Hyperliquid Price Rises 3% as HYPE Bulls Eye $30 Breakout

Highlights:

- The Hyperliquid price has increased by 3% to trade at $29 mark today.

- The derivatives open interest shows decreasing momentum, as investor confidence slips.

- The technical outlook shows mixed signals as Hyperliquid price eyes the $30 zone.

On Friday, Hyperliquid (HYPE) price has soared by about 3% to trade at $29.27 mark today. The recent recovery, however, shows a staggering market confidence in the sense that Open Interest in HYPE futures is losing value. Often, this is a sign of risk-off sentiment among the investors. HYPE bulls are facing a cushion against further upside at around $30 as a short-term spur in the expansion of bullish energy, hints of a possible breakout.

Hyperliquid also has a weakness of losing investor confidence on a short-term basis due to the wider pressure in the cryptocurrency market. After the release of HIP-3 that provided the trading of tokenized commodities based on futures trading on the Decentralized Exchange, the market is waiting for the release of HIP-4.

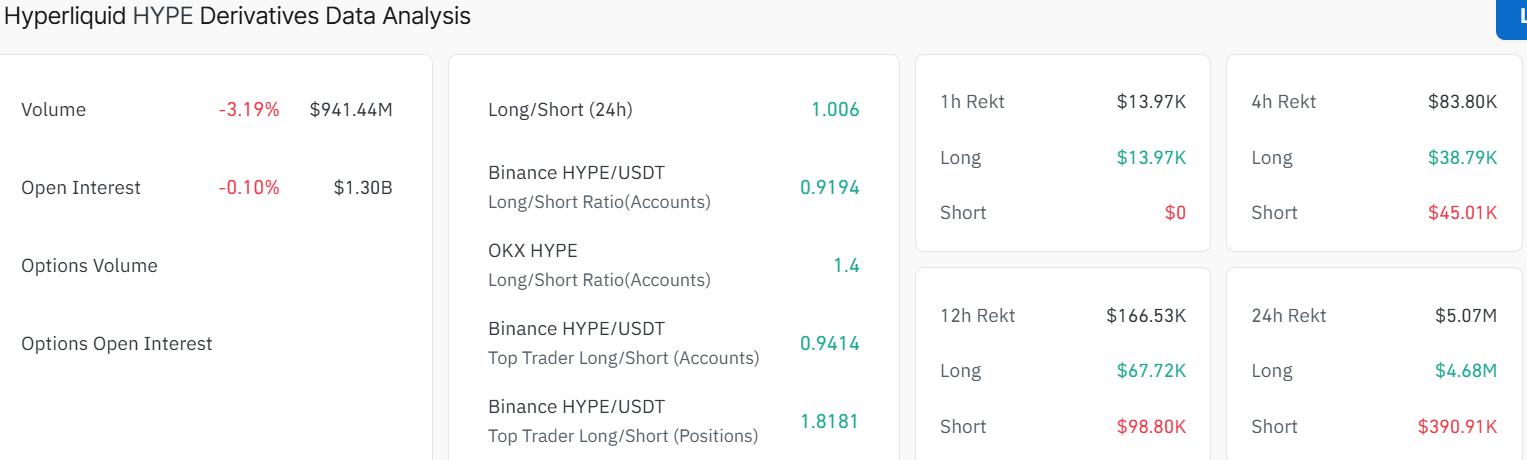

Meanwhile, the HYPE futures market’s inability to maintain a bullish grip is sparking a drop in retail demand. According to derivatives data, on Friday, the HYPE Open Interest (OI) was at $1.30 billion, marking a 0.10% decrease in a day. With the continued liquidation of positions, the indicator indicates that there is a decreased risk appetite. Moreover, the volume has also dropped by about 3.19% to $941 million, indicating that investor confidence has decreased.

Hyperliquid Derivatives Analysis: Coinglass

Hyperliquid Derivatives Analysis: Coinglass

Hyperliquid Price Eyes a Breakout Above $30

The HYPE/USD 4-hour chart shows the price is trading around $29.17 with a recent bounce from the 200-day Simple Moving Average at $29. This indicates building momentum, only if the bulls keep the energy alive. The Hyperliquid price has entered a medium-term consolidation zone, within a falling channel. It is currently facing resistance by the 50-day SMA at $30.22. The RSI at 47.18 sits in neutral territory, but with potential to move to the upside. In the meantime, there is a mixed sentiment in the market, as the bulls and bears aim to take control.

HYPE/USD 4-hour chart: TradingView

HYPE/USD 4-hour chart: TradingView

Looking ahead, the $30 resistance aligning with the 50-day SMA is the next big test for the HYPE bulls. If the Hyperqliquid price smashes through, it could surge toward the $33-$38 psychological level. However, a drop below the $29 floor could spell trouble, potentially sliding back to $28-$27 if the bears take over.

The chart’s momentum, with the daily trading volume picking up by 7%, reinforces a potential upside. Notably, the 200-day SMA on the 4-hour chart is trending upward, giving the bulls strength to rally. However, with the crypto market wobbling, as seen by BTC sliding towards the $66,000 mark, traders should be cautious. This is because there might be a pullback to $29, where the support line holds strong. In the short term, HYPE could surge, hitting the $30 zone if the hype holds. However, for the long term, it is a wait-and-see strategy as there is mixed sentiment around the crypto market.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

Russia’s Central Bank Prepares Crackdown on Crypto in New 2026–2028 Strategy