Bitcoin derivatives market forming ‘dangerous’ setup as hopes of a swift bounce fuel rapid leverage climb: K33

Bitcoin's derivatives market is flashing what research and brokerage firm K33 describes as a "dangerous" and structurally concerning pattern as traders add aggressive leverage into a deepening correction that pushed bitcoin down 14% over the past week to an intraday low of $89,183 on Tuesday — its weakest level since April.

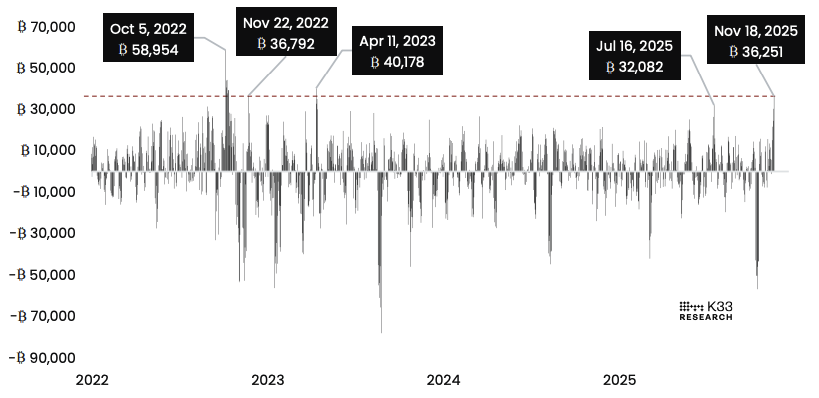

In a new report, K33 Head of Research Vetle Lunde said perpetual futures traders have expanded open interest by more than 36,000 BTC — the largest weekly growth since April 2023 — while funding rates have climbed, signaling "knife-catching" behavior rather than defensive positioning.

"The growing funding rates likely stem from resting limit orders being filled in hopes of a swift bounce with prices pushing below 6-month lows," he wrote. "However, no bounce has materialized, and now, this leverage represents excess overhang, increasing risks of amplified volatility driven by liquidations."

Because every long is matched with a short in monetary value, squeeze risk exists on both sides of the market, Lunde noted. Still, the rise in funding rates shows that more traders are competing for long exposure, increasing the vulnerability of those positions if prices continue lower, he said.

Open Interest 7-day change, BTC Perps. Image: K33.

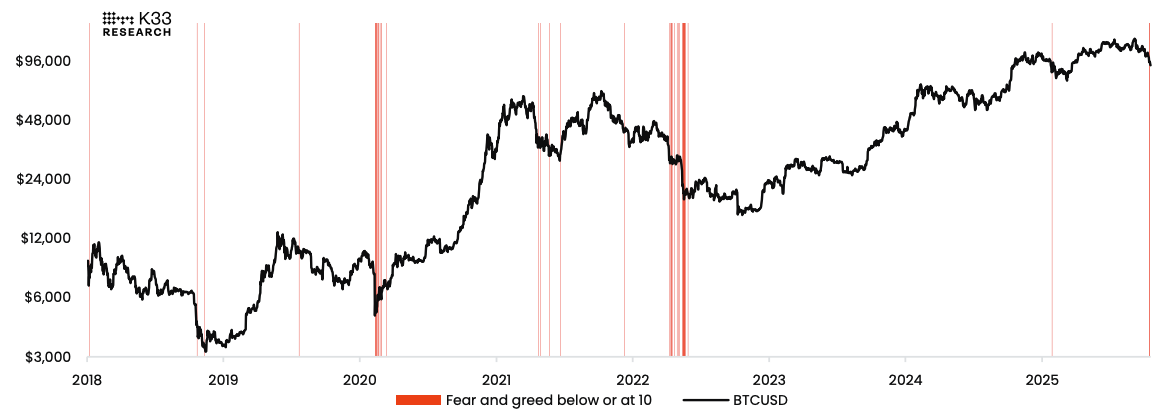

In contrast, CME futures premiums sit near yearly lows, and the term structure remains narrow, reflecting persistent risk aversion among institutional participants, according to K33. Lunde warned that such divergence has historically preceded negative price action ahead.

This "concerning" market structure statistically mirrors seven similar regimes over the past five years, he said, six of which saw continued declines over the following month, with an average 30-day return of -16%.

"While we have been vocally bullish in the early stages of this downtrend, we view this as a sufficiently dangerous omen, making the case for reducing overall risk."

BTC vs. Fear and Greed below 10. Image: K33.

Bitcoin has also faced a wave of ETF selling, with products losing 20,150 BTC over the past week and nearly 40,000 BTC over the past 30 days, the analyst noted. Six of the past seven ETF trading sessions have ended in outflows, including a 10,060 BTC single-day withdrawal on Nov. 13 — the fourth-largest daily outflow since the U.S. ETFs launched.

The selling further coincides with long-term holder distribution and weakness relative to tech stocks, Lunde added. Bitcoin's 30-day return is -14.7% versus the Nasdaq's -0.18%, even as correlations between the assets hit yearly highs.

A deep and steady drawdown

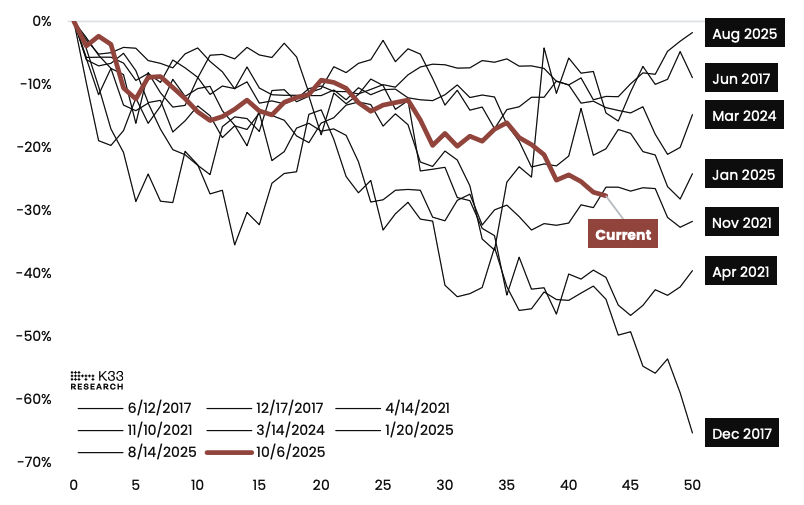

Lunde said that while the firm expects "rosier times ahead" amid accelerating institutional adoption and supportive monetary conditions, the present drawdown ranks among the most severe 43 days into a downturn since 2017.

K33 acknowledged that measuring 43-day returns is arbitrary and emphasized that it does not expect a repeat of the lasting bear cycles of 2018 and 2022. However, if the decline tracks the two deepest drawdowns of the past two years, it estimates a potential bottom between $84,000 and $86,000, with a deeper leg toward April's low and Strategy's average entry price of $74,433 if selling pressure intensifies.

First 50 days of all +50-day drawdowns in BTC since March 2017. Image: K33.

"Both levels are psychological areas eyeballed by many traders, and while a common misunderstanding is present that Strategy may become a forced seller with prices south of its cost basis, the level itself represents a potential area the market could chase," Lunde said.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Ayrıca Şunları da Beğenebilirsiniz

Egrag Crypto: XRP Could be Around $6 or $7 by Mid-November Based on this Analysis

Moto completes $1.8 million pre-seed funding round for its Solana eco-credit card project.