Bitcoin, Ether ETFs Bleed Millions Ahead of Fed Chair Jerome Powell Speech Today

![FOMC Meeting Today [Live] Updates FED Decision Time Today, Jerome Powell Speech Today](https://image.coinpedia.org/wp-content/uploads/2025/09/17183125/FOMC-Meeting-Today-Live-Updates-FED-Decision-Time-Today-Jerome-Powell-Speech-Today-1024x536.webp)

The post Bitcoin, Ether ETFs Bleed Millions Ahead of Fed Chair Jerome Powell Speech Today appeared first on Coinpedia Fintech News

The crypto market is tense today.

Hours before U.S. Federal Reserve Chair Jerome Powell delivers a key speech at 11:30 a.m. ET, investors pulled hundreds of millions from Bitcoin and Ether ETFs, signaling a clear risk-off mood. With Bitcoin already struggling near support levels, Powell’s words could decide whether the market steadies or sinks further.

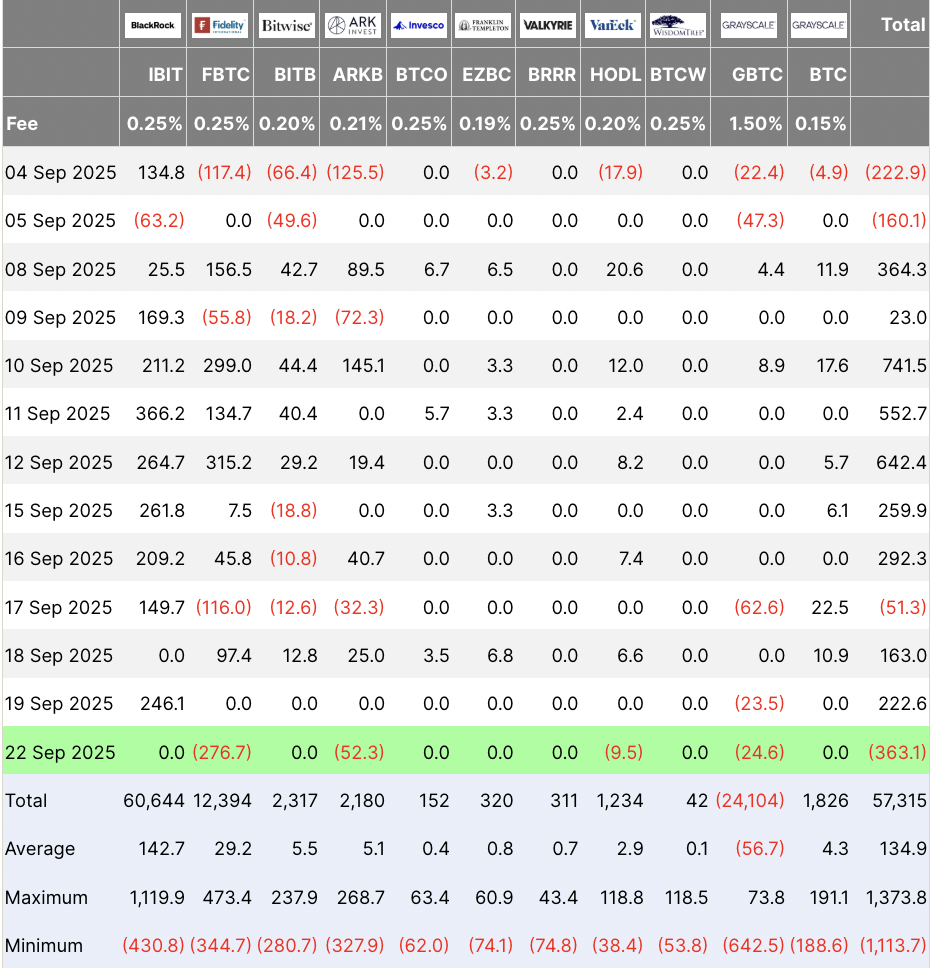

Bitcoin ETFs Bleed $363M

Fresh data from Farside Investors shows spot Bitcoin ETFs saw $363.1 million in net outflows on September 23, the biggest this month. Fidelity’s FBTC alone accounted for $276.7 million, followed by $52.3 million from Ark 21Shares’ ARKB and $24.6 million from Grayscale’s GBTC. VanEck’s HODL lost another $9.5 million, dragging total ETF assets under management below $150 billion.

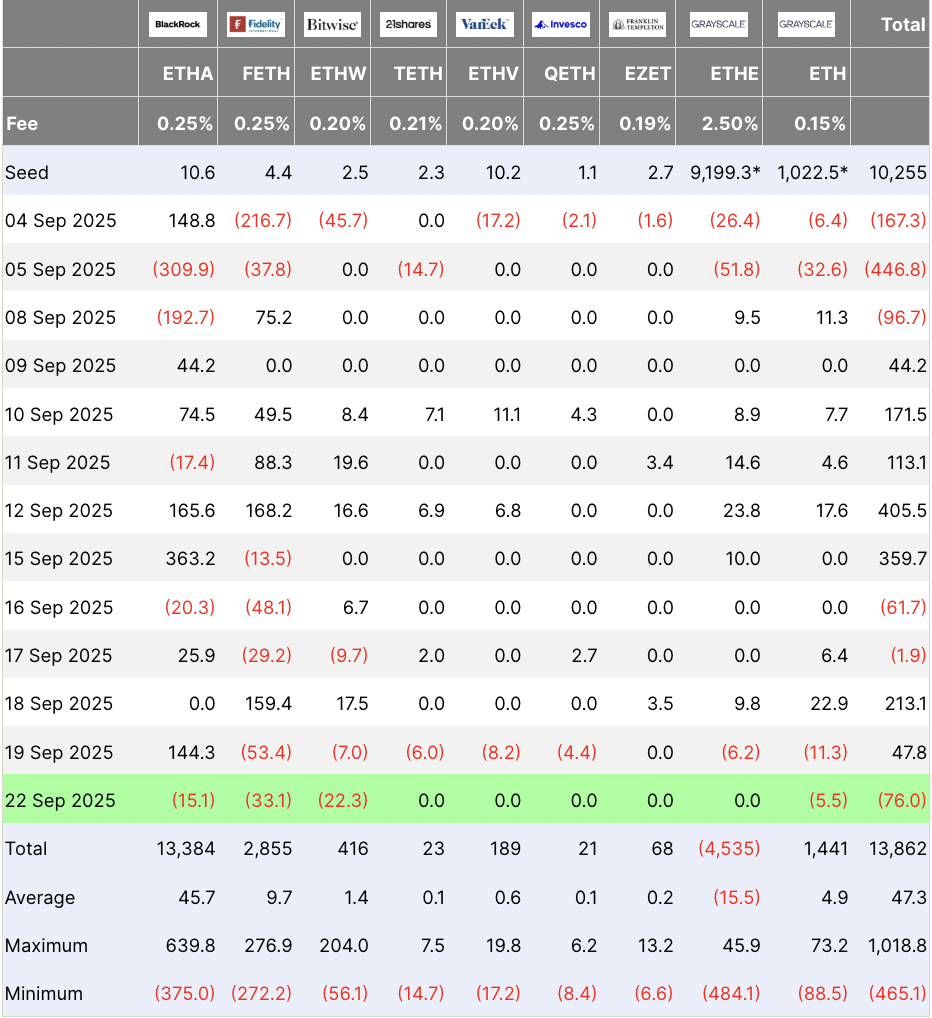

Ether funds faced pressure too. Spot Ether ETFs recorded $76 million in outflows, ending two days of inflows. Fidelity’s FETH led with $33.1 million, while Bitwise’s ETHW and BlackRock’s ETHA also saw redemptions.

Together, the moves show investor caution ahead of Powell’s update.

Powell Steps Into the Spotlight

Today’s speech comes just days after the Fed’s first rate cut of 2025, a quarter-point move that lowered rates to 4.00%-4.25%. Powell warned last week that the decision was about “risk management,” not a signal of aggressive easing.

Markets now want clarity on whether the Fed will stay cautious or open the door to further cuts. That direction could set the tone for Bitcoin’s next move.

Pressure From All Sides

It’s not just the Fed weighing on sentiment. The U.S. Dollar Index is firm above 97.00, while 10-year Treasury yields hold near 4.15%. Gold is climbing, and JPMorgan CEO Jamie Dimon has warned the Fed won’t cut further until inflation eases.

That mix has left crypto investors bracing for more volatility.

Bitcoin, ETH, and the Altcoin Question

Bitcoin is trading around $113,000, with support near $111,000. Ethereum is holding just above $4,200. The Fear & Greed Index sits at 40, which is neutral territory for now.

Analysts are divided too.

Joao Wedson of Alphractal says Bitcoin’s cycle “is running out of steam” as on-chain profitability weakens, while Michaël van de Poppe calls the crash a “classic liquidity sell-off” that could set up a rebound.

Some analysts, meanwhile, point to altcoins as the next big play. The altcoin-season index hit its highest level since late 2024 earlier this month, signaling growing rotation.

With ETFs bleeding and investors cautious, the Fed’s tone today will likely decide whether crypto steadies or faces another wave of selling.

You May Also Like

Strike’s Revolutionary 13% Rate Unlocks Crypto Liquidity In The US

XRP Price Holds $1.34 Amid This Best Crypto Presale Pulling Eyes From Every Investor: Pepeto’s Clock Never Rewinds at $0.000000186 With 269x and $7.391 Million Raised