Vitalik Buterin Proposes Onchain Gas Futures to Stabilize Ethereum Fees

- Vitalik Buterin said that the Ethereum gas futures market would allow developers, traders, and institutions to hedge against fee volatility.

- The proposal comes as Ethereum prepares for major scaling upgrades, including a 5x increase in the gas limit.

Vitalik Buterin, the co-founder of Ethereum blockchain, shared a new idea on having an on-chain futures market for gas. Buterin said that this will help users get some clarity over transaction fees, amid a wide network adoption.

The proposal from Buterin came while responding to questions on whether the current roadmap can ensure low gas fee. In a post on X on Saturday, Vitalik Buterin said the Ethereum ecosystem needs a “trustless on-chain gas futures market.”

He suggested that one solution would be to allow users to lock in gas prices for future periods. Buterin noted that this could be achieved through a market for Ethereum’s base fees, which form the foundation of overall transaction costs.

Vitalik Buterin Explains How Ethereum Futures Market Would Work

In the traditional futures market, participants can buy and sell assets like Gold, stocks, oil, etc., through contracts, for a predetermined price in the future. This allows for both, speculation as well as risk hedging. Bringing a similar mechanism to Ethereum would allow users to lock in gas fees for specific future time windows. This would help in preventing any potential price surges.

Vitalik Buterin believes that a reliable and mature on-chain gas futures market would be beneficial for the ecosystem. This puts a clear benchmark for planning, forecasting, and building around expected network costs. In his message on the X platform, Vitalik Buterin wrote:

Such a gas-free prediction market would offer a crucial tool for high-volume network participants such as developers, traders, applications, and institutions. Also, users can forecast and manage their operational expenses with better cost certainty.

Last month, Vitalik Buterin assured that the Ethereum blockchain would undergo a 5x surge in gas limit, as mentioned in our previous story, as part of the team’s effort to accelerate scaling and optimization. According to Ethereum Foundation researcher Toni Wahrstätter, the upgrade will increase mainnet throughput substantially.

With the gas limit rising to 60 million, each block will be able to process more transactions, on-chain activity, and smart contract executions. This shows that the network is ready to handle more complex applications.

The Drop In ETH Gas Fee

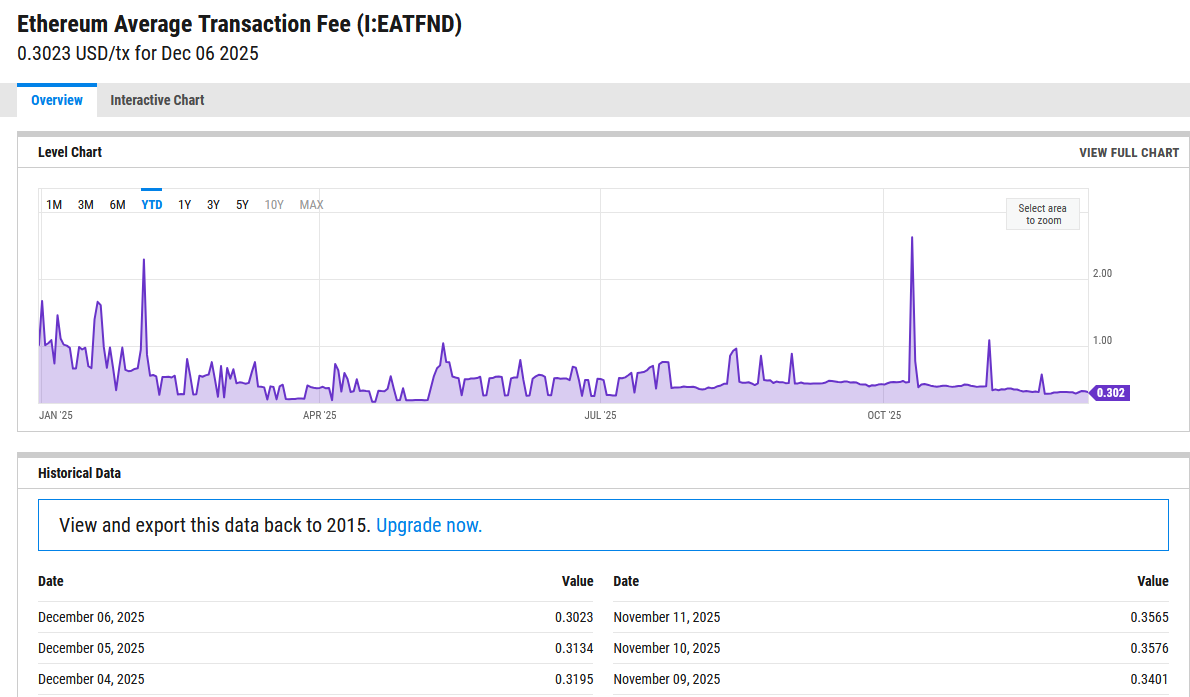

Throughout this year in 2025, the average ETH gas fee has remained low and volatile. Basic Ethereum transactions currently cost around 0.474 gwei i.e. $0.01, according to Etherscan data.

More complex operations, including token swaps, NFT trades, and cross-chain bridging, carry higher costs, averaging approximately $0.16, $0.27, and $0.05, respectively. As said, the ETH gas fee has remained fluctuating throughout 2025.

Ycharts data indicates that average transaction costs began the year at $1 before falling to around $0.30. Throughout the year, fees have moved between highs of $2.60 and lows of $0.18, underscoring the persistent volatility Buterin aims to address.

Source: YCharts ]]>

Source: YCharts ]]>Ayrıca Şunları da Beğenebilirsiniz

VivoPower Ripple deal opens South Korean investor access to $300 million in Ripple Labs shares

Will XRP Price Increase In September 2025?