Industry Giant H Mining Teaches You How to Get $110,000 Worth of Bitcoin

In this era full of opportunities, we’ve witnessed Bitcoin grow from a digital concept into a global store of value. But how can one truly own and continuously accumulate this digital wealth? For most people, this seems like a distant dream.

Today, as a leader in the cloud mining industry, H Mining will show you a shortcut to wealth, teaching you how to get $110,000 worth of Bitcoin through our stable and efficient platform.

Leave Tradition Behind, Embrace a Smarter Way to Acquire Bitcoin

Traditional methods for acquiring Bitcoin are fraught with uncertainty: you can buy at a high and get stuck at a low; you can also try to mine yourself, but you’ll have to deal with expensive equipment, high electricity bills, and complex maintenance. These high barriers make accumulating Bitcoin extremely difficult.

The emergence of H Mining has completely changed this situation. We provide you with a zero-barrier, high-return cloud mining solution. You no longer need to be a technical expert or purchase any hardware. You have only one task: choose a mining contract. We’ll handle the rest.

The Path to $110,000 in Wealth

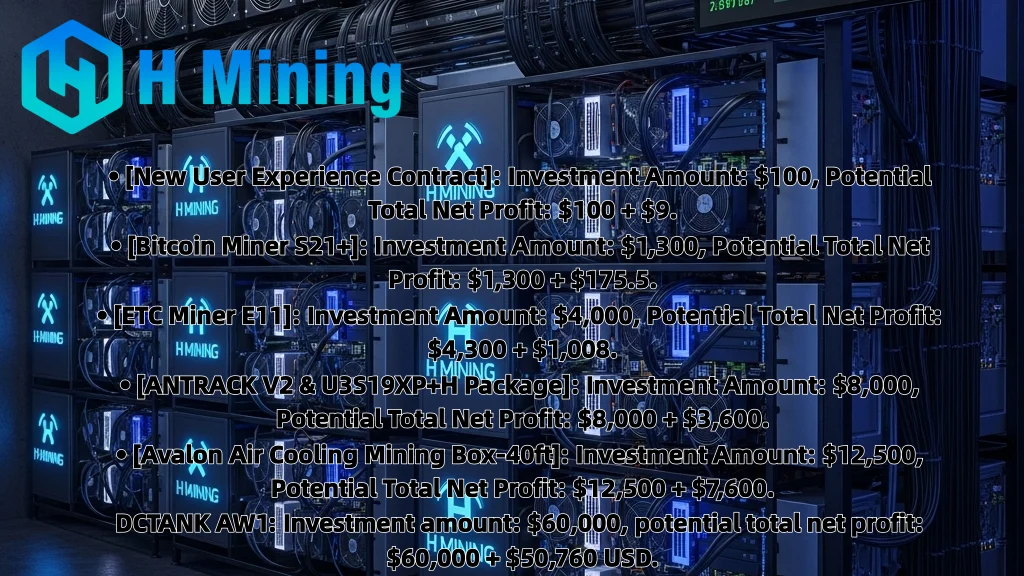

This is not an empty promise, but a clearly defined path. Our top-tier mining solutions were created for exactly this purpose.

Take our DCTANK AW1 contract as an example. You only need to invest $60,000 to get a net profit of over $50,000. This means that your initial investment plus your mining returns can easily reach or even exceed a total value of $110,000 in a short period.

This wealth growth is not based on dramatic price fluctuations, but on the stable and predictable returns provided by hash power. Every dollar you invest will be converted into real hash power, continuously creating wealth for you.

Why Choose H Mining?

- A Truly Zero-Barrier: Whether you are a financial novice or an experienced investor, you don’t need to worry about technical issues. We handle all the complex mining processes for you.

- Security and Compliance: We are strictly regulated by the UK and the EU and are protected by McAfee® and Cloudflare® with end-to-end security, ensuring your assets are always safe.

- Sustained Compounding Effect: You can choose to reinvest your daily mining returns to achieve a dual overlay of “mining returns + price appreciation,” allowing your wealth to grow exponentially.

Getting $110,000 worth of Bitcoin is no longer a distant dream. H Mining will provide you with the tools and platform needed to turn your wealth vision into reality.

Are you ready to start your journey to wealth?

H Mining’s Operating Model

H Mining’s operating model is a disruptive cloud mining solution designed to enable anyone to participate in cryptocurrency mining in a simple, secure, and efficient way. The core of this model is to transfer the complexity, high costs, and high risks of traditional mining entirely to the platform, allowing users to enjoy a “zero-effort, high-return” experience.

Core Principles of the Operating Model

H Mining’s operating model is based on the following core principles to ensure it provides unique value to users:

- Complete Outsourcing of Technology and Costs

Unlike traditional mining, which requires purchasing expensive rigs, paying high electricity bills, and handling complex maintenance, H Mining manages all technical and hardware-related matters for you. Users only need to choose and invest in a mining contract to get the corresponding hash power. All mining equipment deployment, software configuration, and daily maintenance are handled by our expert team, so you don’t need any technical knowledge. - Driven by Sustainable Green Energy

H Mining’s global mining farms are strategically located in regions rich in renewable energy sources, primarily utilizing wind, solar, and hydropower. This not only significantly reduces operational costs, making our mining contracts more competitive, but also ensures the entire mining process is environmentally responsible and aligns with the global trend of sustainable development. - Ultimate Automation and Transparency

The platform is highly automated. Once you invest in a contract, the system automatically allocates hash power and mines in real time. Mining returns are settled automatically every day and can be withdrawn to your personal crypto wallet at any time. All transactions, earnings, and hash power data are transparently displayed to you through the application, ensuring you have a complete overview of your assets.

For more information, please visit: hmining.com

Or contact the platform’s official email address: info@hmining.com.

You May Also Like

Will Bitcoin Soar or Stumble Next?

PH files protest vs China embassy: Sobriety, respect not against national interest