Trading time: BTC bull market score hits a two-year low, and the layout of multiple ETF products is accelerating

1. Market observation

Keywords: BNB, ETH, BTC

The BSC ecosystem remains strong. He Yi began to promote the ecological Meme project. Influenced by his comments and attention, the Meme coins BUBB and TAT on the Binance chain have become popular recently. At the same time, the internal competition of the Solana ecosystem has intensified. Pump.fun launched the native decentralized exchange PumpSwap, and Raydium is also developing the Meme coin issuance platform LaunchLab.

In terms of the market, BTC has recently moved in a similar direction to the stock market, fluctuating around $85,000. The latest data from CryptoQuant shows that the Bitcoin bull market score index has dropped to its lowest point in two years, at only 20, down 23% from its peak. Historical data shows that a strong rebound will only occur when the index is above 60, and the continued downturn in the current index may indicate the formation of a bear market trend. From the perspective of institutional trading, the Greeks.live report shows that large transactions are mainly concentrated in the Bitcoin options market, with a buy risk reversal transaction of up to $33.4455 million, indicating that institutional investors are actively deploying to hedge downside risks. From the perspective of community reactions, Chinese and English investors also have different views on the market outlook. Some investors are closely watching the important level of $83-85K, and some traders expect Bitcoin to rise briefly before the continued volatility. There are even radical views predicting that Bitcoin may rise to $444,000. BitMEX co-founder Arthur Hayes recently expressed the view that Bitcoin may have formed a stage bottom at $77,000. However, he also reminded investors to remain flexible and hold sufficient cash, as the stock market may need further adjustments, which often affect the trend of the cryptocurrency market.

The SEC recently made an important decision, determining that PoW mining activities do not constitute securities issuance. At the same time, NYSE Arca has submitted an application to the SEC for changes to the Bitwise Ethereum ETF pledge rules. Robert Mitchnick, head of digital assets at BlackRock, said that the Ethereum ETF has performed mediocre since its launch in July last year, mainly due to the problem of not being able to obtain pledge income. In addition, Ripple CEO expects to launch the XRP ETF by the end of 2025, while Bitnomial announced the launch of the first XRP futures product in the United States regulated by the CFTC.

At the macro level, QCP Capital analysis pointed out that the Fed's decision to reduce the quantitative tightening (QT) program from April provided an important upward catalyst for the market, which was one of the important factors that pushed the price of Bitcoin above $85,000. However, considering the Fed's expected three interest rate cuts in 2025 and the current differentiation of market sentiment, traders need to pay special attention to the performance of price support levels and do a good job of risk management. At the same time, retail investor sentiment remains cautious. The latest survey of the American Association of Retail Investors (AAII) shows that bullish sentiment is only 21.6%, far below the historical average of 37.5%, while the bearish ratio is as high as 58.1%, which has remained above 57% for the fourth consecutive week.

2. Key data (as of 13:30 HKT on March 21)

-

Bitcoin: $84,384.27 (-9.82% year-to-date), daily spot volume $24.648 billion

-

Ethereum: $1,972.88 (-40.89% year-to-date), with a daily spot volume of $13.189 billion

-

Fear and corruption index: 31 (fear)

-

Average GAS: BTC 2 sat/vB, ETH 0.44 Gwei

-

Market share: BTC 60.6%, ETH 8.6%

-

Upbit 24-hour trading volume ranking: XRP, AUCTION, BTC, VANA, LAYER

-

24-hour BTC long-short ratio: 0.9818

-

Sector gains and losses: SocialFi sector rose 3.25%, RWA sector rose 2.48%

-

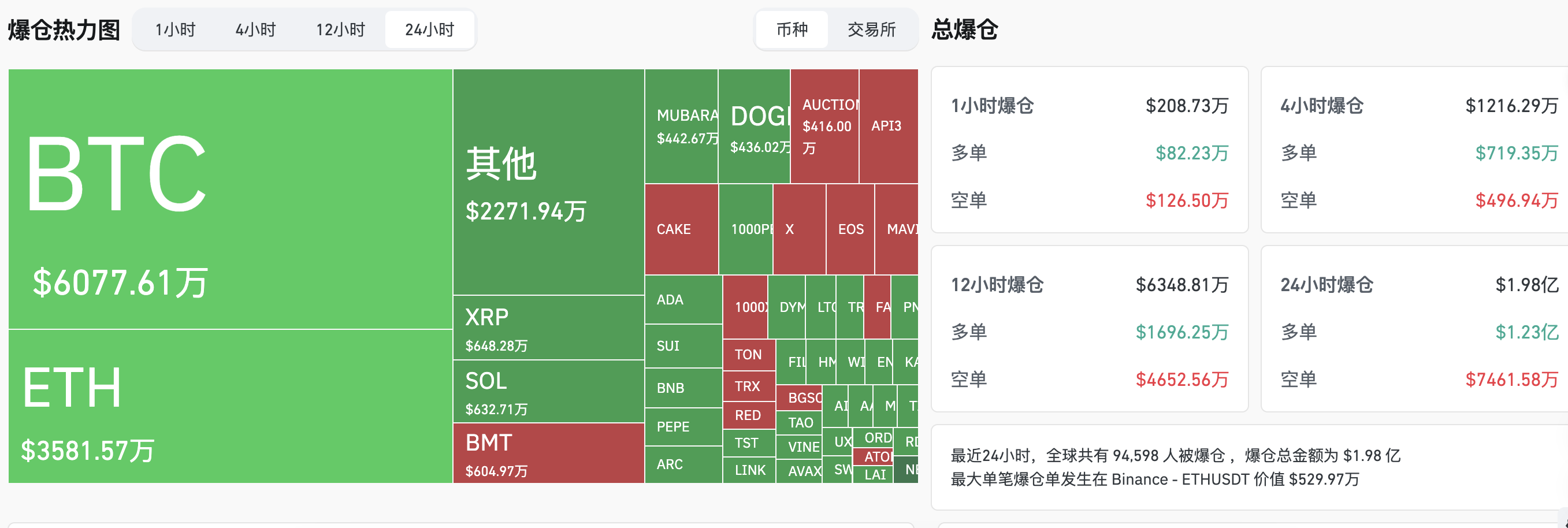

24-hour liquidation data: A total of 83,084 people were liquidated worldwide, with a total liquidation amount of US$191 million, including BTC liquidation of US$64.04 million and ETH liquidation of US$33.12 million

3. ETF flows (as of March 20 EST)

-

Bitcoin ETF: $166 million

-

Ethereum ETF: -$12,409,300

4. Today’s Outlook

-

Binance Launchpool will list Nillion (NIL) and will launch NIL spot trading pairs on March 24

-

Binance will launch 6 perpetual contracts including TUT/USDT and BID/USDT, with a maximum leverage of 25x

-

Starknet is about to start voting for STRK Staking V2 and plans to launch the testnet in a few weeks

-

The first roundtable meeting of the SEC’s cryptocurrency working group will be held on March 21

-

Binance Supports BinaryX (BNX) Rebranding and Token Swapping to Four (FORM)

-

BNB Chain: TVL incentive program extended for 1 month, deadline is March 21

-

South Korean gaming company Wemade's WEMIX token performance bonus dispute lawsuit will proceed to the next debate

-

Ethereum Foundation extends application deadline for 2025 academic grant program to March 23

-

Immutable (IMX) will unlock 24.52 million tokens at 8:00 am Beijing time on March 21, accounting for 1.39% of the current circulation, with a value of approximately US$13.4 million;

-

SPACE ID (ID) will unlock 78.49 million tokens at 8:00 a.m. Beijing time on March 22, accounting for 18.23% of the current circulation, with a value of approximately US$19.3 million;

-

MANTRA (OM) will unlock 5 million tokens at 8:00 am on March 23rd (Beijing time), accounting for 0.51% of the current circulation, with a value of approximately US$32.8 million;

-

Murasaki (MURA) will unlock 10 million tokens at 8:00 am on March 23rd (Beijing time), accounting for 1.00% of the current circulation, with a value of approximately US$7.4 million;

The biggest gainers in the top 500 by market value today: Orca (ORCA) up 67.54% in 24 hours, Bone ShibaSwap (BONE) up 28.10%, X Empire (X) up 23.78%, Vana (VANA) up 19.32%, LayerZero (ZRO) up 18.49%

5. Hot News

-

Deputy Director of the National Finance and Development Laboratory: Bitcoin is a peculiar financial asset

-

Bithumb to List Pax Gold (PAXG) in Korean Won Market

-

A trader turned $304 into $482,000 by trading BUBB tokens, with a return rate of 1,586 times

-

BlackRock’s head of digital assets: Approval for staking would be a “huge leap” for Ethereum ETFs

-

A whale/institution that held ETH for 8 years transferred 34,000 ETH to Coinbase and earned 44 times the profit

-

YZi Labs Announces Jane He as General Partner to Lead Biotech Investments

-

NYSE Arca applies to the US SEC to add staking functionality to the Bitwise Ethereum ETF

-

Coinbase adds ALT, PENDLE and L3 to its listing roadmap

-

Tether to become seventh-largest holder of U.S. Treasuries in 2024, surpassing countries like Canada and Norway

-

US SEC says proof-of-work mining does not involve securities laws

-

Coinbase Adds Freysa (FAI) to Its Asset Roadmap

-

Canary has filed its S1 form for the PENGU ETF

-

Walrus Protocol Announces Token Economic Model: 10% for Walrus User Airdrops

-

Telegram-based TON Foundation raises over $400 million in token sale

-

ZachXBT: “Hyperliquid High Leverage Whale” may be the fraudster William Parker

-

Binance Alpha has added BR (Bedrock)

-

Telegram’s monthly active users exceeded 1 billion, helping BOMBIE become the top mini-game in TON ecosystem revenue

-

Binance Launchpool will list Nillion (NIL) and will launch NIL spot trading pairs on March 24

-

Binance will launch 6 perpetual contracts including TUT/USDT and BID/USDT, with a maximum leverage of 25x

-

The balance of the SHELL market maker's public repurchase address has reached 19.95 million tokens, which means that 74% of the repurchase progress has been completed.

-

Binance launches first round of voting for listings, with the first batch of voting pools specifically for BNB chain-based tokens

-

UNI Token Holders Approve $165.5 Million in New Foundation Funding, Laying the Groundwork for “Fee Switch”

You May Also Like

Venice Token Jumps 50% as Trading Volume Hits $55M: What’s Behind VVV Rally?

Venice Token Surges 50% in 24 Hours: Data Behind VVV’s Meteoric Rise