SEC Greenlights New ETF Standards, Opening Door for Altcoin ETFs

The U.S. Securities and Exchange Commission (SEC) has approved new generic listing standards for spot crypto and altcoin exchange-traded funds (ETFs), marking a landmark shift in digital asset regulation.

Previously, every crypto ETF required lengthy case-by-case approval under Section 19b-4—a process that could drag on for months. With this new framework, ETFs meeting specific conditions can now be listed directly on major exchanges like Nasdaq, Cboe, and NYSE without waiting for individual sign-offs.

This decision is expected to accelerate the arrival of altcoin ETFs in the U.S., broadening investment access beyond Bitcoin and Ethereum. Analysts say the streamlined system represents the clearest path yet toward regulated, diversified crypto exposure.

Grayscale Leads With First Multi-Crypto ETF

Grayscale secured a first-mover advantage as its Digital Large Cap Fund (GDLC) was approved under the new standards. The fund includes Bitcoin, Ethereum, XRP, Solana, and Cardano, making it the first diversified multi-crypto ETF in the U.S.

“Grayscale Digital Large Cap Fund $GDLC was just approved for trading… with Bitcoin, Ethereum, XRP, Solana, and Cardano,” Grayscale CEO Peter Mintzberg confirmed.

ETF analysts noted this milestone signals a shift toward broader portfolio products rather than single-asset ETFs. Bloomberg’s Eric Balchunas estimated that 12–15 cryptos could soon qualify under the SEC’s framework, provided they have established regulated futures trading for at least six months.

Altcoin ETFs Considered Imminent

Beyond the majors, other altcoins are lining up for potential ETFs. Dogecoin (DOGE), Litecoin (LTC), and Chainlink (LINK) already meet the key requirement of regulated futures trading on Coinbase Derivatives.

Solana, for instance, became eligible on August 19, six months after its futures launch. The Chainlink community has also expressed optimism, with both Bitwise and Grayscale filing LINK ETF applications.

Meanwhile, the Litecoin Foundation has welcomed the decision, seeing it as a pathway for LTC listings in U.S. markets. Even Hedera (HBAR) is gaining attention, with investors speculating on its ETF prospects.

Industry watchers describe the SEC’s move as a turning point for crypto, one that reduces regulatory friction and boosts market confidence. As ETF analyst James Seyffart put it, “We’re gonna be off to the races in a matter of weeks.”

With the SEC’s greenlight, the question is no longer if altcoin ETFs will launch, but which will debut first.

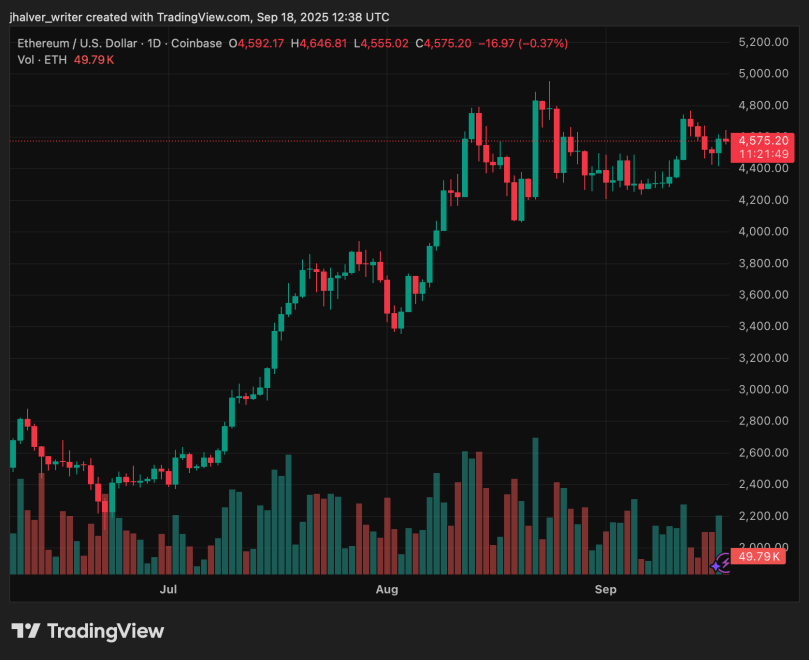

Cover image from ChatGPT, ETHUSD chart from Tradingview

You May Also Like

Trump ally raises eyebrows with startling admission on Fox News: 'Cover-up isn't new'

South Korean Prosecutors Sell 320 Bitcoin for $21.5M After Hacker Returns Stolen Funds