Bitcoin holds steady amid higher-than-expected core PCE inflation and weakening futures volumes

- Bitcoin trades near $107,000 on Friday as the US core PCE data for May came in higher than expected.

- The core PCE rose to 2.7%, above expectations of 2.6%, which could further slow the Federal Reserve's decision to cut rates.

- The calm in the market comes as Bitcoin’s spot and futures volume have declined in the past few weeks.

Bitcoin (BTC) trades around $107,000 on Friday as the core Personal Consumption Expenditure (PCE) inflation data for May rose to 2.7%, beating expectations of 2.6%. The higher inflation data could lead to a continuation of the decline in Bitcoin's trading activity over the past few weeks, as spot and futures volumes have decreased, signaling a loss of appetite among traders.

Bitcoin continues consolidation amid higher inflation and weakening futures data

The US core PCE data for May exceeded expectations on Friday, rising by 2.7% in the past year. On a monthly basis, core PCE rose by 0.2%, above consensus, while headline PCE increased by 0.1%.

The rise in inflation could see the Federal Reserve (Fed) maintain its wait-and-see approach as PCE is the policymaker's preferred measure of inflation. This aligns with Fed Chair Jerome Powell's testimony before the House Financial Services Committee on Tuesday, where he highlighted that policymakers remain cautious concerning rate cuts, considering the potential inflation that could arise from the impact of President Donald Trump's tariffs on the economy.

Bitcoin held steady above $106,000 despite a slight decline in the broader cryptocurrency market following the release of the slightly hawkish inflation data.

The top crypto has continued to trade around the $100,000 and $110,000 price range amid a slowdown in network activity, with transfer volume dropping from its May peak of $76 billion to $52 billion in the past week, according to data from Glassnode.

"Currently, the market appears to be in a cool-down phase after the third significant wave of profit-taking, indicating that while large gains have been secured, momentum is now easing as realized profitability tapers off," Glassnode wrote in a report on Thursday.

The cool-off in Bitcoin's momentum has been accompanied by declines in spot and futures trading volumes, indicating a lack of speculative appetite among investors.

Glassnode stated that spot volumes remain at $7.7 billion despite Bitcoin's rise to $111,000, which is considerably lower than the volumes from previous rallies in Q2 and Q4 of 2024.

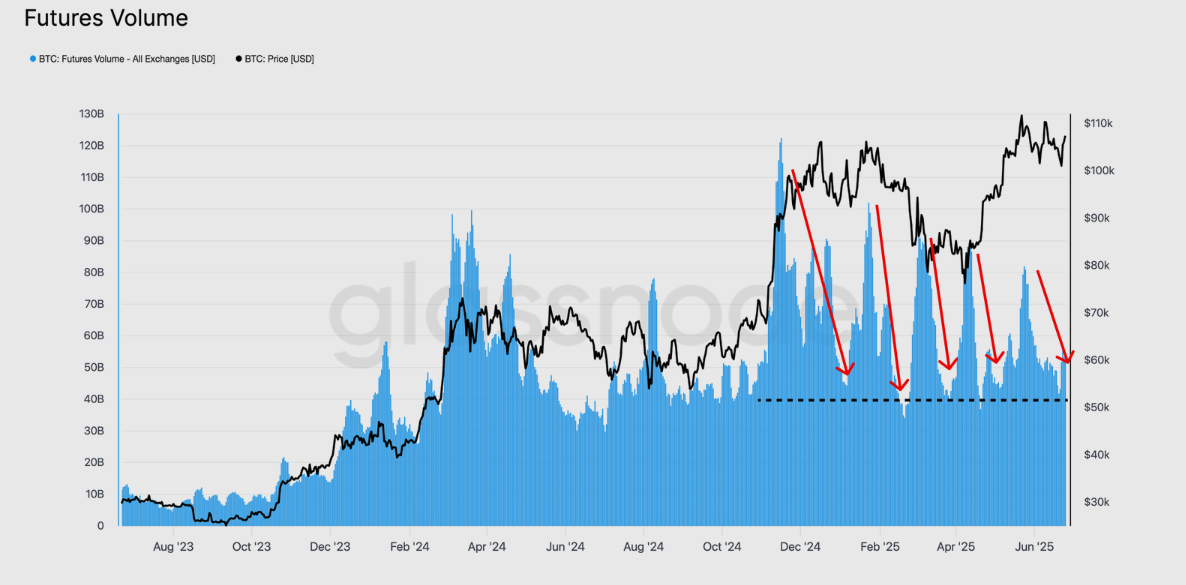

Futures volumes witnessed a similar decline over the past weeks, with market participants showing less enthusiasm compared to the all-time high rally in Q1. The drop in futures volume was further spurred by a decline in annualized funding rate and the 3-month futures rolling basis. The fall showcases a drop in the desire to hold long positions.

"This points to a more cautious and less conviction-driven speculative environment," wrote Glassnode.

BTC Futures Volume. Source: Glassnode

Glassnode analysts noted that traders might be exploiting price gaps between Bitcoin futures and spot markets for low-risk profit rather than betting directionally on price increases.

Despite the declining volume, the analysts noted that Bitcoin remains in a bull market if it holds the support between $93,000 and $100,000 — a key level that has seen high investor activity. However, a move below this support could trigger a deeper market correction, "especially if holders with a cost basis in this zone begin to capitulate and add to the sell pressure," Glassnode wrote.

Bitcoin is changing hands at $107,050 at the time of writing, down 0.5% on Wednesday.

Ayrıca Şunları da Beğenebilirsiniz

Exploring the Future of the Internet with ‘web3 with a16z’

Unstoppable: Why No Public Company Can Ever Catch MicroStrategy’s Massive Bitcoin Holdings