Fold Holdings to Launch Bitcoin Credit Card with Stripe, Visa Partnership

Fold Holdings, Inc. (NASDAQ: FLD) has announced the upcoming launch of its Bitcoin BTC $111 870 24h volatility: 0.9% Market cap: $2.23 T Vol. 24h: $43.10 B Rewards Credit Card, with Stripe providing the backend infrastructure and Visa serving as the issuing network, on September 23. Besides this big announcement, its shares are down more than 14% today.

The new product enables users to earn Bitcoin on every purchase, positioning itself as a direct entry point for accumulating Bitcoin through daily spending. Fold says the card will deliver up to 3.5% back in Bitcoin, with users earning an unlimited 2% instantly and up to 1.5% more by paying purchases via its Fold Checking Account.

Stripe and Visa Partnership Powers Bitcoin Rewards Card

The card utilizes Stripe Issuing’s platform and Visa’s global network to support both reliability and wide-scale access. The Head of Money Management Product at Stripe, Sateesh Kumar Srinivasan, described their partnership with Fold as a blueprint for rolling out innovative financial products without requiring companies to handle the complexities of direct program management, according to the press release.

“Fold’s Bitcoin rewards, paired with Visa’s scale and security, give consumers a safe, simple way to earn Bitcoin as they shop,” said Cuy Sheffield, Head of Crypto at Visa. “With the Fold Bitcoin Credit Card, cardholders can earn Bitcoin anywhere Visa is accepted.” Visa keeps a close eye on the crypto industry, with even a partnership with Avalanche at the beginning of 2025.

FLD Shares Drop 14% Despite Bitcoin Ecosystem Expansion

Fold, which claims over $3.1 billion in transaction volume and more than $83 million distributed in Bitcoin rewards, reports nearly 1,500 BTC held in its treasury. The new credit card will join Fold’s existing suite of products related to crypto and Bitcoin services.

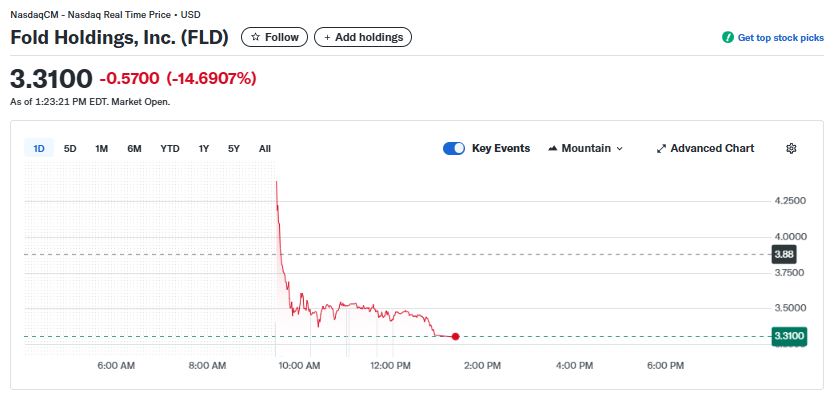

Graphic of price for the shares of Fold Holdings, Inc. Source: Yahoo! Finance

In the market, Fold Holdings shares (NASDAQ: FLD) were down more than 14% following the credit card announcement today, according to Yahoo! Finance. The share prices began at $3.88, but by the end of the day, they had dropped to $3.31, with significant volume following the announcement of the Bitcoin Credit Card. This reaction follows the general activity of the cryptocurrency market on September 23, characterized by bearish sentiment.

nextThe post Fold Holdings to Launch Bitcoin Credit Card with Stripe, Visa Partnership appeared first on Coinspeaker.

You May Also Like

BFX Presale Raises $7.5M as Solana Holds $243 and Avalanche Eyes $1B Treasury — Best Cryptos to Buy in 2025

Bitcoin ETFs Surge with 20,685 BTC Inflows, Marking Strongest Week