Crypto Inflows Hit $1.9B After Fed’s First Rate Cut of 2025

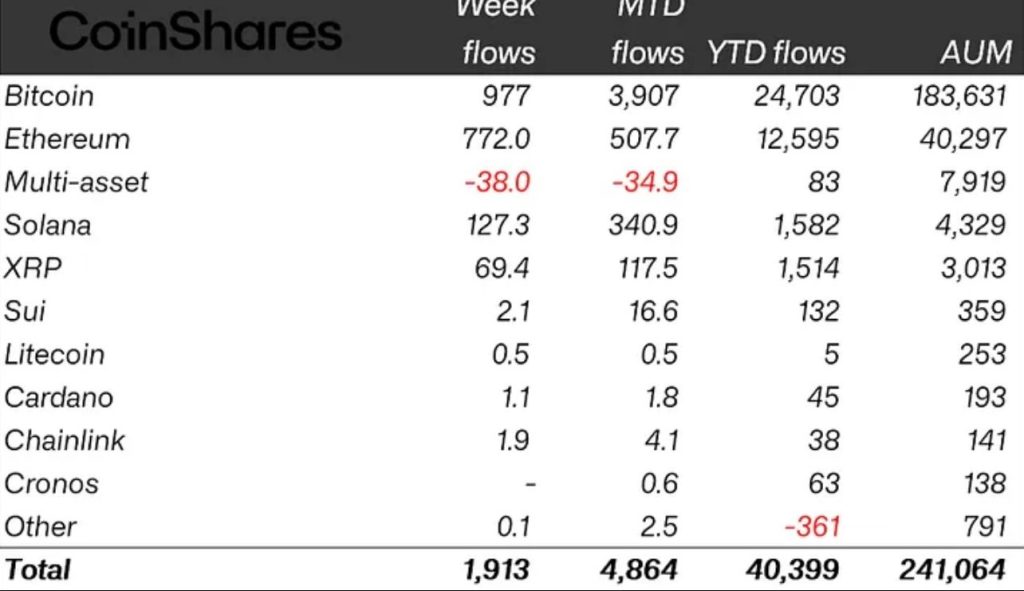

Digital asset investment products recorded $1.9 billion in inflows last week following the Federal Reserve’s first interest rate cut of 2025, according to data from CoinShares.

The inflows marked the second consecutive week of gains for the sector, lifting total assets under management (AuM) to a year-to-date high of $40.4 billion.

Source: CoinShares

Source: CoinShares

Bitcoin and Ethereum Lead $1.9B Crypto Inflows Following Fed Move

The Fed lowered its benchmark rate by 25 basis points on September 17, trimming the target range to 4.25%. It was the first cut since 2023, coming after a series of weaker labor market readings and softer inflation data.

While the move was characterized as a “hawkish cut,” with policymakers signaling caution on further easing, investors turned to crypto products later in the week, with $746 million flowing in on Thursday and Friday alone.

Bitcoin funds attracted the largest share, with $977 million in inflows. The gains followed $2.4 billion of inflows the prior week, bringing Bitcoin’s four-week total to $3.9 billion, according to SoSoValue.

Short-Bitcoin products continued to weaken, recording $3.5 million in outflows and driving their total AuM to a multiyear low of $83 million.

Ethereum also benefited strongly, seeing $772 million in inflows. That pushed its year-to-date total to a record $12.6 billion, underscoring the renewed demand for Ether-backed exchange-traded products.

Solana and XRP also drew investor interest, with inflows of $127.3 million and $69.4 million, respectively.

Market reaction to the Fed’s cut was volatile. Bitcoin briefly rose above $117,000 last Thursday before retracing to $115,089 at press time, down 1.2% in 24 hours and sitting 7% below its all-time high of $124,128.

Ether traded as high as $4,600 during the week before slipping back to around $4,465. More than $105 million was liquidated across the crypto market following Fed Chair Jerome Powell’s press conference, with $88.8 million in long positions wiped out alongside $17 million in shorts.

Institutional interest also remained strong through spot ETFs. On September 19, Bitcoin spot ETFs saw a total net inflow of $222.6 million.

BlackRock’s iShares Bitcoin Trust led with $246.1 million in daily inflows, while Grayscale’s GBTC posted $23.5 million in outflows.

The cumulative net inflow into Bitcoin spot ETFs now stands at $57.7 billion, with total net assets of $152.3 billion, representing 6.6% of Bitcoin’s market capitalization.

Ethereum ETFs also recorded notable activity. BlackRock’s ETHA product led with $144.3 million in inflows, while Grayscale, Fidelity, and Bitwise products saw modest outflows.

Overall, the sector’s AuM hit $40.3 billion, its highest level on record.

Crypto ETF Race Heats Up as SEC Clears Faster Listings, New Products Debut

The wave of fresh capital into crypto funds coincided with a flurry of ETF activity in Washington.

On Tuesday, five new applications were filed with the U.S. Securities and Exchange Commission, signaling issuers’ growing appetite for products tied to assets beyond Bitcoin and Ethereum.

The latest lineup includes Bitwise’s proposed spot Avalanche ETF, Defiance ETFs designed around Bitcoin and Ethereum basis trades, and Tuttle Capital’s “Income Blast” funds tracking Bonk, Litecoin, and Sui. T-Rex also entered the race with a leveraged 2x Orbs ETF.

ETF Institute co-founder Nate Geraci noted that the sector should expect “floodgates” of filings in the months ahead. These additions bring the number of pending crypto ETF applications above 92, with most facing SEC deadlines in October and November.

The pressure on regulators intensified on Wednesday, when the agency approved new listing standards for Nasdaq, Cboe BZX, and NYSE Arca.

The rules will allow exchanges to list commodity-based trust shares, including crypto spot ETFs, without case-by-case reviews, cutting the timeline from more than 200 days to as little as 75.

The first products to benefit are expected to be Solana and XRP spot funds.

Notably, the SEC has approved Grayscale’s Digital Large Cap Fund (GDLC), marking the first multi-crypto ETP to hit the market.

The same day, two new ETFs began trading in Chicago: the Dogecoin ETF (DOJE) on Cboe BZX, which recorded $6 million in its first hour, and the spot XRP ETF (XRPR), which topped $24 million within two hours.

Both funds are issued by REX Shares and Osprey Funds.

Bloomberg analyst Eric Balchunas reported that DOJE and XRPR, along with the first spot crypto “basket” ETF ($GDLC), all exceeded average launch volumes, though they still trailed Bitcoin products.

You May Also Like

Vitalik Buterin Admits Ethereum Hasn’t Meaningfully Improved People’s Lives

Top Altcoin Primed to Grab Market Share from Cardano (ADA) in the Upcoming Q4 Altseason