SEEK (SEK) Stock: Drops Lower as Weak Hiring Data, RBA Concerns Pressure Market Sentiment

TLDRS;

- SEEK stock fell to A$22.82 as hiring softness and RBA uncertainty drove risk-off sentiment across growth names.

- Weak job-ads data and mixed employment figures added pressure, deepening SEK’s ongoing technical downtrend.

- Analysts remain optimistic with A$30+ price targets despite the stock trading near yearly lows.

- Future performance depends on job-market stabilization, RBA decisions, and upcoming company disclosures.

SEEK Limited (ASX:SEK) closed another volatile session in December 2025 firmly in the red, slipping to A$22.82 as investors reacted to weakening labour-market signals and renewed concerns about the Reserve Bank of Australia’s rate trajectory.

Despite a still-bullish analyst community, the stock remains caught in a technical downtrend that has pulled it more than 22% below its 52-week high.

Steward Large Cap Enhanced Index Fund A, SEEKX

SEK Extends Downtrend

SEEK spent most of the day under pressure, trading between A$22.59 and A$22.90, with volumes hovering around 1.55 million shares. The stock’s latest drop caps a difficult week marked by a sharper fall on 11 December, when SEK slid more than 2% in a single session.

Market data shows the company continuing to drift near the lower end of its range, well below its September peak of A$29.18. The sustained weakness has now placed SEEK in a growing list of ASX names highlighted by ChartWatch technical scans for “dangerous downtrends,” an unwelcome signal for momentum-sensitive traders. According to those scans, SEEK has lost over 11% in the past month, mirroring its one-year decline.

For long-term holders, the technical deterioration doesn’t necessarily reflect the company’s underlying fundamentals, but in the current market environment, price action is driving sentiment.

Hiring Trends Add Pressure

SEEK’s business model is uniquely exposed to shifts in employment activity, making macroeconomic data just as influential as company-specific updates. The latest Australian labour-market figures have therefore added discomfort for investors.

November’s employment report showed unemployment steady at 4.3%, but also revealed a sharp contraction in full-time roles, down 57,000, partially offset by a rise in part-time positions. Economists warn that such mixed signals could keep the RBA uneasy, raising the likelihood of a “higher for longer” rate stance into early 2026.

Complementing the macro numbers, Jobs and Skills Australia reported that online job ads declined 1.3% in November and have fallen 7.2% over the past year. Although not specific to SEEK’s platform, the broader slowdown reinforces investor concerns around hiring momentum.

SEEK itself has recently updated its job-ads reporting methodology, adopting trend estimates from August 2025 and incorporating company listings from November. The shift is intended to provide a clearer view of advertising activity, but it also means historical comparisons require more context, a potential source of confusion in a jittery market.

Regulatory Filings Spark Mild Curiosity

Recent ASX filings have added minor noise but little substantive change to the investment narrative. SEEK lodged a notification regarding unquoted securities and an Appendix 3Y for director Ian Narev on 11 December. These updates typically relate to equity incentives or administrative adjustments, not operational developments.

Even so, filings tied to insider activity or employee incentive schemes can influence market psychology during periods of heightened volatility, especially if traders are on alert for dilution risks.

Analysts Still See Meaningful Upside

In contrast to the market’s cautious tone, sell-side analysts continue to project a strong recovery into 2026. Consensus estimates from multiple platforms put SEEK’s 12-month average target price around A$30–A$30.50, with the most bullish calls extending to A$33.50.

Forecasts for the next quarter point to revenue near A$575 million and EPS of approximately A$0.28, suggesting expectations of a gradual rebound in job-advertising volumes or continued improvements in pricing yields.

The bullish targets create a widening gap between analyst optimism and technical reality. The lowest published target, A$22.60, now sits uncomfortably close to SEEK’s current trading price, underscoring the heightened uncertainty.

The post SEEK (SEK) Stock: Drops Lower as Weak Hiring Data, RBA Concerns Pressure Market Sentiment appeared first on CoinCentral.

Ayrıca Şunları da Beğenebilirsiniz

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

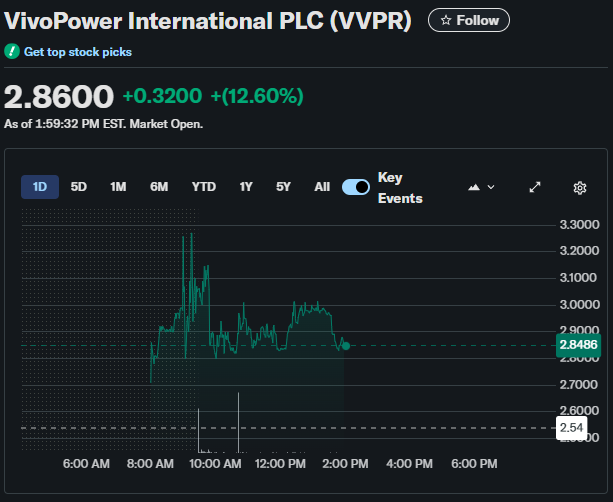

VivoPower’s $300M Investment in Ripple Triggers 13% Stock Rally