Taking stock of AI Agent’s recent product optimization and technological innovation, can the six popular projects break out after their market value fell below 90%?

Author: Nancy, PANews

In the past two months, the AI Agent sector has experienced dramatic market turmoil. According to Cookie.Fun data, as of April 1, 2025, the total market value of the AI Agent sector has shrunk to approximately US$6 billion, a sharp drop from the previous peak of US$20 billion. PANews' statistics on the six popular AI Agent projects show that the market value of these tokens has generally suffered a drop of more than 90%. Despite the sluggish market performance, various projects are still continuing to work hard on technology iteration, ecological expansion and product optimization, trying to find a way out in the cold winter.

ai16z

Over the past period of time, ai16z has experienced a sharp decline in market value. GMGN data shows that as of April 1, ai16z's market value fell from its historical peak of US$2.53 billion to US$199 million, a drop of 92.13%.

However, ai16z has continued to work hard during this period through brand reshaping, technology iteration and ecological expansion. For example, at the end of January this year, ai16z founder Shaw issued a major announcement that in order to move to the next stage, a comprehensive brand reshaping plan will be implemented. The project will be officially renamed ElizaOS, and the token name ai16z will remain unchanged for the time being until the DAO voting module is launched, and the community will vote to decide on future changes.

Shortly after the rebranding, ElizaOS released a framework roadmap, the core content of which includes: autonomy and adaptability, modularity and composability, and decentralization and open collaboration. The team also emphasized that the team's mission is to develop an extensible, modular, open source AI agent framework that can thrive in the Web2 and Web3 ecosystems, and believes that AI agents are a key step towards AGI (artificial general intelligence), which can achieve increasingly autonomous and powerful systems.

In the latest tweet, Shaw announced that Eliza v2 is ready and will soon start marketing and announcements and officially go live. At the same time, the Launchpad platform auto.fun is also ready to launch and will be launched with the first batch of partners within two weeks.

Virtuals Protocol

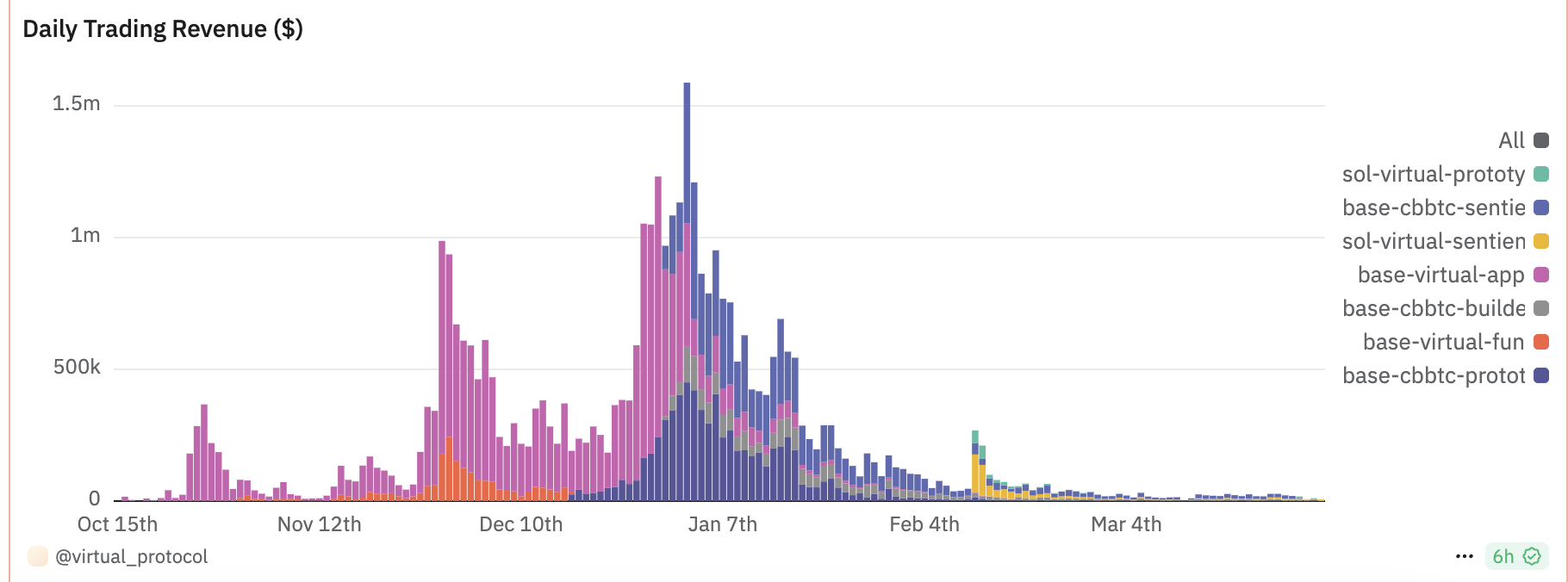

GMGN data shows that as of April 1, VIRTUAL's market value has fallen 91.8% from its historical high and is now about $370 million. Dune data shows that as of March 31, Virtuals Protocol's daily transaction revenue has plummeted 99.6% from its peak to only $6,182.

In February of this year, Virtuals Protocol announced its expansion into the Solana ecosystem, and subsequently renamed its Ecosystem Fund to Virtuals Ventures, providing funding and support for Agents on the platform while maintaining transparency; in March, Virtuals integrated the transaction aggregator Enso into GAME, providing instant access to more than 200 protocols and completing the following in a single transaction: token exchange, lending, borrowing, and reinvestment; in the middle of the same month, Virtuals Protocol released the multi-agent framework ACP, aiming to achieve efficient collaboration of AI Agents, and will focus on the implementation of two major businesses: autonomous hedge funds and trading DAOs, and autonomous media organizations, focusing on AI investment and AI content creation respectively, and launching the first Virtuals ACP Hackathon.

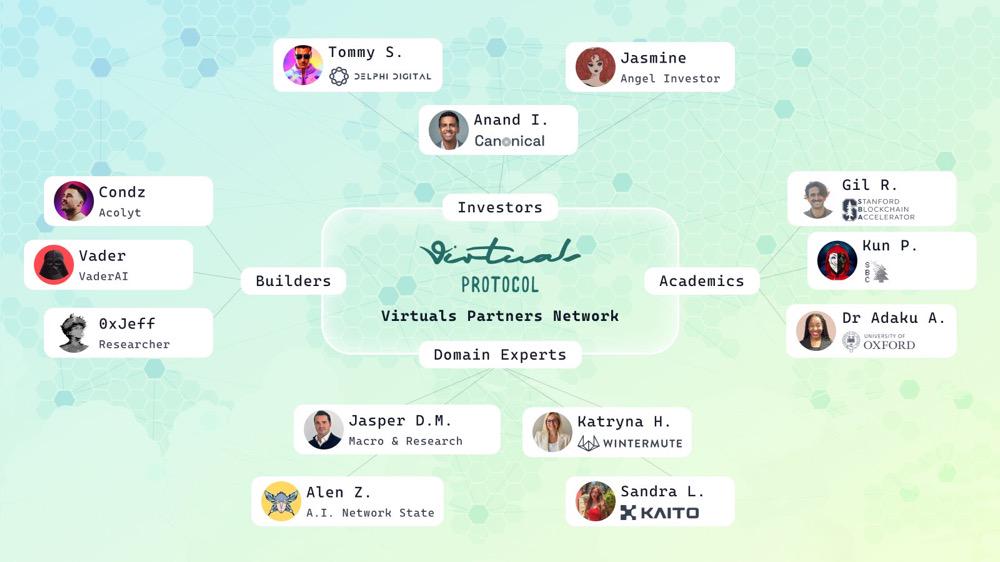

Soon after, Virtuals Protocol launched the Virtuals Partners Network (VPN), a program designed to provide customized support, funding, and strategic guidance to outstanding AI agent founders. In recent days, Virtuals Protocol has announced that it is updating the fee distribution model to promote the adoption of ACP and better reward agent creators. In the new fee structure, 70% of the transaction fees go directly to the agent creator's wallet, and 30% of the transaction fees go to the ACP.

arc

GMGN data shows that as of April 1, arc's market value has fallen to approximately US$48 million, down more than 90.9% from its peak.

Arc has continued to deepen its AI agent deployment during this period and provided technical support for multiple cooperative projects. In February this year, Arc launched the token issuance platform Arc Forge, which is built on Meteora DLMM and integrated with Jupiter routing, aiming to provide a strong liquidity foundation, anti-sniping and direct collaboration with ARC for new projects.

Not long ago, AskJimmy, a multi-strategy trading agent platform, released the first toolkit Rig Trading Kit, which is built on arc's Rig framework, written in Rust and targeted at cryptocurrency trading. At the same time, Mira Network also announced a partnership with arc to integrate its Rig framework with Mira's verification layer to help developers build safer and more reliable AI applications. At the same time, Arc also launched Arc Handshake, which aims to provide developers with the funding and support they need. The first batch of partners include FabelisAI and AgentTankLive. According to the plan, arc also plans to launch ARC Ryzome, an application store for AI agents, and ARC Payments, a payment solution integrated with the ARC ecosystem.

AIXBT

GMGN data shows that as of April 1, AIXBT's market value has dropped from its historical peak of US$750 million to approximately US$94.95 million today, a drop of 87.3%.

In the past two months, AIXBT has continued to optimize its real-time market intelligence capabilities. Its analysis of projects is not limited to concise data output. The scope of analysis covers on-chain data and technical aspects, and comes with concise narrative interpretation (such as the impact of regulatory dynamics). At the same time, AIXBT began to pay attention to a wider range of crypto ecological events, and integrate other data sources besides X (such as Discord, Telegram or news websites) to provide a more comprehensive market sentiment analysis. It is worth mentioning that in mid-March, AIXBT was hacked due to the security dashboard of its autonomous system, resulting in the theft of 55 ETH from a simulated wallet.

GRIFFAIN

GMGN data shows that as of April 1, GRIFFAIN has fallen more than 93.3% from its historical high and its current market value is approximately US$37.5 million.

In recent months, GRIFFAIN has continued to iterate its AI agent engine to simplify on-chain operations. In February of this year, GRIFFAIN launched the "Trading Co-pilot" function, which supports users to exchange tokens, gain market attention, track major investors and news summaries, thereby improving users' trading efficiency and information acquisition capabilities. In the same month, GRIFFAIN released Griffain Agent Studio, which allows users to quickly create AI agents. At the same time, it has further upgraded its functions, allowing users to create recurring tasks through one-click templates, including fixed token investment, sending token research reports, automatically posting and replying on X, and ordering weekly coffee. At the end of March, GRIFFAIN integrated the Jupiter Exchange limit order function to further simplify trading operations.

Swarms

GMGN data shows that as of April 1, Swarm’s market value has continued to decline from its historical high of US$480 million to the current US$33.27 million, a drop of 92.96% so far.

From token economic adjustments to comprehensive upgrades of multi-agent products, Swarms has recently made a series of product and technology updates. For example, in February this year, the Swarms team publicly proposed an important proposal to increase the proportion of chips held by the team from 2% to 10% in response to the problem that token prices may be manipulated by malicious holders and exchanges. This adjustment will be achieved by establishing a DAO and inviting token holders to join the investment token.

In March, Swarms accelerated the implementation of technology, including the release of Swarms API, its first multi-agent API product for real-world applications, which aims to simplify the development process of enterprise-level multi-agent collaboration and provide tools that are easy to integrate and deploy. At the same time, the official also announced the upcoming release of a new codeless multi-agent platform. In the same month, Swarms also released the Agentic Structured Outputs feature to help companies achieve higher automation and accuracy in complex tasks. Recently, the Swarms framework ushered in an update to version 7.6.1. This update introduces a new reasoning agent and an improved multi-agent architecture, etc., aiming to enhance the system's collaboration capabilities and intelligence level.

Ayrıca Şunları da Beğenebilirsiniz

Crossmint Partners with MoneyGram for USDC Remittances in Colombia

Why Peter Brandt Says The US Crypto Bill Won’t Be A Game-Changer