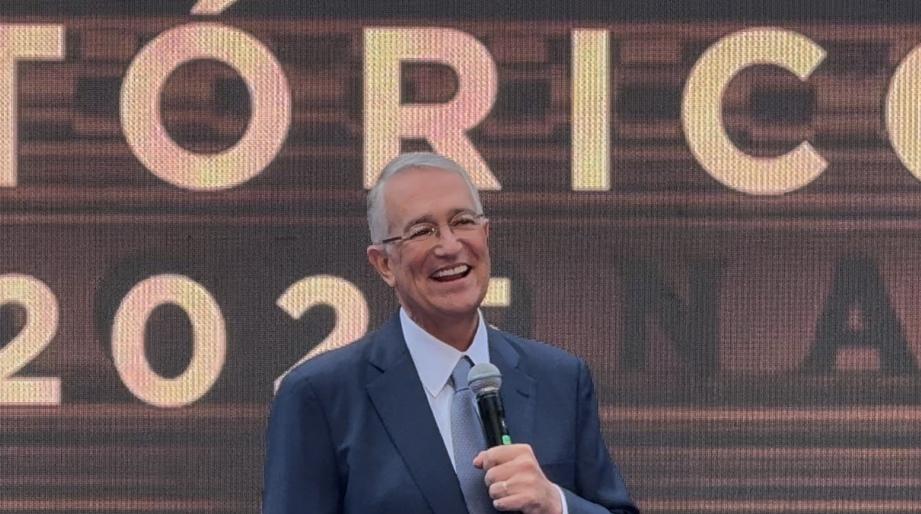

Ricardo Salinas’ presence at Histórico added weight to the moment. In his remarks, he said “El Salvador is on the right side of history,” and pointed to the dramatic improvement in public safety: “You have better security than in Japan. I wish my country could be like this.” Coming from one of Latin America’s most influential entrepreneurs, his words echoed what many visitors felt this week.

Photo: Efrat Fenigson

Photo: Efrat Fenigson

The Presidential Dinner

But the clearest window into that future came at the dinner.

Photo: The Bitcoin Office El Salvador

Photo: The Bitcoin Office El Salvador

Bukele is nothing like his international caricature. He’s sharp, fast, funny, and completely fluent in the culture of Bitcoin. As he sat down to the dinner table, he joked, “Guys, it’s over, Bitcoin’s done,” because the price had dipped under $100k that day. He’s not a politician trying to sound relatable or quote scripted talking points; he actually understands the room and gets bitcoin.

When the conversation turned to Bitcoin’s long-term trajectory, he said something that stayed with me: “Bitcoin should be a currency.”

Not an investment, not an asset class, a currency. He sees the end state clearly. And he sees the steps that lead there. He talked about circular economies – El Zonte, Berlin – as a practical mechanism for adoption. Communities that use Bitcoin daily are the ones that will carry it from an idea into a functioning monetary system.

His wit revealed just as much as his analysis. Giacomo Zucco, Director of Plan B Network, was introduced as an anarcho-capitalist, and Bukele immediately replied, “It’s fine, I’m also friends with Milei,” then called him “the anarchist” throughout dinner. After Wiz gifted him a katana (a Japanese sword) and Giacomo gifted him a bottle of rum named “Dictador” (a light jab at the media narrative) someone noted that Bukele doesn’t drink. He answered instantly: “It’s fine, I don’t often fight with swords either.”

As the evening ended, Giacomo thanked him, and Bukele smiled and said something that summed up his entire approach to governance: “I’m sorry if I run a government. But it’s a very small one.”

Happy People Whistle

I’ve spent time in many countries that are drifting toward a darker trajectory; more surveillance, more centralization, more control, more violence. What’s happening in El Salvador feels like the opposite: safety without oppression, structure without suffocation, freedom with responsibility. After decades of oppression by violent gangs, Salvadorans feel liberated. You can see it in their faces, they’re kind, relaxed and grateful. On a previous trip, I saw a 75-year-old man cycling through El Zonte at sunrise, whistling. “When do people whistle?” I asked myself. “Happy people whistle. People whistle when they feel safe”. That simple moment became my quiet metaphor for this place.

Yes, the country still interfaces with global institutions such as the IMF. The recent repeal of bitcoin as a legal tender was unfortunate, but after peeking under the hood, it feels like one step back, four steps forward. Indeed progress is uneven. But the direction is unmistakable: a push toward monetary sovereignty, digital sovereignty, educational sovereignty, and civic sovereignty, all moving in the same direction.

This week gifted me with a glimpse into a nation rebuilding itself.

While most other nations struggle with their economy, security, frail social fabric under the influence of global agendas, El Salvador is transforming its reality, moving into a new timeline.

And meeting Bukele didn’t feel like meeting a president.

It felt like meeting the architect of a country determined to liberate itself and lead the way.

This is a guest post by Efrat Fenigson. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

This post El Salvador: The Making of a Sovereign Nation first appeared on Bitcoin Magazine and is written by Efrat Fenigson.

You May Also Like

World Liberty Financial Price Outlook: Can WLFI Reach $0.075 in 2026?

e-Hailing drivers kick as Bolt introduces cheaper ‘Wait and Save’ ride category