HYPE Price Drop Triggers Major Whale Loss

- HYPE price drop affects large investor positions significantly.

- Analyst commentary highlights market reaction.

- Broader crypto market shows cautious sentiment.

The claim of a whale’s $15.3 million floating loss in HYPE is not backed by primary sources. Observations show HYPE’s price at multi-month lows, with on-chain metrics not specifying any individual losses.

The notable decline in HYPE’s value has sparked concern among investors, highlighting vulnerabilities in large leveraged positions. Some market analysts speculate further downside may pressure broader crypto sentiment.

Market Overview

The decline in HYPE, used widely on the Hyperliquid exchange, correlates with a broader market lull. The token’s drop to the $26-27 range has impacted investor sentiment, with analysts watching for potential support levels.

Investor Concerns and Risk Analysis

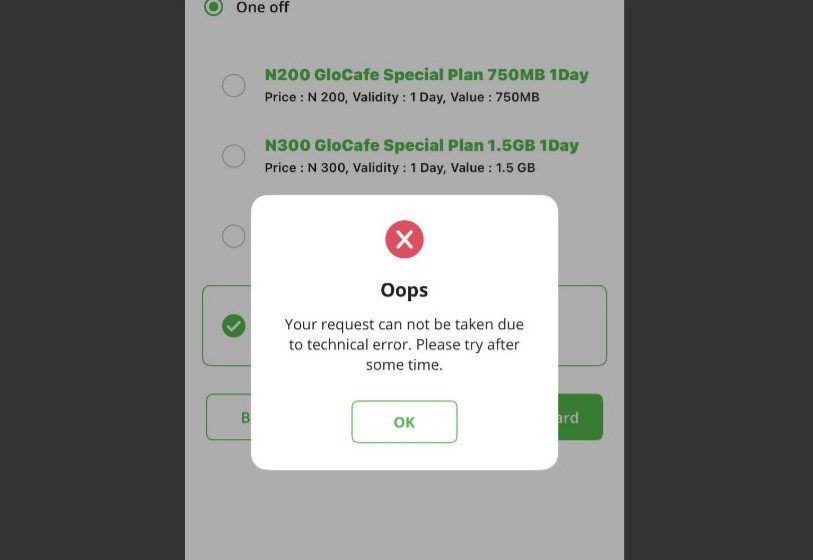

Large investors and analysts have raised concerns regarding potential liquidation risks in leveraged positions, as HYPE’s price remains depressed. Hyperliquid, a decentralized exchange, is seeing cautious trading amid these market conditions.

Recent analysis from CoinMarketCap indicates the crypto market faces mounting pressures, with HYPE’s decline aligning with a general risk-off sentiment. Bitcoin and Ethereum see reduced trading volumes as investors examine market positions.

On-chain data shows strong correlation with prior declines, suggesting potential further impacts if HYPE continues its descent. Analysts point out similarities to past market trends where high leverage increases downside risk.

Regulatory and Future Outlook

The evolving situation emphasizes attention on regulatory scrutiny and exchange stability, especially in decentralized finance systems like Hyperliquid. The outcome could impact investor strategies and future protocol upgrades crucial for market resilience.

You May Also Like

XRP Prints 707,000,000 in 24 Hours: Is This Enough?

XRP Price Prediction: Target $2.29 Resistance Break Within 7 Days for Move to $2.70