Oracle ($ORCL): Surges 6.31% on TikTok Algorithm Oversight Deal

TLDRs;

- Oracle stock surged 6.31% as it secured oversight of TikTok’s U.S. algorithm and user data operations.

- ByteDance will cut its stake in TikTok’s U.S. venture below 20%, with Americans controlling the majority.

- Trump extended TikTok’s divestment deadline by 120 days and will approve the restructuring via executive order.

- Lawmakers remain uncertain whether TikTok’s algorithm can be fully separated from ByteDance’s Chinese operations.

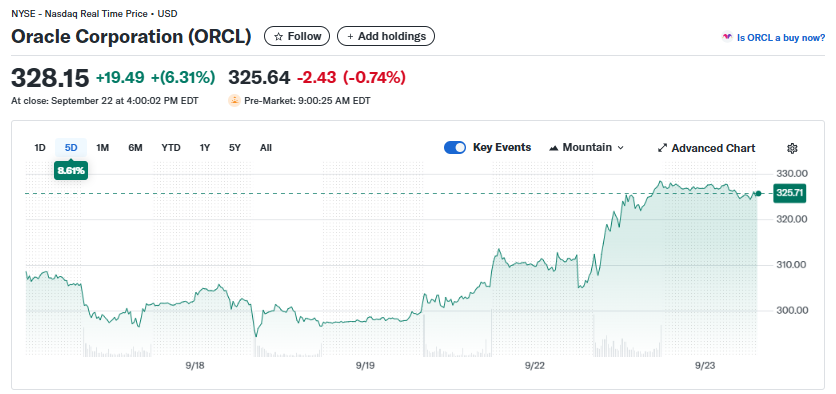

Oracle Corporation (NYSE: ORCL) jumped 6.31% on Monday to close at $328.15, after reports confirmed it will take a leading role in the restructuring of TikTok’s U.S. operations.

The deal, which is being finalized between ByteDance, Oracle, and a consortium of American investors, is designed to address national security concerns raised by Washington over foreign control of the popular social media app.

Oracle Corporation (ORCL)

Oracle Corporation (ORCL)

Oracle Steps Into the Spotlight

As part of the arrangement, Oracle will take charge of recreating and retraining TikTok’s U.S. algorithm, ensuring that ByteDance, TikTok’s Beijing-based parent company, no longer has direct influence over how content is served to American users.

Oracle will also store U.S. user data on its secure cloud infrastructure, blocking access by foreign entities.

For Oracle, this represents not just a high-profile security mandate but also a lucrative expansion of its existing cloud partnership with TikTok. Analysts suggest the move could bolster Oracle’s credibility as a trusted custodian of sensitive data, a role that has historically been dominated by rivals like Amazon and Microsoft.

ByteDance’s Stake Shrinks

The deal requires ByteDance to reduce its ownership in TikTok’s U.S. business to under 20%, with American investors controlling the majority.

Of the seven proposed board seats, six will be held by U.S. citizens, while ByteDance will be excluded entirely from participating in security-related decisions.

This restructuring follows a federal law requiring ByteDance to divest TikTok’s American operations or risk a nationwide ban. While ByteDance retains an indirect financial interest, it will lose its influence over the app’s algorithm, considered the company’s most valuable asset.

Trump Extends Deadline for Sale

President Donald Trump, who has long pressed for TikTok’s sale to U.S. interests, announced plans to extend the divestment deadline by 120 days. He is expected to sign an executive order later this week formalizing the arrangement.

White House press secretary Karoline Leavitt confirmed that the new structure addresses security concerns, ensuring that TikTok’s U.S. operations are majority-owned and majority-controlled by Americans.

Importantly, the deal does not grant the U.S. government an equity stake or “golden share” in the company, a departure from similar arrangements Trump has previously pursued with other industries.

Questions Remain Over Security Separation

Despite the optimism surrounding the deal, lawmakers remain divided. Some question whether it is technically possible to separate TikTok’s U.S. algorithm entirely from ByteDance’s engineering resources in China. Others worry that ByteDance’s continued minority ownership could still allow for indirect influence.

For now, however, markets have responded positively, with Oracle’s stock rallying on the announcement. Investors see the development as both a political win for the company and a sign of its growing influence in the cloud and cybersecurity landscape.

The post Oracle ($ORCL): Surges 6.31% on TikTok Algorithm Oversight Deal appeared first on CoinCentral.

You May Also Like

Tether CEO Delivers Rare Bitcoin Price Comment

Zepto Life Technology Launches Plasma-Based FungiFlex® Mold Panel as CLIA Reference Laboratory Test