Hype to utility tokens: Why some altcoins survive bear markets

Bear markets strip away speculation, allowing utility tokens with real demand, strong development, and sustainable economics to survive while hype-driven tokens fade.

- Hype-driven altcoins collapse as speculative capital exits.

- Utility creates consistent, non-speculative demand during downturns.

- Strong development and tokenomics drive long-term survivability.

Bear markets are often described as periods of destruction for the crypto sector, but in reality, they serve as powerful filters. While many tokens disappear as speculative capital exits the market, a smaller group of altcoins continues to build, attract users, and retain relevance. The difference between those that survive and those that fail often comes down to one factor: utility.

Understanding why some altcoins endure bear markets provides valuable insight into long-term market structure and helps distinguish sustainable projects from short-lived hype cycles.

The rise and fall of hype-driven tokens

During bull markets, capital flows freely into narratives. Token rallies do not occur because of adoption or usage, but because tokens align with trending themes such as memes, AI, gaming, or layer-2 scaling. In these conditions, price appreciation itself becomes the primary driver of demand.

Bear markets reverse this dynamic. As liquidity dries up, speculative demand collapses. Tokens that rely purely on hype lose volume, attention, and ultimately relevance. Without real users or use cases, there is no natural demand to support price once speculation fades.

This is why many altcoins never recover after a major downturn. They were designed to perform well in bullish conditions but lack the foundations needed to survive periods of contraction.

Utility creates baseline demand

Altcoins that survive bear markets typically provide ongoing utility that generates consistent demand regardless of price trends. This includes projects involved in decentralized finance infrastructure, data oracles, payments, security, or real-world asset integration.

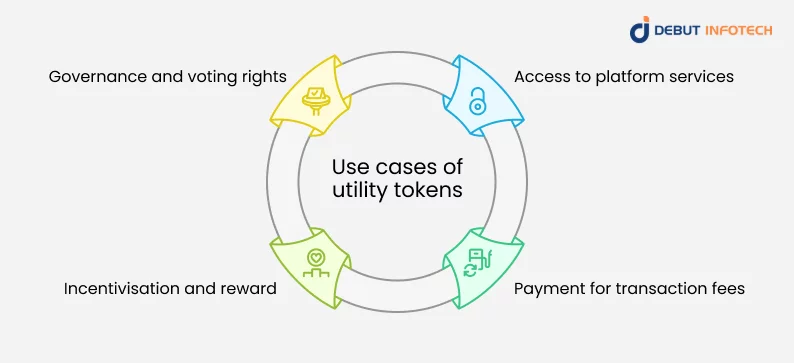

When users rely on a network for transactions, data, or services, demand becomes structural rather than speculative. Even if token prices fall, usage can continue, allowing projects to maintain relevance and liquidity through difficult market conditions, a core principle behind how utility tokens work and why they matter.

This baseline demand is critical. It stabilizes price action, reduces volatility, and attracts long-term participants who are less sensitive to short-term price movements.

Developer activity and ecosystem growth

Another key factor separating survivors from failures is developer commitment. Bear markets tend to slow development across the industry, but strong projects continue shipping updates, expanding ecosystems, and improving infrastructure.

Consistent development during downturns positions altcoins to outperform once market conditions improve. When liquidity returns, capital often flows first into projects that demonstrated resilience and progress during the bear market.

Ecosystem growth, including partnerships, integrations, and user adoption, also plays a major role. Projects that remain active and relevant during bearish conditions are better equipped to capture demand during the next expansion phase.

Tokenomics and long-term incentives

Sustainable token economics further increase survivability. Altcoins with excessive inflation, weak incentive structures, or poorly designed emissions often struggle during bear markets, as selling pressure overwhelms demand.

In contrast, projects with controlled supply dynamics, real fee generation, or mechanisms that align token value with network usage are better positioned to endure prolonged downturns.

Bear markets expose these weaknesses quickly, forcing inefficient designs out of the market.

What to expect in the coming cycles

As crypto matures, bear markets will continue to separate speculation from substance. While hype-driven tokens may dominate headlines during bull runs, utility-driven altcoins are far more likely to survive downturns and lead the next cycle.

For long-term participants, bear markets are less about fear and more about identifying which projects continue to build when attention fades.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

Wintermute Pumps Millions into Bitcoin Spot Ahead of the Fed Report Release