Oil Prices Hold Steady at $67 Ahead of U.S.-Iran Talks This Week

TLDR

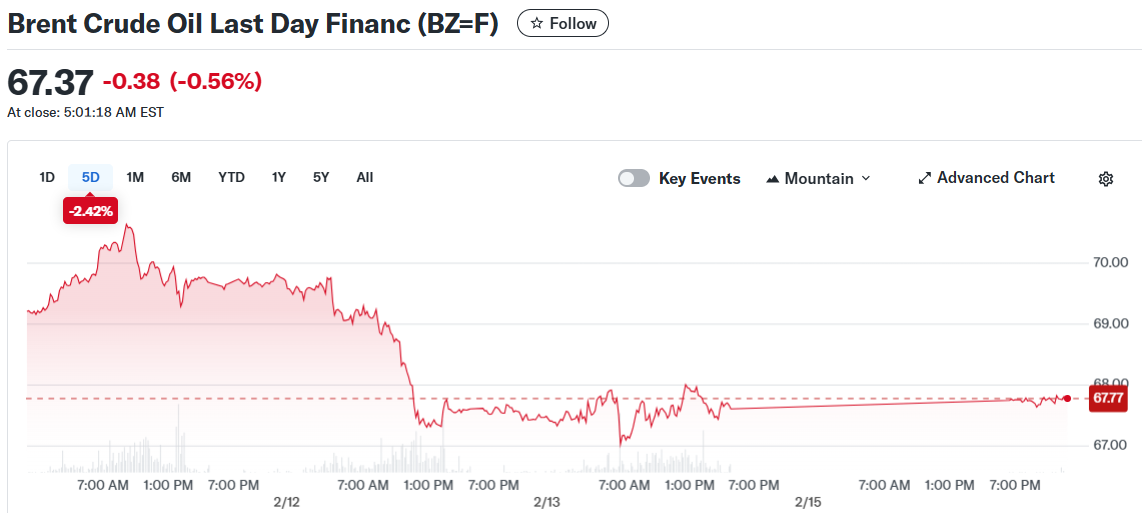

- Oil prices remain mostly flat with Brent crude at $67.60/barrel and WTI at $62.30/barrel ahead of U.S.-Iran talks

- Markets posted weekly losses last week with limited upside potential above $70 unless Middle East supply disruptions occur

- Risk premium remains in oil prices due to uncertainty over U.S.-Iran tensions and President Trump’s regime change comments

- OPEC members reportedly see room to resume output increases in April at their March 1 meeting

- U.S.-brokered peace talks between Russia and Ukraine could reduce oil’s risk premium and push prices lower

Oil prices showed little movement on Monday as traders awaited the second round of talks between the United States and Iran. Brent crude rose 0.1% to $67.60 per barrel. WTI crude remained flat at $62.30 per barrel.

Brent Crude Oil Last Day Financ (BZ=F)

Brent Crude Oil Last Day Financ (BZ=F)

Both benchmarks posted weekly losses last week. Trading volumes were limited due to market holidays in China and the United States. The WTI contract had no settlement price for the day.

Analysts at Saxo Bank noted that oil prices face limited upside potential. Without Middle East supply disruptions, a sustained move above $70 per barrel appears unlikely. The market continues to focus on ample global supply levels.

A risk premium remains built into current oil prices. This reflects ongoing uncertainty about U.S.-Iran relations. President Trump recently stated that regime change would be the best outcome for Iran.

These comments have added to market concerns about potential escalation. However, ING analysts Warren Patterson and Ewa Manthey pointed out a different dynamic. The U.S.-brokered peace talks between Russian and Ukrainian officials aimed at ending the four-year war appear more de-escalatory.

OPEC+ Supply Plans Under Scrutiny

Media reports suggest some OPEC members believe the group can resume output increases in April. This potential policy shift has caught the attention of market watchers. OPEC+ is scheduled to meet on March 1 to discuss their supply agreement.

ANZ Research analysts noted these reports could weigh on prices. The prospect of increased production from the cartel adds downward pressure to the market. Current supply conditions already show ample availability across global markets.

If tensions in the Middle East ease, the risk premium could decline further. This would allow bearish oil fundamentals to take center stage. Patterson and Manthey suggested this scenario could push prices lower.

The balance between geopolitical risk and supply fundamentals continues to shape the market. Traders are monitoring both diplomatic developments and OPEC+ production decisions. The coming weeks will be critical for determining oil’s price direction.

For now, the market remains in a holding pattern. Prices are consolidating as participants await clarity on multiple fronts. The combination of peace talks and potential supply increases creates uncertainty about the path forward.

OPEC+ members will need to assess demand conditions before finalizing any production changes. The March 1 meeting will provide more concrete information about the group’s plans for April and beyond.

The post Oil Prices Hold Steady at $67 Ahead of U.S.-Iran Talks This Week appeared first on CoinCentral.

Ayrıca Şunları da Beğenebilirsiniz

Rizz Network Lands $5M Capital Commitment from Nimbus Capital to Drive Next-Generation AI-DePIN Rizz Wireless Rollout

Paris Saint-Germain Embraces BTC for Treasury Strategy