FTX Recovery Trust Unlocks $1.6B for Creditors This Month — Major Payouts

The FTX Recovery Trust has announced a significant third distribution of approximately $1.6 billion to creditors, marking another step in the ongoing efforts to settle claims stemming from the collapse of the major cryptocurrency exchange.

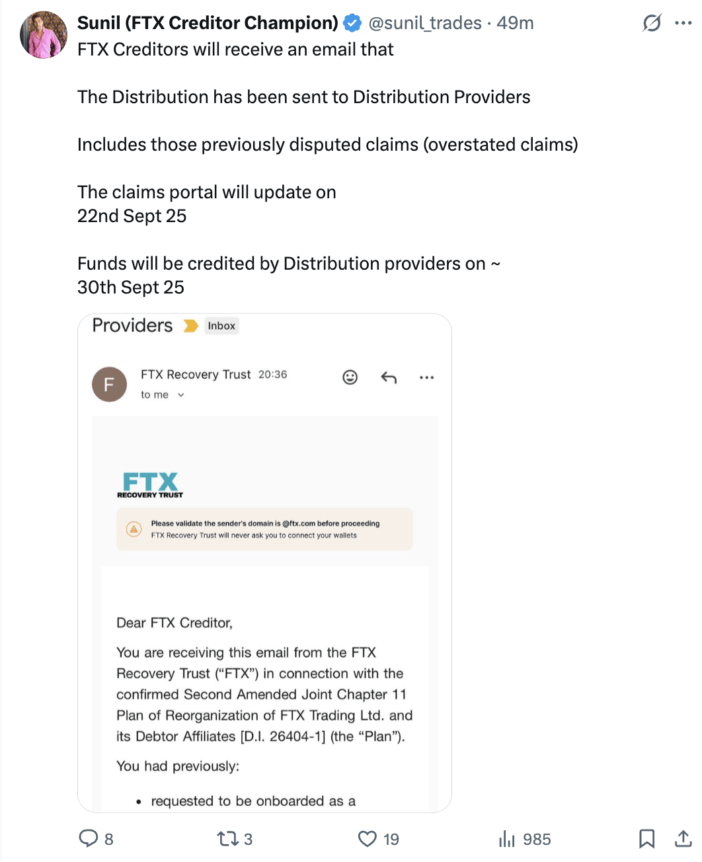

According to the official statement, the distribution is scheduled for September 30, with funds expected to reach creditors’ accounts within three business days of the payout date. This marks the third major disbursement by the trust, following earlier payouts of $1.2 billion in February and another distribution of $5 billion in May.

The third installment includes a 6% payout for Dotcom Customer claims, a substantial 40% for US Customer Entitlement Claims, and 24% for General Unsecured Claims along with Digital Asset Loan Claims. Additionally, convenience claim holders will receive a 120% reimbursement as part of this payout. These distributions are part of the trust’s ongoing efforts to return value to affected creditors amid the ongoing legal and financial fallout from the exchange’s collapse.

Source: Sunil Kavuri

Source: Sunil Kavuri

The FTX Recovery Trust has been diligently reimbursing creditors since February, when it first distributed $1.2 billion. The subsequent $5 billion payout in May has helped mitigate some of the financial chaos caused by the exchange’s implosion. Currently, the trust holds assets valued at around $16.5 billion, earmarked for creditors and former customers, amidst the wider crypto market uncertainties.

The collapse of FTX in 2022 sent shockwaves through the cryptocurrency sector, intensifying the bear market that had begun earlier that year. Investors remain vigilant about how these payouts and ongoing proceedings could influence the stability of cryptocurrency markets, especially as regulators worldwide scrutinize the industry more closely.

Former FTX CEO Sam Bankman-Fried to Appeal Conviction

In November 2023, Sam “SBF” Bankman-Fried, the founder and former CEO of FTX, was found guilty on seven charges, including wire fraud, securities fraud, commodities fraud conspiracy, and money laundering. He was subsequently sentenced to 25 years in prison in March 2024.

Legal representatives for Bankman-Fried are preparing to appeal his conviction in November, arguing that the trial was unfair and that their client was presumed guilty from the outset. They also maintain that FTX was never insolvent, asserting that the exchange always maintained sufficient funds to meet its obligations and reimburse creditors.

This ongoing legal battle and the distribution process highlight the ongoing repercussions of the FTX collapse, which remains one of the most significant events to shake the crypto industry in recent years.

This article was originally published as FTX Recovery Trust Unlocks $1.6B for Creditors This Month — Major Payouts on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Steak ‘n Shake Adds $10 Million in Bitcoin Exposure Alongside BTC ‘Strategic Reserve’

Saudi Awwal Bank Adopts Chainlink Tools, LINK Near $23