What Hyperliquid Traders Need to Do After the Hyperdrive Exploit

According to incident updates and on-chain traces, the Hyperdrive hack targeted two lending markets on Hyperliquid, resulting in approximately $782,000 in losses.

The attacker used an arbitrary call in the router to drain 672,934 USDT0 and 110,244 thBILL, then bridged funds to BNB Chain and Ethereum. Markets paused while the team investigated and outlined compensation steps.

Exploit Overview and Impact

The Hyperdrive hack focused on two venues: the Primary USDT0 Market and the Treasury USDT Market. Investigators described an arbitrary call path in the router that enabled repeated withdrawals. Funds moved out through deBridge and split across chains before consolidation.

Public posts indicate that money markets remain paused, a fix has been shipped, and a compensation plan is in progress, as noted in a breaking report.

Read More: Hyperliquid Price Hits $58.78 ATH as Open Interest Tops $10B

Why This Matters for Users

Router-level permissions can expose pooled assets if checks fail. Traces reveal how quickly value can shift once a route opens, with on-chain paths captured within the same incident coverage. This incident also lands after earlier security pain points in the same ecosystem, which keeps scrutiny high and raises the bar for audits and live risk controls.

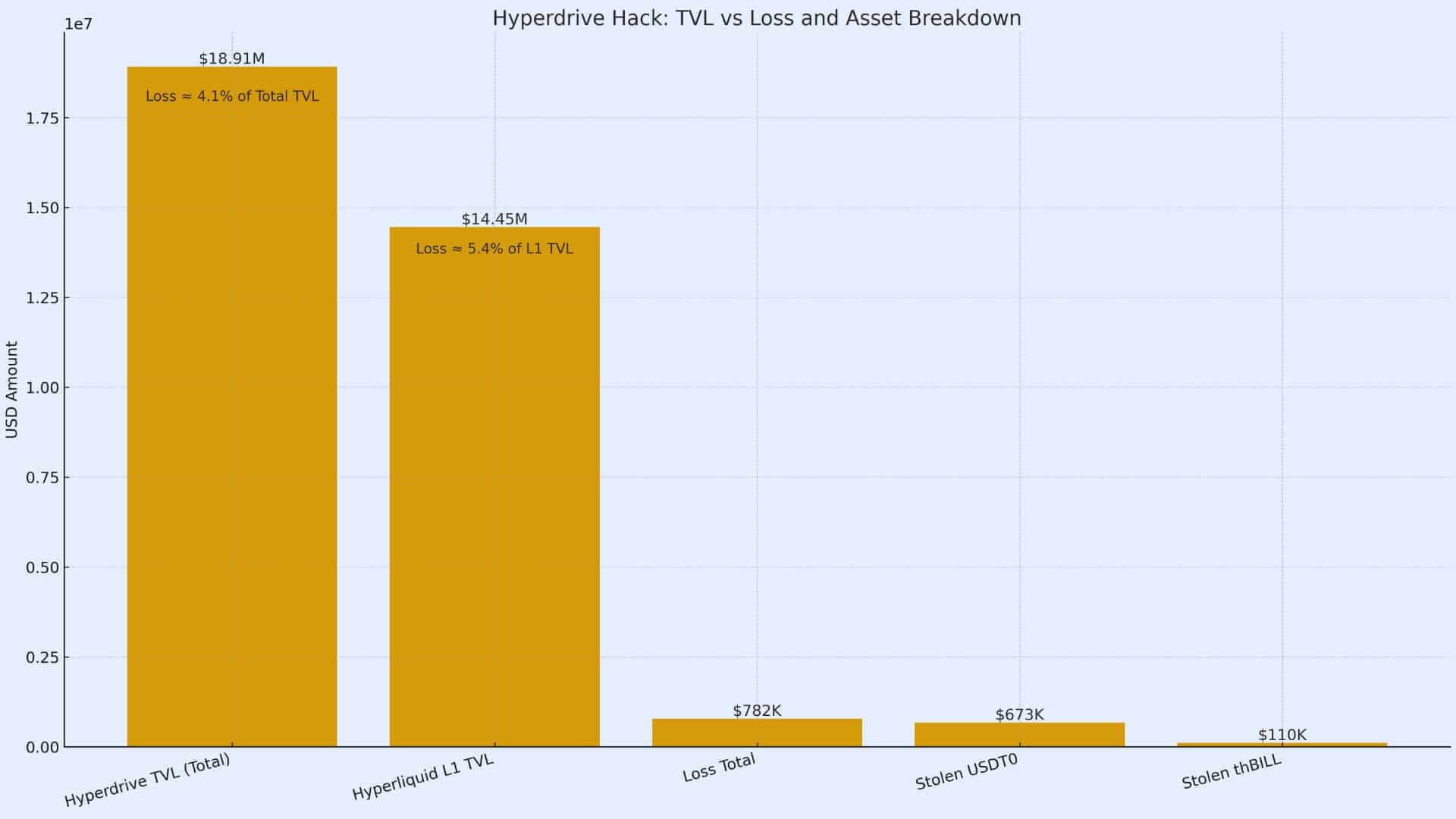

Hyperdrive Hack at a Glance: TVL vs Loss and Asset Breakdown

Hyperdrive Hack at a Glance: TVL vs Loss and Asset Breakdown

Price and TVL Context

Hyperdrive HL shows TVL about $18.91 million, with around $14.45 million on Hyperliquid L1, which frames the loss in scale terms. Check the live dashboard for current figures and chain splits.

As of September 29, 2025, HYPE trades near $47.4, based on a live ticker snapshot in recent coverage, while intraday moves remain volatile. Prices and TVL can fluctuate during active investigations, so confirm trusted dashboards and feeds before taking action.

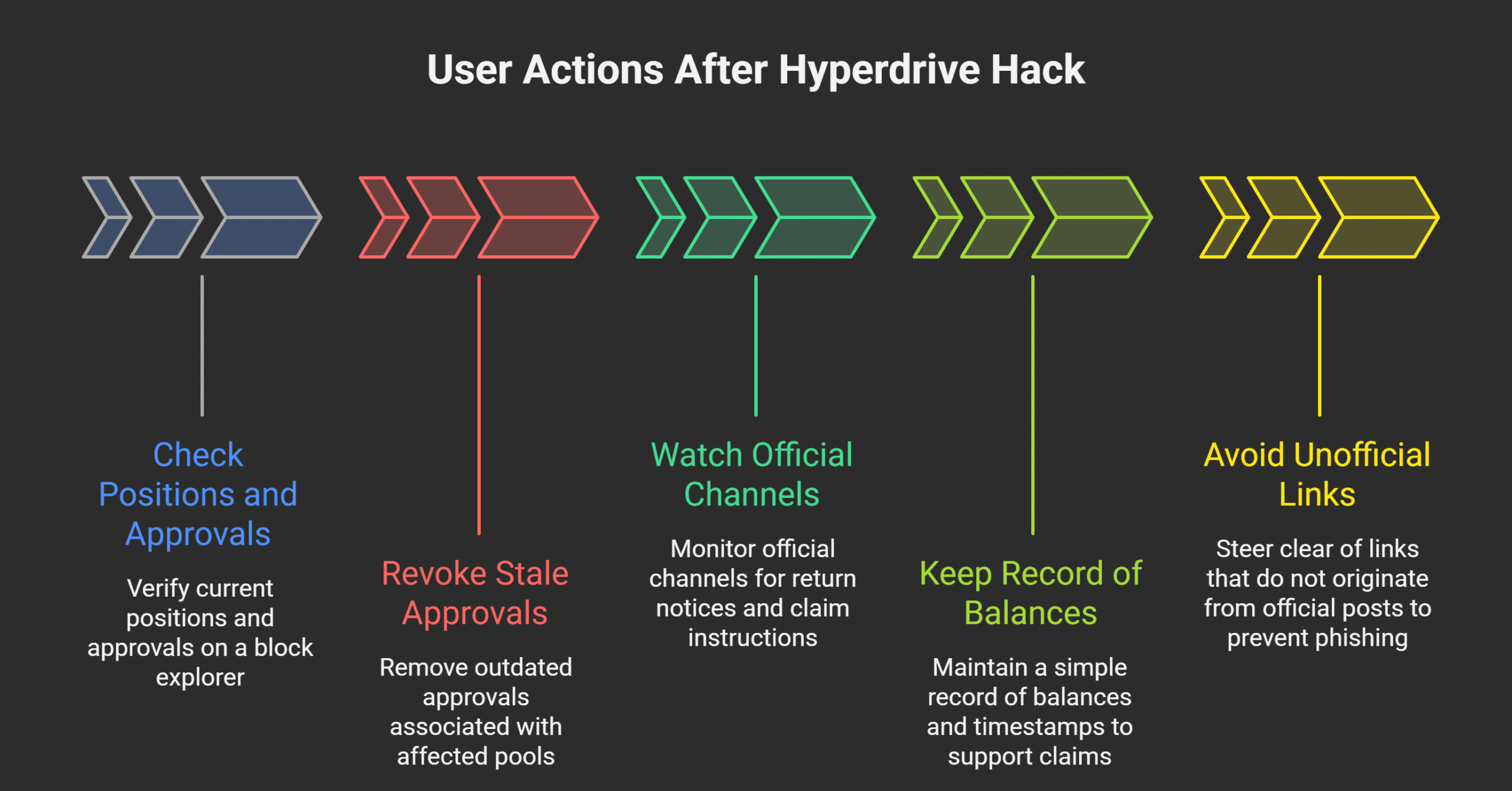

Action Steps for Users

Check positions and approvals on a block explorer. Revoke stale approvals associated with the affected pools. Watch official channels for return notices and claim instructions. Keep a simple record of balances and timestamps to support any claim. Avoid links that do not originate from official posts to reduce phishing risk. Key facts and flows remain consistent with this independent recap.

Conclusion and Next Moves

Based on the latest research, Hyperdrive hack analysis points to a router flaw, quick cross-chain movement, and a fast pause that limited further damage. The path forward depends on the full post-mortem, contract changes, and the final compensation process.

Users should avoid paused pools, review approvals, and follow official updates for reopen steps and claim windows, while tracking TVL and market state on DeFiLlama.

Also read: Crypto Price Prediction Today: XRP Gains Momentum, Hyperliquid and Pump Tokens Eye Breakouts

Summary

The Hyperdrive hack drained about $782,000 from two Hyperdrive markets on Hyperliquid via an arbitrary router call, then bridged funds to BNB Chain and Ethereum. Markets paused, a fix shipped, and compensation is planned. The Hyperliquid hack discussion continues with on-chain updates and TVL context. Users should verify approvals, keep records for claims, and follow official recovery notes until operations resume.

Glossary of key terms

Arbitrary call: a bug that lets a contract execute unintended functions.

Router: a contract that forwards calls and swaps between pools.

thBILL: tokenized Treasury bill exposure used as collateral.

Bridge: infrastructure that moves assets between chains.

TVL: total value locked in a protocol.

FAQs about Hyperdrive Hack

Is the Hyperdrive hack over?

Markets remain paused while a fix is live and a compensation plan is prepared.

Did the Hyperliquid hack touch exchange reserves?

No. Current reports limit impact to two Hyperdrive lending markets, with exchange reserves and core trading operations unaffected.

Where did funds go after the Hyperdrive hack?

Stolen assets were bridged via deBridge to BNB Chain and Ethereum, then consolidated into receiving addresses on those networks.

What should the BILL users do after the Hyperliquid hack?

Check positions and revoke stale approvals on affected pools, then wait for official reopen and compensation instructions.

Read More: What Hyperliquid Traders Need to Do After the Hyperdrive Exploit">What Hyperliquid Traders Need to Do After the Hyperdrive Exploit

Ayrıca Şunları da Beğenebilirsiniz

XRP gaat multichain: 5 inzichten uit Ripple’s strategie op Solana Breakpoint

Market Direction and Use Case Comparison for 2026 –