Trader Scores $1M Profit from Unusual Binance Market Maker Activity

Trader Profits from Unusual Market Activity on Binance Amid Memecoin Surge

A trader reportedly earned approximately $1 million on New Year’s Day by leveraging unusual trading behaviors associated with a low-liquidity memecoin on Binance. The activity was linked to BROCCOLI714, a token on the BNB Chain that experienced a sudden spike in price followed by a rapid reversal early Thursday morning in Asia. The trader described identifying this anomaly through automated systems that monitor significant price movements and discrepancies between spot and perpetual futures markets.

According to the trader, Vida, the abnormal activity involved large spot buy orders on Binance’s order book, which appeared suspicious and prompted a strategic trading response. Vida explained, “I figured it had to be either a hacked account or a bug in the market-making program, because no whale would be dumb enough to do charity like that.” The trader engaged in a quick long position as prices surged due to buying pressure, then swiftly reversed to short as liquidity normalized, capitalizing on the brief market inefficiency.

A trading execution log of automated order attempts and fills on the BROCCOLI714USDT perpetual contract. Source: VidaRumors initially suggested that the unusual activity resulted from hacking, but Binance has dismissed these claims. The exchange issued a statement confirming that their security protocols and risk controls are functioning as intended, and they have not identified any breaches or received reports of account compromises. Despite this, Vida expressed skepticism, questioning how such substantial amounts of USDT could be used for what appeared to be charity-driven pumping, suggesting potential systemic irregularities.

Binance Denies Hacking Allegations

Following online speculation, Binance reaffirmed that the suspicious market movements did not stem from security breaches. In an official comment, a Binance spokesperson stated, “Based on initial system checks, Binance’s risk controls and security mechanisms are operating as intended. There is no indication of platform breaches or hacker activity at this stage, and no reports of account compromise have been received.”

Meanwhile, Vida noted that the trading pattern did not seem normal, pointing out the peculiarity of utilizing tens of millions of USDT in spot transactions for what appears to be charity-driven market manipulation. The incident underscores ongoing concerns about the integrity of trading activities and the potential vulnerabilities within digital asset markets.

Memecoin Boom on Binance’s BNB Chain

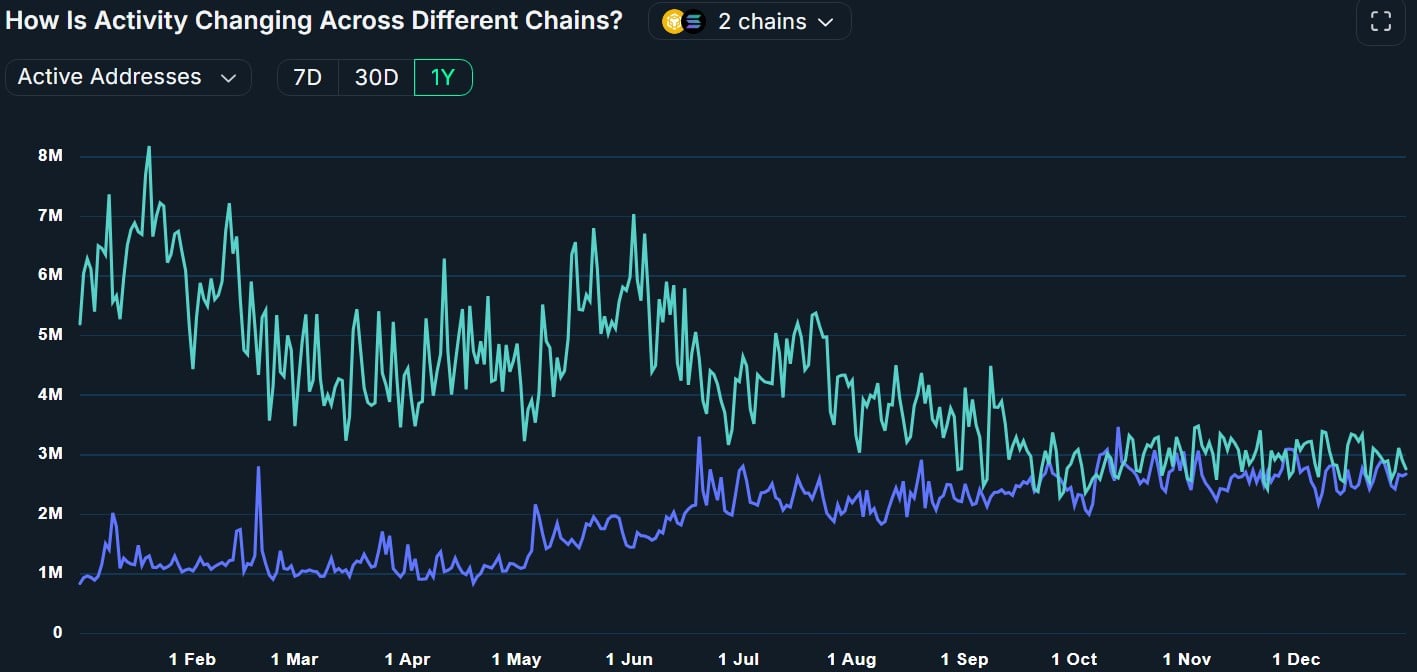

Meanwhile, memecoins inspired by Binance’s co-founder Changpeng Zhao’s pet dog Broccoli have surged in popularity on the BNB Chain, which has experienced a renaissance this year as one of the industry’s most active networks. After starting the year with fewer than one million daily active addresses, activity swiftly increased, partly driven by a memecoin craze as interest in similar tokens on Solana waned. By mid-September, the number of active addresses on BNB Chain matched that of Solana, according to data from Nansen.

Memecoins help BNB Chain rival Solana in active addresses. Source: Nansen

Memecoins help BNB Chain rival Solana in active addresses. Source: Nansen

By the end of 2024, BNB Chain had surpassed 2.6 million daily active users and secured the second position in overall active addresses and transaction volume for the year. This rise reflects the growing influence of memecoin activity on BNB Chain as it continues to compete with other major blockchain networks in terms of user engagement and transaction metrics.

This article was originally published as Trader Scores $1M Profit from Unusual Binance Market Maker Activity on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

Ayrıca Şunları da Beğenebilirsiniz

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

Three big IPOs are about to launch: SpaceX, OpenAI, and Anthropic