Bitcoin Bear Thesis Persists After New $93,500 Rejection

Cryptocurrency Markets React to U.S. Jobs Data Amid Federal Reserve Rate Outlook

Bitcoin experienced a decline from its 2025 yearly open amid significant market reactions to the latest U.S. employment figures. Despite robust job data suggesting a resilient economy, markets continue to anticipate a potential interest rate cut by the Federal Reserve as early as December. This divergence has led to a complex trading environment, with Bitcoin and other cryptocurrencies maintaining a cautious stance as key resistance levels loom.

Key Takeaways

- Strong U.S. labor market data did not deter expectations of a rate cut by the Fed in December.

- Cryptocurrencies are diverging from stock market trends, which are expected to see a strong finish in 2025.

- Bitcoin faces crucial resistance levels that must be reclaimed to shift from a bearish trend.

- Market participants remain divided on the future trajectory of interest rates, adding volatility to the space.

Tickers mentioned:

Crypto → $BTC, $ETH

Stocks → None

Sentiment: Neutral

Price impact: Negative. Bitcoin’s retreat reflects caution amid conflicting signals on rate hikes and cuts.

Market context: The ongoing debate over Fed policy continues to influence crypto market dynamics amid broader economic resilience.

Market Reaction to U.S. Employment Data

Data from St. Louis Fed revealed both initial and ongoing jobless claims fell below expectations, indicating ongoing strength in the U.S. labor market. Despite this robust data, markets speculate that the Federal Reserve will proceed with a rate cut at its upcoming December meeting, driven by the widening gap between risk assets and consumer spending.

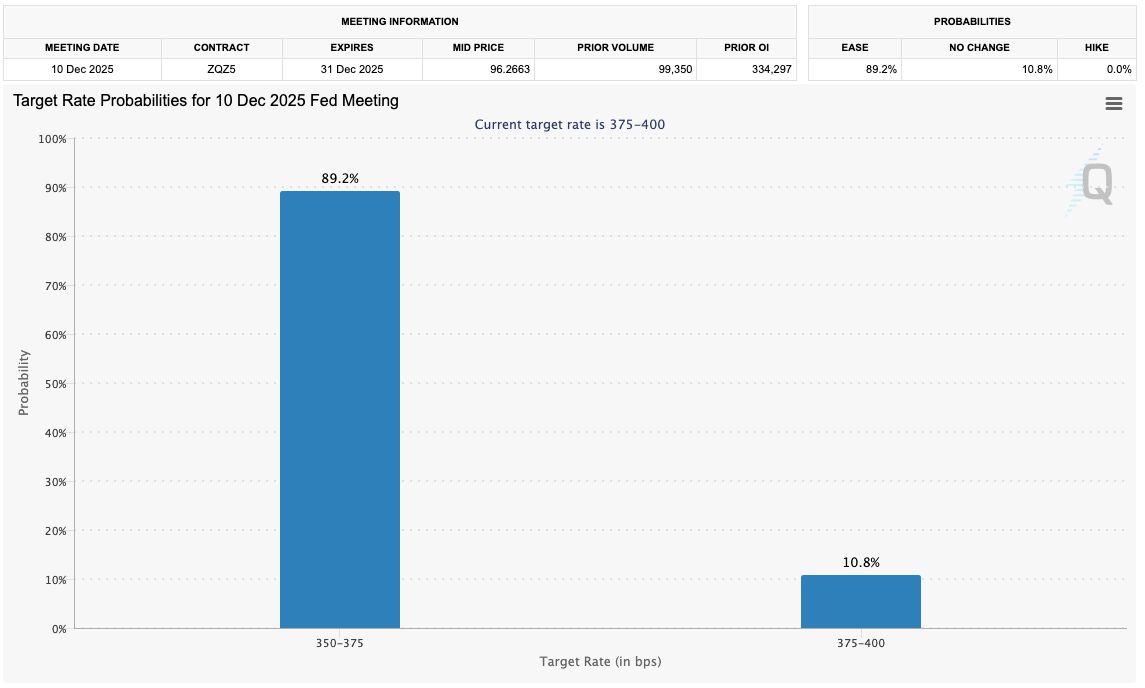

BTC/USD one-hour chart. Source: Cointelegraph/TradingViewThe anticipation of a rate cut is supported by market tools such as the CME FedWatch, which signals a growing probability of easing measures. However, economic analysis points to ongoing tension between inflation concerns, running at around 3%, and the desire to stimulate consumer activity through monetary policy.

Fed target rate probabilities for December 10 meeting. Source: CME Group FedWatch Tool

Fed target rate probabilities for December 10 meeting. Source: CME Group FedWatch Tool

Meanwhile, contrasting policies abroad, Japan’s central bank announced a substantial $135 billion stimulus—a move that adds to the global complexity of monetary policy. The country’s simultaneous rate hikes and stimulus injections highlight the fragmented nature of global economic strategies.

Japan’s 30-year bond chart. Source: The Kobeissi Letter/X

Japan’s 30-year bond chart. Source: The Kobeissi Letter/X

Analysis from Mosaic Asset Company warns that despite market optimism, the path of future rate cuts remains uncertain, with internal divisions creating potential volatility. Nonetheless, early signals suggest a favorable environment for a year-end rally in risk assets, including cryptocurrencies.

Bitcoin’s Bearish Outlook Persists

While the S&P 500 remains close to its all-time highs, Bitcoin and other altcoins continue to show signs of weakness. Resistance levels at around 96,000 to 98,000 dollars need to be cleared, including key moving averages and liquidity zones near 100,000 dollars. Market analysts caution that Bitcoin failing to retake the yearly open indicates the bearish trend remains intact, with key indicators such as RSI and order book liquidity pointing to continued caution.

Further, recent analyses emphasize that the inability of Bitcoin to surpass its beginning-of-year price has solidified the bearish thesis, casting doubt on a swift recovery in the near term. Market participants watch the resistance zones closely, awaiting confirmation of a potential reversal or continuation of the current downtrend.

Investors are advised to approach current market movements with caution, as the conflicting signals from macroeconomic data and monetary policy outlooks continue to create a nuanced and volatile environment for cryptocurrencies.

This article was originally published as Bitcoin Bear Thesis Persists After New $93,500 Rejection on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

Ayrıca Şunları da Beğenebilirsiniz

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon