Robert Kiyosaki Buys Another Bitcoin at $67,000 as BTC Price Shows Recovery Signs

Fear tends to grow louder when Bitcoin price slides toward key support. Recently, BTC price drifted toward the lower edge of a long rising channel near $60,000. Many expected hesitation but Robert Kiyosaki chose a different move.

Robert Kiyosaki posted that he bought one more whole Bitcoin at $67,000 even as Bitcoin was crashing. He shared two reasons for the decision. He believes a major wave of money printing will begin if US debt pressures the dollar.

He also pointed to Bitcoin’s fixed supply, noting that the 21 millionth Bitcoin is getting closer to being mined. He argues that once that limit is reached, Bitcoin becomes better than gold.

Robert Kiyosaki has repeated his concern about US debt and central bank policy for years. His latest Bitcoin purchase ties directly to that view. He expects what he calls the Big Print, meaning large scale expansion of the money supply. That outlook drives him toward scarce assets.

Bitcoin stands apart because of its hard cap of 21 million coins. No central authority can expand that supply. Each new Bitcoin enters circulation at a predictable pace. That scarcity narrative becomes stronger as the network moves closer to mining the final coins.

Gold has long been the hedge against currency weakness. Robert Kiyosaki now places Bitcoin in the same category, and in his view even above gold once issuance fully ends. His stance connects macro risk with digital scarcity. Bitcoin becomes his response to both.

Bitcoin Price Tests $60,000 Support Inside A Long Term Ascending Channel

The weekly chart shows Bitcoin price moving inside an ascending channel that has guided BTC price action for years. The lower boundary of that channel now sits near $60,000, which it hit 2 weeks ago. Each time Bitcoin touched that base in the past, a rebound followed.

Current price action shows BTC price once again near that lower trend line. The recent move down from above $126,000 to below $70,000 brought Bitcoin back to structural support. Candles near $60,000 to $65,000 show early signs of stabilization as buyers have stepped in near that level before.

BTC Price Chart

BTC Price Chart

Reversal signals appear on the chart, though clear bullish confirmation has not yet arrived. A strong weekly close above recent lower highs would strengthen the case for a new upward leg. Failure to hold the channel base could open deeper retracement levels. Structure still favors the long-term uptrend as long as Bitcoin stays inside that rising range.

Bitcoin price now sits at a technical crossroads. The $60,000 zone acts as both psychological and structural support. Holding that level keeps the ascending channel intact. Breaking below would challenge the broader bullish framework.

Read Also: Render (RENDER) Price Rebuilding Strength as AI Tokens Stabilize

Robert Kiyosaki appears less focused on short-term volatility. His decision at $67,000 shows conviction in Bitcoin’s supply mechanics and macro backdrop. Chart structure and macro narrative now meet at the same point.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

The post Robert Kiyosaki Buys Another Bitcoin at $67,000 as BTC Price Shows Recovery Signs appeared first on CaptainAltcoin.

You May Also Like

Metaplanet CEO Denies Hiding Details

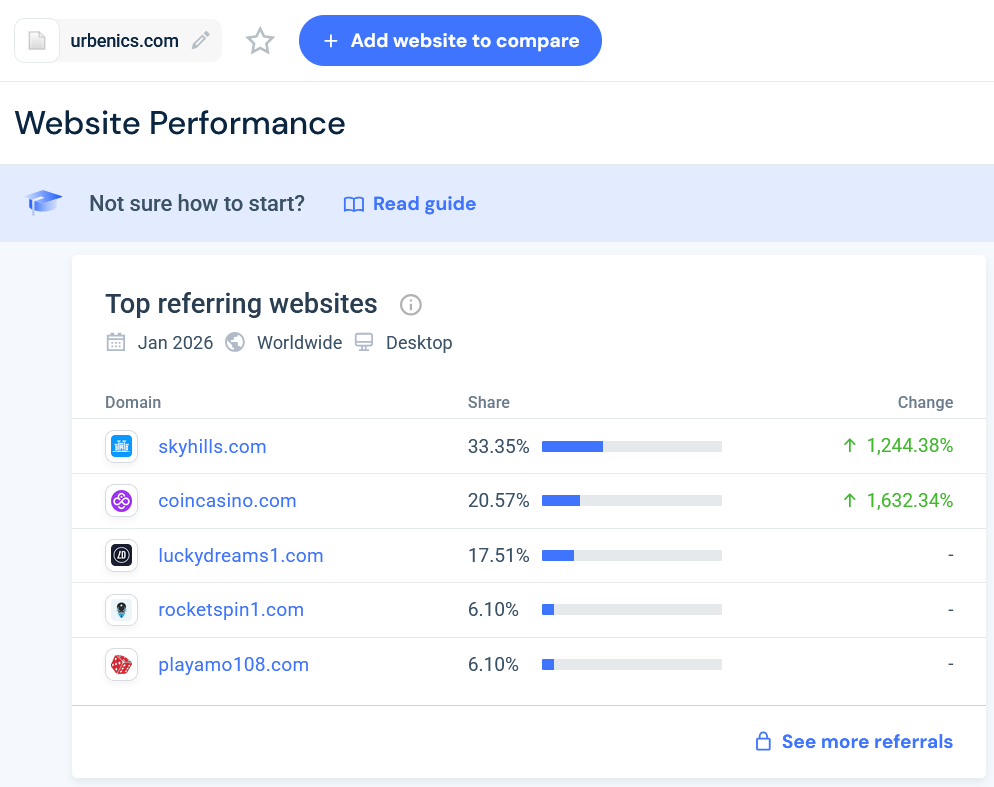

Shadows in the Payment Rail: The Urbenics.com Mystery