Bitcoin Whale Wallets Add $7.3B in September as ETH and SOL See Increased Accumulation

Bitcoin whale wallets have added billions in September, sparking renewed talks about where fresh capital may flow next. Alongside Bitcoin, Ethereum, and Solana are drawing attention. But analysts also flag MAGACOIN FINANCE as another altcoin to watch while traders rotate into new opportunities.

Bitcoin Sharks Boost Holdings with $7.3B Accumulation

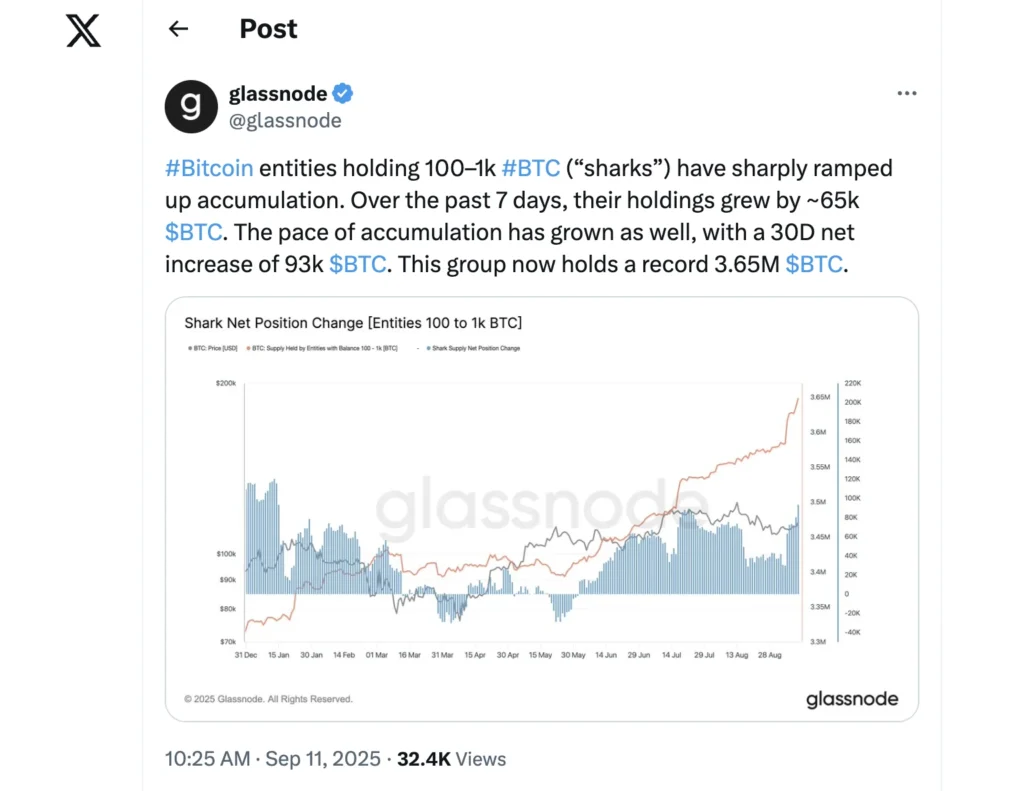

Fresh data from Glassnode shows that Bitcoin wallets holding between 100 and 1,000 BTC—often referred to as “sharks”—have ramped up buying. In the past seven days alone, these wallets scooped up 65,000 BTC, worth about $7.38 billion at current prices.

Their total holdings now stand at a record 3.65 million BTC, representing 18% of the circulating supply.

This level of activity highlights growing conviction among mid-sized players. By absorbing supply, these wallets reduce liquid availability in the market, which often adds upward pressure on price.

The recent activity also signals that these holders may be bracing for higher valuations toward the end of the year, especially with forecasts ranging from $150,000 to $200,000.

For everyday traders, this surge in accumulation is a reminder of how capital concentration in Bitcoin can shape broader market flows. When shark wallets buy heavily, history shows that other investors often follow their lead.

Renewed Whale Selling After Brief Pause

Despite shark accumulation, one of Bitcoin’s largest whales has resumed selling. A wallet tied to a long-term holder deposited over 1,100 BTC (roughly $136 million) into Hyperliquid, just weeks after offloading $4 billion worth of Bitcoin for Ethereum. This move has caught attention, as it suggests that even seasoned holders are taking profits and repositioning.

Large-scale movements like these often spark speculation about short-term price pressure, but they also create openings for new entrants to accumulate.

Ethereum and Solana Attract Big Allocations

Ethereum and Solana are also drawing capital flows, with institutions making bold plays. Solana, in particular, is seeing renewed interest after Pantera Capital revealed a $1.1 billion allocation, now its biggest single position. Analysts highlight Solana’s efficiency, transaction speed, and growing use in decentralized exchanges and NFT markets.

Ethereum remains central to decentralized applications and smart contracts, maintaining steady inflows even as attention shifts to faster blockchains. The ETH/BTC ratio has held stable, reflecting balanced flows between the two.

For traders hunting the best altcoin to buy, both ETH and SOL remain high on the list. But market watchers are also pointing toward smaller, undervalued tokens that could benefit from this rotation of capital.

MAGACOIN FINANCE: Hidden Gem in Capital Rotation

Alongside Bitcoin, Ethereum, and Solana, analysts are flagging MAGACOIN FINANCE as another altcoin worth watching. Described as undervalued and positioned for exchange listings, this project is gaining attention from whales and retail traders. Analysts list it among their picks for the best crypto to buy now, suggesting that capital rotation out of Bitcoin could drive interest into hidden gems like this.

With analysts framing it as an altcoin to watch, curiosity is building around whether MAGACOIN FINANCE could be the next surprise performer.

Final Take: How Traders Should Position

Shark wallets are sending a clear signal with billions flowing into Bitcoin, while Ethereum and Solana continue to see allocation from major funds. But the search for the top altcoin to buy is pushing attention beyond the large caps. Traders eyeing diversification may want to explore MAGACOIN FINANCE while its entry point remains attractive.

Learn more at:

- Website: https://magacoinfinance.com

- X: https://x.com/magacoinfinance

- Telegram: https://t.me/magacoinfinance

You May Also Like

Hauser’s Stark Warning Charts Reveal Persistent Economic Pressure

China’s mineral moves shake global tech and defense